Page 1 :

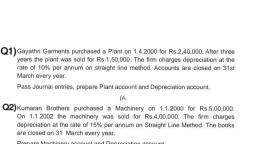

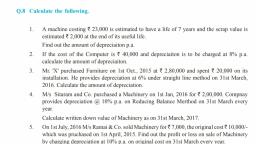

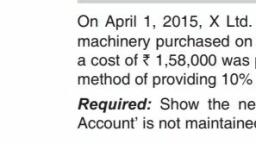

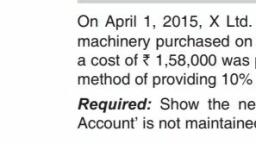

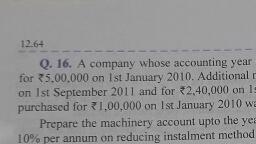

Cy, hi, , You, , 4 photos, , , , ‘Show the Furniture Account for the first four years, Depreciation A/c is written off according ¥, to the Straight Line Method., , , , , , , , , , , ‘On Ist April, 2012, Shri Ram purchased a machinery costing Rs.40,000 and spent Rs.5,000, ‘on its erection, The estimated effective life of the machinery is 10 years with a scrap valued, ‘of Rs.$,000. Calculate the Depreciation on the Straight Line Method and show the Machinery, , Account of first three years. Accounting year ends on 31st March every year., , , , (On Ist April, 2011, A Lid. purchased a machine for Rs.2,40,000 and spent Rs, 10,000 on its, erection. On Ist October, 20111, an additional machinery costing Rs.1,00,000 was purchased., ‘On 1st October, 2013 the machine purchased on Ist April, 2011 was sold for Rs.1.43,000 and, , on the same date, a new machine was purchased at a cost of Rs.2,00,000., , ‘Show the Machinery Account for the first four financial years after charging Depreciation at, , 5% pa. by the Straight Line Method., , , , , , From the following transactions of a concern, prepare the Machinery Account for ended 31at, March, 2015:, , Ast April, 2014: Purchased second-hand machinery for Rs.40,000., , Ist April, 2014: Spent Rs.10,000 on repairs for making it serviceable., , 30th September, 2014: Purchased additional new machinery fort 20,000., , 3st December, 2014: Repairs and renewals of machinery Rs.3,000., , ist March, 2015 :Depreciate the machinery at 10% p.a.