All Classrooms

(14 Classrooms listed)

GST Classes

Practically Work With GST

GST CLASSES

PRACTICALLY WORK WITH GST

GST Classes

Tax Invoice in GST

GST CLASSES

ADVANCE & REVERSE CHARGE

GST Classes

GST AND TDS

GST CLASSES

GST DUE DATE & FINE CALC.

How to write Book's A/c

Bookkeeping

1. Learn How to maintain Books of Accounts

2. Learn how to Closed Accounts

3. Learn Closing Adjustment

4. Learn Tax Calculation

5. Learn Provision of Taxation Entry

Module 02- TDS/GST

TDS/GST

1) TDS

2) TDS Section

3) TDS Computation

4) TDS Entry-26AS

5) TDS Recoverable

6) Due Date

7) PAN/TAN

8) Advance Tax

9) TDS Return

10) Challan Payment

11) 281, 280, 283 etc

12) 24Q- TDS on Salary

13) 26Q- TDS on Other Than Salary- Resident

14) 27Q- TDS on Other than Salary- Non-Resident

15) Form 16, 16B, 16A - TDS Certificate

16) Computax Software ØWebtel SoftwareØ KDK Software

17) Case Study Øwww.tdscpc.gov.in

Payroll Management

Payroll Management

Dear Students,

If you are join this class room then you will be able to work in the filed of "Payroll Management"

Learning Skill:-

a) Calculation of CTC,

b) TDS on Salary

c) Tax Saving Plan

d) Increment Letter

e) Form 16

f) More

TDS Return - Salary

TDS Return-Salary

TDS-Other Than Salary

TDS-Other Than Salary

VIIT A/cting Classes

GST Return

If You have to join the Class then you will be able to learn following Skill:-

1. Preparation of GST Return Filing Data

2. Due Date

3. Interest, Late Fee, Penalty

4. GSTR-1, 3B, 9

5. Reconciliation

VIIT A/cting Classes

Bookkeeping

You will be able to understand that How to Maintain Accounting Record and Presentation of Accounting Data.

VIIT A/cting Classes

Payroll Management

If You have to join the Class then you will be able to learn following PM Skill:-

1. Salary Calculation

2. CTC-Cost to Company

3. Attendance Record

4. Advance Adjustment

5. Computation

6. Minimum TDS

7. 24Q-TDS Return

8. ITR-1 Filing

Your Request is Submitted.

Teacher will connect with you soon.

Teacher will connect with you soon.

VIIT Computer Classes

Tell Us About You

We need this information so that tutor can connect with you.

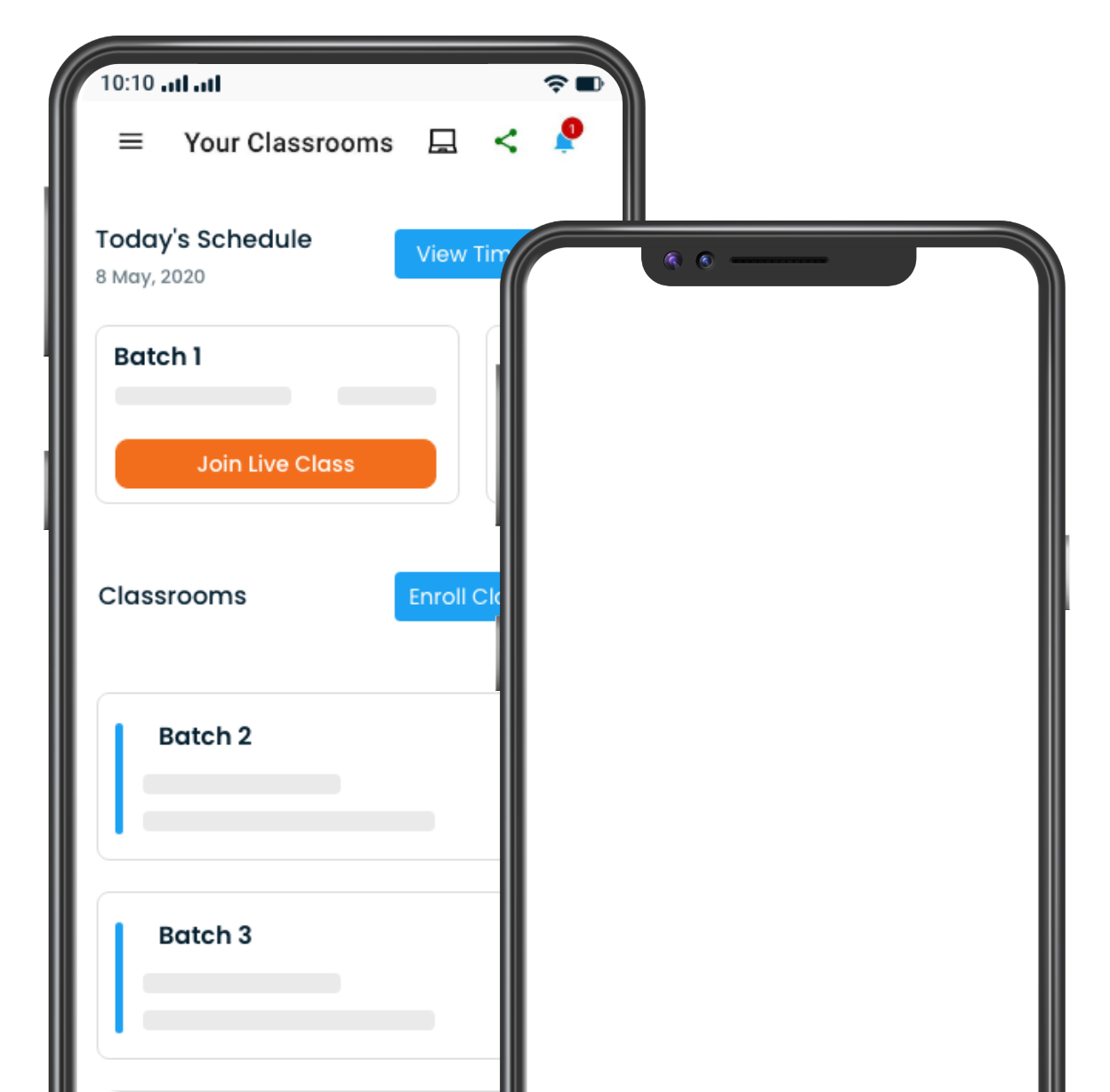

Our Online Classroom Benefits

Live Class Interaction

Ask your questions and get your doubts

clarified during live class

clarified during live class

Recorded Lectures

Access our lecture recordings anytime

from mobile, tablet or PC

from mobile, tablet or PC

MCQs and Assignments

Take our online tests and get instant

evaluation about your progress

evaluation about your progress

Study Material

Download Class Notes and revise

anytime offline

anytime offline

About Institute

VIIT-Accounting Classes Practical Approach

Social Links