Page 1 :

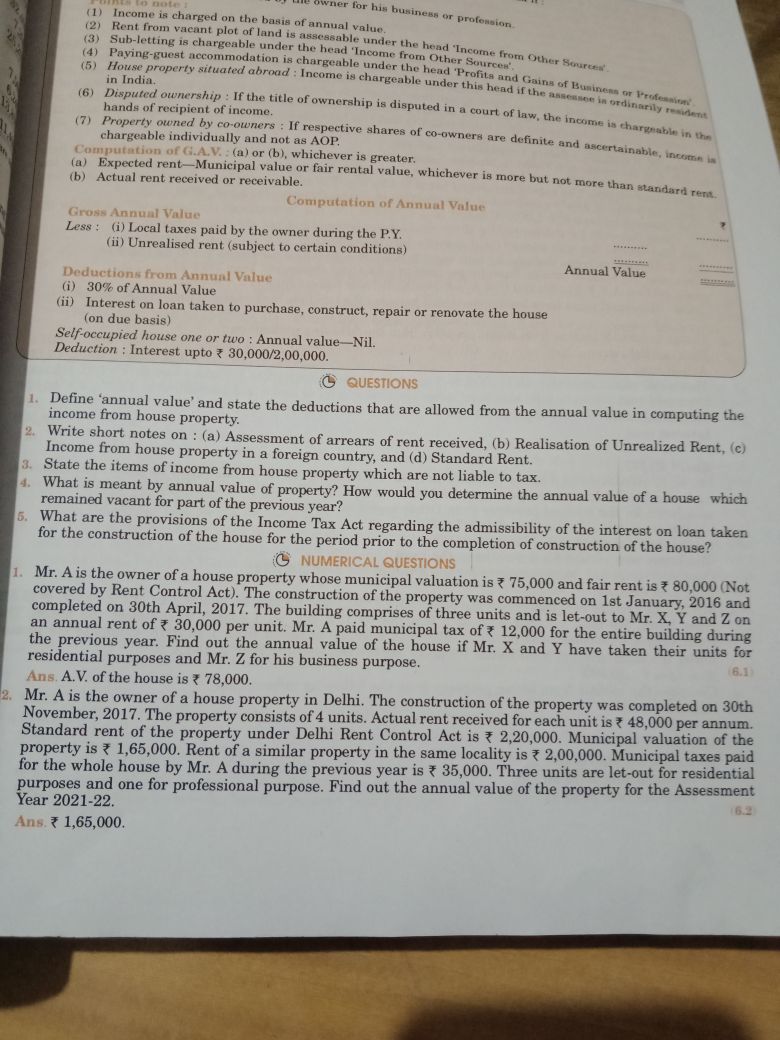

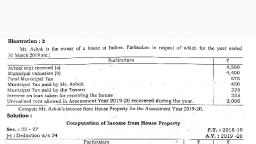

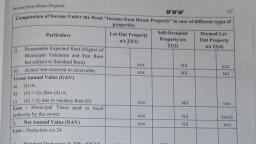

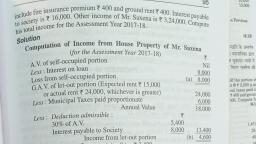

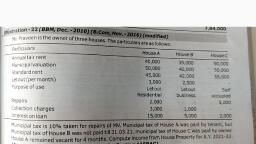

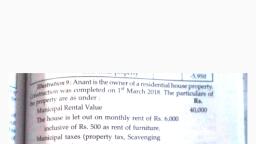

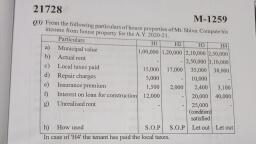

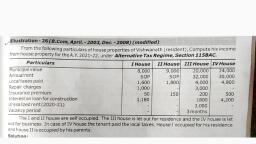

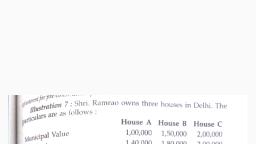

Under the head 4, income from Othe, , modation is chargeable under the hoot, , (5) House property situated abroad : Income ia, , ee chargeable unde, (8) Disputed ownership : Ifthe title of ownership is dis, hands of re hip is disputed in a court of taw,, , , , (7) Property owned by co-owners : If respective shares o, chargeable individually and not as AOP., putation of G.A.V. :(a) o (b), whichever is greater, (a) Expected rent—Municipal value o1, (b) Actual rent received or receivable., , f co-owners are defini, , , , * fair rental value, whichever is more but not more than standard, a rent, , , , tation of An:, Gross Annual Valu r, Less: (i) Local taxes paid by the owner during the PY., , (ii) Unrealised rent (subject to certain conditions), , , , Annual Value, , Deductions from Annual Value [, (i) 30% of Annual Value, (G) Interest on loan taken to purchase, construct, repair or renovate the house, (on due basis), ‘Selfoccupied house one or two : Annual value—Nil., Deduction ; Interest upto % 30,000/2,00,000., , , , , ® Questions, , the deductions that are allowed from the annual value in computing the, , Define ‘annual value’ and state, income from house property., Write short notes on : (a) Assessment of arrears of rent received, (b) Realisation of Unrealized Rent, (c), Income from house property in a foreign country, and (d) Standard here, , State the items of income from house property which are not liable to tax., , What is meant by annual value of property? How would you determine the annual value of a house which, , remained vacant for part of the previous year?, , unat are the provisions of the Income Tax Act regarding the admissibility of the interest on loan taken, , for the construction of the house for the period prior to the completion of construction of the hnrea?, , (NUMERICAL QUESTIONS, , Mr. Ais the owner of a house property whose municipal valuation is % 75,000 and fair rent is & 80,000 (Not, covered by Rent Control Act), The construction of the property was commenced on 1st January, 2016 and, completed on 30th April, 2017. The building comprises of three units and is let-out to Mr. XW and Z on, fn, annual rent of € 30,000 per unit. Mr. A paid municipal tax of € 12,000 for the entire building during, the previous year. Find out the annual value of the house if Mr. X and Y have taken their suite he, residential purposes and Mr. Z for his business purpose, , Ans A.V. of the house is % 78,000., , %, Mr. Ais the owner of a house property in Delhi. The construction of the property was completed on 30th, November, 2017. The property consists of 4 units. Actual rent received for each unit is % 48,000 per annum., Standard rent of the property under Delhi Rent Control Act is % 2,20,000. Municipal valuation of the, Property is € 1,65,000. Rent of a similar property in the same locality is ¢ 2,00,000. Municipal taxes paid, for the whole house by Mr. A during the previous year is % 35,000. Three units are let-out for residential, purposes and one for professional purpose. Find out the annual value of the property for the Assessment, Year 2021-22, os, , , , Ans % 1,65,000.