In the realm of employment negotiations and human resource management, one term stands out as a cornerstone of compensation discussions: Cost to Company (CTC). CTC, often abbreviated as such, is a comprehensive metric that encompasses all expenses incurred by a company in relation to employing an individual. It goes beyond the basic salary and includes various allowances, benefits, bonuses, and perks provided to employees as part of their overall compensation package.

Unraveling CTC: Breaking Down the Concept

CTC full form as Cost to Company, serves as a crucial determinant in both employer-employee negotiations and strategic HR planning. Let’s delve deeper into its components and significance.

Components of CTC: What Makes Up the Whole?

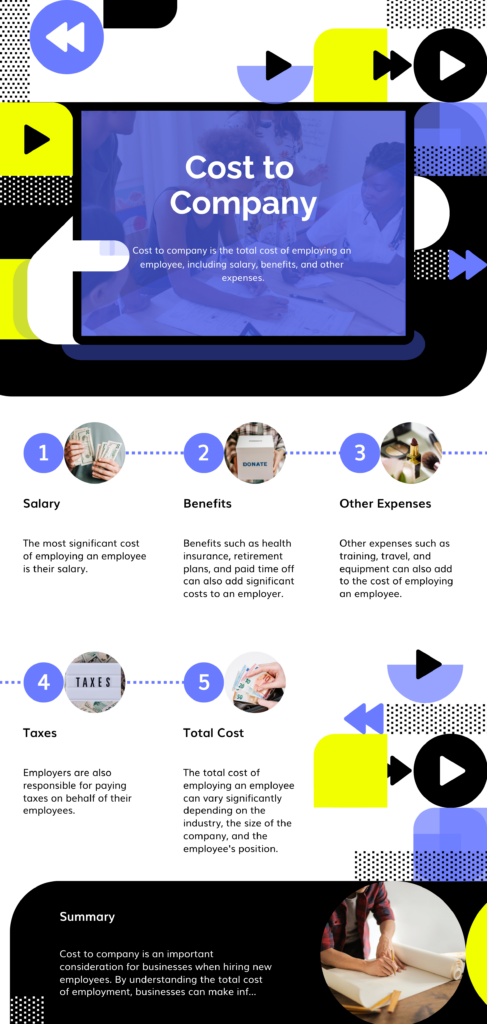

CTC Full form comprises various elements that contribute to the overall compensation package of an employee. These components include:

- Basic Salary: The fundamental component of CTC, the basic salary, represents the fixed amount paid to an employee as compensation for their services.

- Allowances: Additional payments are provided to cover specific expenses such as housing, transportation, medical, or other necessities.

- Bonuses and Incentives: Additional payments or rewards given to employees based on their performance, achievement of targets, or company profitability.

- Employee Benefits: Contributions towards employee welfare schemes such as provident funds, health insurance, life insurance, and retirement plans.

- Perquisites (Perks): non-monetary benefits offered to employees, including company-provided accommodation, vehicles, memberships, or stock options.

CTC: Significance for Employers and Employees

For Employers: CTC holds paramount importance for employers in several key areas:

- Budgeting and Resource Allocation: CTC provides a comprehensive view of the total cost associated with employing staff, enabling effective budgeting and resource allocation.

- Attracting and Retaining Talent: Offering competitive CTC packages helps companies attract and retain top talent, enhancing their competitiveness in the job market.

- Compliance and Transparency: Ensuring transparency and compliance with labor laws regarding CTC builds trust and fosters positive employee relations.

For Employees: CTC is equally significant for employees, offering numerous benefits such as:

- Understanding Compensation: By comprehending the components of CTC, employees can assess the true value of their compensation package beyond just the basic salary.

- Financial Planning: Knowledge about the benefits and allowances included in CTC enables employees to plan their finances effectively.

- Negotiation and Career Growth: Armed with knowledge about CTC, employees can negotiate their compensation package during job interviews or performance evaluations, contributing to their career growth and financial well-being.

Challenges and Considerations

Despite its significance, CTC comes with its own set of challenges and considerations:

- Variable Components: Components like bonuses and incentives can fluctuate, making it challenging to accurately predict the total CTC for an employee.

- Tax Implications: Certain components of CTC may have tax implications, necessitating careful tax planning and compliance for both employers and employees.

- Transparency: Employers must ensure transparency and clarity regarding the components included in the CTC package to avoid misunderstandings or disputes with employees.

In Conclusion

Understanding the Cost to Company (CTC Full Form) is essential for both employers and employees in navigating the complexities of employee compensation. With its comprehensive view of all expenses related to employing an individual, CTC serves as a crucial metric in negotiations, budgeting, and strategic HR planning. By unraveling the components and significance of CTC, both employers and employees can foster transparency, fairness, and mutual satisfaction in the employment relationship.

Learn more about Teachmint plans here.