Page 1 :

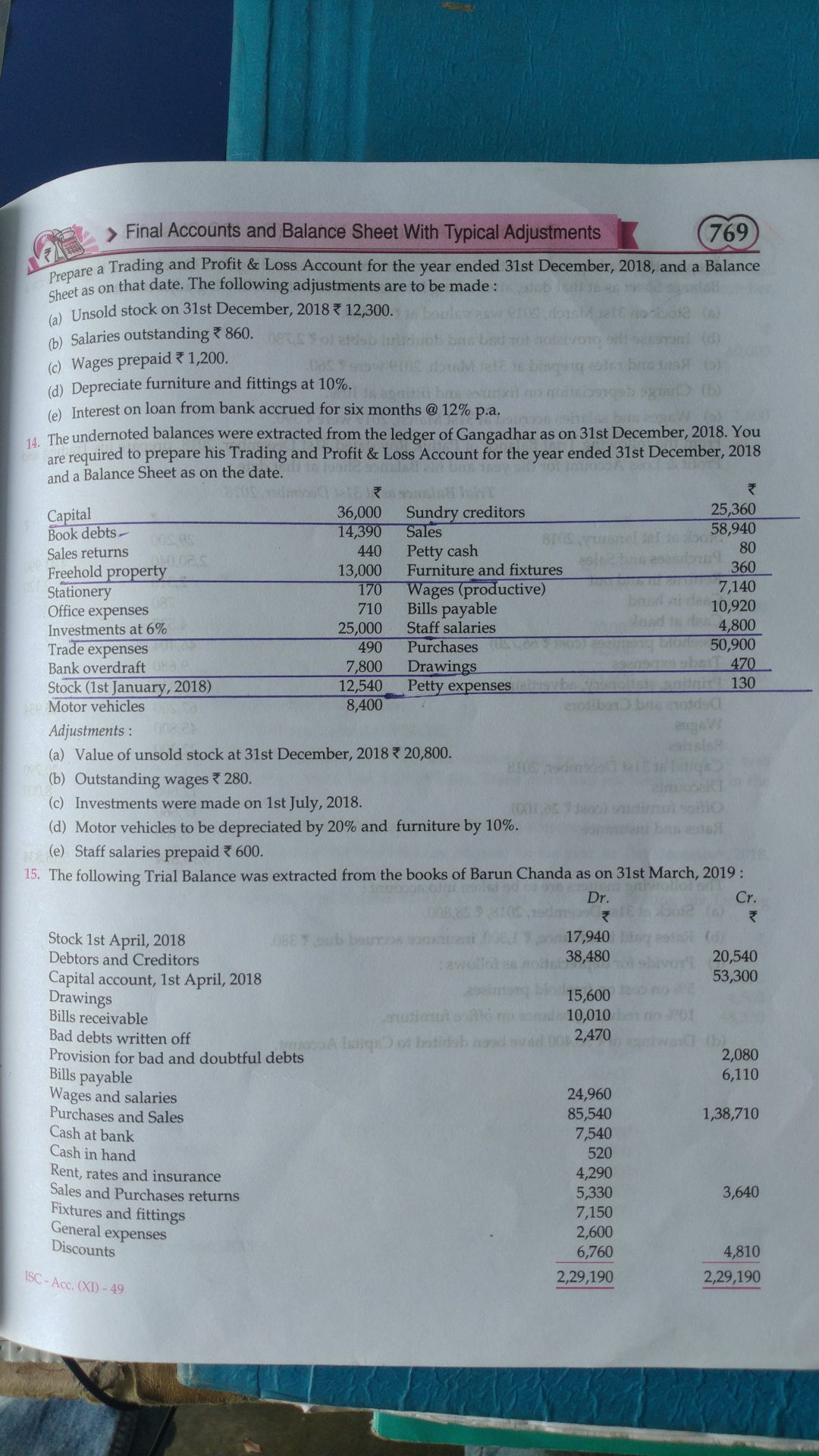

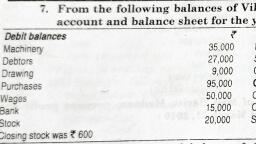

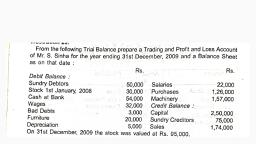

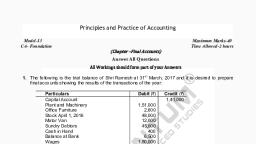

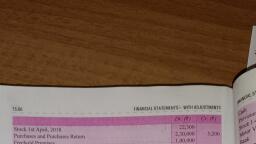

prepare, , cheet as on that date. The following adjustments are to be made :, . Unsold stock on 31st December, 2018 % 12,300., “») Salaries outstanding ¢ 860., ) Wages prepaid < 1,200., Depreciate furniture and fittings at 10%., ) Interest on loan from bank accrued for six months @ 12% p.a., , The undernoted balances were extracted from the ledger of Gangadhar as on 31st December, 2018. You, are required to prepare his Trading and Profit & Loss Account for the year ended 31st December, 2018, and a Balance Sheet as on the date., , , , , , , , , , , , Ran sone z, Capital << ee, Book debts - Y les 58,940, Sales returns 440 Petty cash Ms 80, Freehold propert 13,000 Furniture and fixtures - 360., Stationery 170 _ Wages (productive) 7,140, Office expenses 710 Bills payable 10,920, stments at 6% 25,000 _ Staff salaries 4,800, expenses 490 Purchases 2 50,900, Bank overdraft 7,800 __ Drawin;, Stock (ist January, 2018) 12,540 _ Petty expenses. f 130, Motor vehicles 8,400 i, , , , stments :, , (a) Value of unsold stock at 31st December, 2018 € 20,800., , (b) Outstanding wages ¥ 280., , (c) Investments were made on Ist July, 2018., , (d) Motor vehicles to be depreciated by 20% and furniture by 10%., , (e) Staff salaries prepaid % 600., , The following Trial Balance was extracted from the books of Barun Chanda as on 31st March, 2019 :, , , , , , , , , Dr. Cr., z Ri, Stock 1st April, 2018 aa, Debtors and Creditors nan 53.300, Capital account, 1st April, 2018 sane, Drawings 10010, Bills receivable "2A, Bad debts written off at, Provision for bad and doubtful debts i, Bills payable r, Wages and salaries a, Purchases and Sales a tg, Cash at bank Cash in hand oat, Rent, rates and insurance sae, Sales and Purchases returns is 7, ixtures and fittings a, x al expenses A a, iscounts rome sae, , 2,29,190 2,29,190