Page 1 :

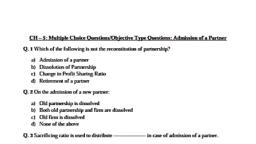

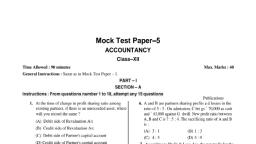

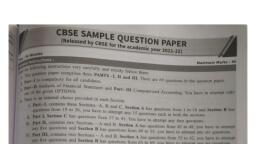

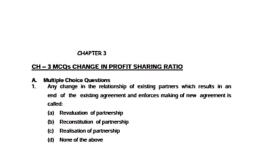

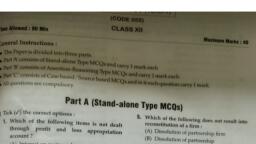

and C will share profits in the rat ogee, ( A fre profits in ratio 3 : 2 (0 Of3: 2: 1 were to share, re Revaluation A/c, Partner's Capital Aje and Balance Sheet, new firm %, tiple Choice Questions, mu rtner brings his sh, ena new pal IGS His share of goodwill in Cash,, , eeniss- hein, ja) Goodwill A/c, (b) Capital A/es of new partner, (c) Capital A/cs of old partners, @ Cash A/c, , When a new partner doesn't bring his share of goodwill in cash, the, amount is debited to—, , (a) Cash A/c (b) Current A/c of new partner, (c) Capital A/cs of old partners, (d) Premium for Goodwill A/c, , 3, It, at the time of admission, some profit and loss account balance, appears in the books, it will be transferred to—, , (a) Profit and loss adjustment A/c, (b) Revaluation A/c, (c) Old partner's capital account, (d) All partner's capital accounts, 4. If, at the time of admission, there is some unrecorded liability, it will be—, (a) Credited to revaluation account, (b) Debited to revaluation account, (c) Debited to partner's capital account, , (¢) Credited to partner's capital account, te the time of admission, the revaluation A/c shows a loss, it should, , , , , , , , , , , , , , , , , , , , , (8) Credited to old partners capital A/c in old ratio., () Credited to old partners ca in sacrificing ratio., () Debited to old partners cap 1 old ratio., (9) Debited to old partners capital sacrificing ratio., , Revaluation A/c is a~, (8) Real account (b) Asset account, , (©) Personal account

Page 2 :

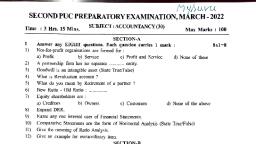

Ye, a5, 7. When the balance sheet is prepared after the new paring, , t—, , agreement, the assets and liabilities are recorded ni z, (a) Current figures (b) Revalued = ‘, (c) Historical cost (d) Realisable v4 2 a a6, i fits in ratio 0 2 respec :, , te sare ct abe hinery would be appr, fi, N was admitted for 1/5" share ~ an would be doprecineg (4, 000) an, Btestntn) Ooms sss os S| |, books new and a creditor amounting to z a ae revaluation?” Day ef, ing on this account. What will be pro’ ', om = 28,000 (b) Profit z oa, (c) Loss 2 40,000 (d) Profit % 40,0 _—* 7, , rtners sharing profits in the ratio of 5 : 4. They admits, : Bae i> pratt for which he paid & 90,000 against capital and % 45,00) (, , ital balance for each partner taking cy, , ~, , against goodwill. Find the cap, capital as base capital., (a) % 2,00,000; % 90,000; % 90,000, (b) % 3,00,000; % 2,40,000; % 1,35,000, (c) 7 2,00,000; % 1,60,000; ¥ 90,000, (4) % 3,00,000; 1,35,000; % 1,35,000, 10. X and Y are partners sharing profits and losses in, , admission, C brings § 70,000 as cash and z 40,00, , New profit ratio between X,Y and Zis 7:5: 4. T, X and Y is—, , sg (b) 1:3, (c) 4:5 (d) 5:9, , 11. Aand B are partners in a firm i, C was admitted for 1/3" mech tiene, , , , , , , , op the amount of goodwit os and brings %, , fa) 22,40,, , (c) ioe (>) % 1,00,000, , 12. A.B.CandD are pa k (4) % 3,00,000, and D share remai ~. 8nd B share 2/3", ratio of A, B, C and m9 Profits in the ratio ors? 7, (a) 8: §: 3 2 ’ 4., (c) 25 25:8 (b) 7

Page 3 :

(a) Reserves (b), , (c) Revaluation profit (d), 14. X, Y and Z are partners sharing pr, to admit M into the firm. X, Y and Zz, of their profit. The share of profit of, (a) 11/54 (b), (c) 13/54 (d), , 15. Aand B are partners sharing pro, sheet shows machinery at % 4,00,, at € 320,000. C is admitted and, , 6:9: 5, Machinery is revalued at 2 3;, , ; @ Provision is made, for doubtful debts @ 2.5%., , A's share in loss on revaluation amount to, , , , ® 20,000. Revalued value of stock will be—, @) 98 000 (b) % 1,00,000, ) ® 60,000 (d) % 62,000, , Answers, , * (d) 3

Page 4 :

(c) ——IO Wy SS 82,000, , , , , , Answers, 4. (a) 2. (b) 3. (c), 5. (0) 6. (d) 7. (b) pe, 9. (c) .10. (a) 11. (d) =, 43. (D) 14. (c) 15. (a), , 4, Contigent liability becoming a certain liability, account at the time of admission of a partne, , On revaluation of assets and liabilities, capi, , 2., donot change., 3, Unless agreed otherwise, the new profit s, will be the same as their old profit sharing, , 4, Itis necessary that partners should have c, , ratios., 5. Inthe absence of any information, any su, should be adjusted through current accou, , 6. Revaluation account is credited for bills a, not recorded in books earlier., , 7. An old customer, whose account was W, , 5 promised to pay but it will not be shown in ,, , Echoyee’s provident fund will be distributed among old partners in old, , , at the time of admission of a partner.

Page 5 :

9. General reserve, in balance sheet at the, distributed among partners in their saci, , 10. Existing Goodwill A/c in balance sheet is, in Odd ratio at the time of admission of, , Answers, 1. True 2. False 3.7, 5. False 6. False 7 F, 9. False 10. True, , Fill in the Blanks with Appropriate, , 1. Partner's current A/c balances in the, capital A/cs are ............, , 2. For any decrease in the value of Asset,, , 3. Investment fluctuation reserve is a reserve set aside out of profit to, , adjust the difference between... ONG on of investments. |, + tims ot aoe oan Hann, 5. a oe iS prepared to record the assets and liabilities at ther re, ies tare Answers ;, Te a i » Debited S.. Panis tiadine Rade at