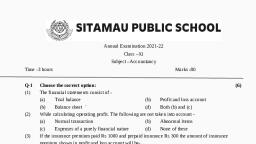

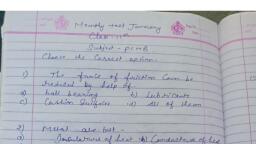

Question 1 :

Outstanding salary of $Rs.34,000$ to be provided in the accounts will be recorded in ____________.

Question 2 :

On purchase of old furniture, the amount spent on its repair should be debited to _________.

Question 4 :

Rectifying the error of a credit purchase of goods recorded as credit sale discovered two months later, the entry will be in __________.

Question 5 :

Endorsed cheques are always recorded on the payment side in the bank column.<br/>

Question 6 :

Which of the following is/are cause of difference of balance between cash book & the pass book?

Question 7 :

The proper treatment of unrecorded deposits (deposits in transit) on a bank reconciliation is to show them as an _______________.

Question 8 :

__________ is the reason for bank pass book showing less balance than Cash book.

Question 12 :

Wages paid for installation of asset should be debited ___________  A/c.

Question 13 :

If cash discount is offered to customers, then which of the following would increase?

Question 14 :

Generally Accepted accounting principles can be applied to the financial statements in which of the following ________.

Question 15 :

Name the accounting concept on the basis of which income statement is prepared ______________.<br/>

Question 17 :

Under which concept it is assumed that the enterprise has neither the intention nor the necessity of liquidation or of curtailing materially the scale of operation?

Question 18 :

Which of the following is not regarded as the fundamental accounting concept?

Question 19 :

The assumption that a business enterprise will not be sold or liquidated in the near future is known as ____________.

Question 23 :

The Working Capital (or Net Current Assets) of a business is ___________.<br/>

Question 24 :

When sale is $Rs. 48,00,000$, gross loss is $25$% on cost, purchase is $Rs. 35,00,000$ and closing stock is $Rs. 6,00,000$ the stock in the beginning would be _________.

Question 25 :

PQR Associates is not maintaining full-fledged accounts on Double entry system basis. From the following details estimate the capital of the firm as on $31-3-2014$<br>Capital as on $1-4-2013$ Rs. $80,000$<br>Capital added during the year Rs. $20,000$<br>Drawing during the year Rs. $35,000$<br>Profit during the year Rs. $25,000$.<br>

Question 26 :

Read the following which is taken from an income statement.<table class="wysiwyg-table"><tbody><tr><td></td><td>Rs.</td></tr><tr><td>Opening stock</td><td>$50,000$</td></tr><tr><td>Sales</td><td>$1,60,000$</td></tr><tr><td>Freight incurred</td><td>$10,000$</td></tr><tr><td>Sales retunrs</td><td>$10,000$</td></tr><tr><td>Gross profit on sales</td><td>$60,000$</td></tr><tr><td>Net loss for the year</td><td>$10,000$</td></tr><tr><td>Purchases</td><td>$1,00,000$</td></tr><tr><td>Purchases returns</td><td>$9,000$</td></tr></tbody></table>The amount of operating expenses will be ___________________.