Question Text

Question 1 :

Interest on capital will be paid to the partners if provided for in the agreement but only from following _______________.

Question 3 :

The relationship between persons who have agreed to share the profit of a business carried on by all or any of them acting for all is know as.

Question 4 :

Partners can share profits or losses in their Capital ratio, when there is no agreement.

Question 5 :

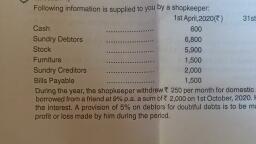

Which of the following is correct in respect of partnership accounts?<br/>1. In the absence of any provision in the partnership agreement to the contrary partners can charge interest at 6% p.a. on loans given by them to the partnership firm.<br/>2. An ordinary partnership firm can have not more than 50 partners<br/>3. A banking partnership firm can have not more than 50 partners<br/>4. In the absence of an agreed ratio in the agreement, partners will share profits and losses in the ratio their capitals.<br/>Select the correct answer using the codes given below.

Question 9 :

If current accounts are not being managed for a partnership firm then partners are maintaining _______________ accounts.

Question 10 :

Persons who have entered  into partnership with one another are called individually "______________" and collectively "_____________",and the name under which their business is carried on is called the "_____________".

Question 12 :

Choose the correct answer from the alternatives given.<br>Which one is correct

Question 13 :

The balance in the investments Fluctuation Fund, after meeting the loss on revaluation of investment at the time of admission of a partner will be transferred to _____________ .

Question 15 :

Partners are supposed to pay interest on drawing only when provided by the ______________.

Question 16 :

If there is no partnership deed then interest on capital will be changed at p.a.______.

Question 17 :

A change in the nature of the business can only be brought about by the consent of ____________.