Question 1 :

Surrender of notes to the bank by the government by a specific period and receive new currency notes is called…….

Question 5 :

Since money acts as an intermediate in the exchange process, it is called ………

Question 6 :

What were the earliest form of objects used as money in India?

Question 7 :

What came after grains and cattle as a medium of exchange in India?

Question 8 :

The modern currency is without any use of its own, then why is it accepted as a medium of exchange?

Question 10 :

People also have the provision to withdraw the money as and when they require the deposits in the bank accounts to be withdrawn, what are these deposits called?

Question 11 :

A ………… is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name it has been issued?

Question 12 :

The facility of cheques against demand deposits makes it possible to directly settle payments without the use of………

Question 13 :

M. Salim wants to withdraw Rs 20,000 in cash for making payments to Prem after Prem receives the money he deposits it in his own account? What is the result?

Question 14 :

Banks in India these days hold about ………. of their deposits as cash. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

Question 15 :

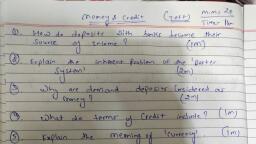

How do banks mediate between those who have surplus funds (the depositors) and those who are in need of these funds (the borrowers)?

Question 16 :

…………refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Question 17 :

In an SHG most of the decisions regarding savings and loan activities are taken by

Question 18 :

In rural areas, the main demand for credit is for …………….

Question 19 :

………………….is an asset that the borrower owns (such as land, building, vehicle, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid?

Question 20 :

Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the …………..?

Question 22 :

According to the information given on formal and informal loans how much of the loan is taken by the poor household from informal sources?

Question 23 :

Which is one of the major reasons which prevent the poor from getting bank loans?

Question 26 :

RBI sees that the banks give loans not just to profit-making businesses and traders but also to………..?

Question 27 :

According to the information given on formal and informal loans how much of a loan is taken by the rich household from informal sources?

Question 28 :

Grameen Bank of Bangladesh is one of the biggest success stories, in 2018 it had over …. million members in about 81,600 villages.

Question 29 :

In situations with high risks, credit might create further problems for the borrower, what is it called?