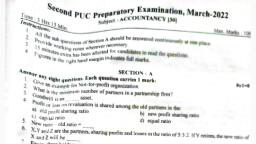

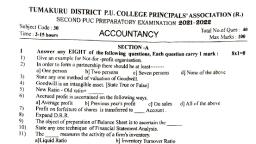

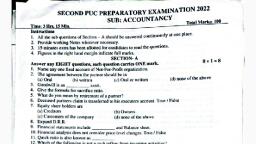

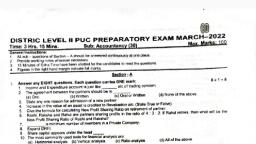

Page 1 :

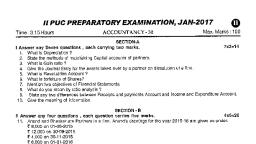

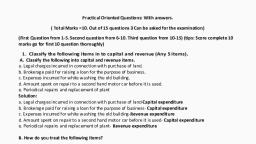

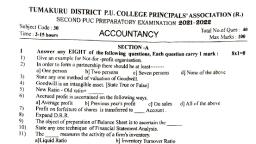

il P U C PREPARATORI[ E&)fflffiifif{I#,, Time:3.15 Hours, , ACCOI.INTANCY, , - 30, , Section - A, l. Answer any SEVEN questions. Each carrying Two marks., 1. What is depreciation?, , JI,N-?IO, 6, , @, , Max. Marks: 100, 7x2=14, , 2. What is fixed capital system?, 3. What is Sacrifice ratio?, 4. Write the Journal entry to close revaluation account. When there is profit., 5. What is Realization Account?, 6. State any two types of Shares., 7. Write any two assets which are shown in fixed assets., B., , 9., , 10., , Write any two types of ratios., What are non-profit organizations?, Give the meaning of data processing., , Section - B, Answer any four questions. Each carrying Five marks., 4x5=20, 11. Hamsini and Vatsalya are partner sharing profits and iosses in the ratio of 3:2. On 1-4-2014 they had capitals, of Rs. 30,000 and Rs. 20,000 respectivety., According to their parlnership deed they are entitled to the following :a) lnterest on capital al 6/" P.a., b) lnterest on Drawings at 5% P.a., c) Vastalya is allowed a salary ol Rs. 500 PM for lirst 6 months and for the remaining period Rs. 1000 P.M., d) Theirdrawings during the year Hamsini Rs.8000 and Vatsalya Rs. 10,000. lnterest on the same Rs.400, and Rs. 500 respectively., The Profit for the year before making the above adjustrnents-was Rs. 24,600., Prepare P&L appropriation alc tor the year ending 31-3-2015., 12. X and Y are padners in a firm sharing Profits and losses in the ratio of 3:2. They admit Z into partnership. The, new profit sharing ratio is 4:3:3. calculate the sacrifice ratib of X and y., 13. A B and C are partners sharing profits and losses in the ratio of 2:2:1. Their capitals on 01-04-2015 were Rs,, 50,000, Rs.30,000 and Rs. 25,000 respectivety, 'A'died on 01-10-2015 and the partnership deed provided the tollowing:, a) Salary to'A'at Hs. 500 P.M., b) lnterest on capital at 5% P.a., c) His share of goodwilt. The Goodwill of the firm is valued at Rs. 2s,000., d) His share in accrued profit upto the date of death amounted to Rs. 5,000, Prepare A's Capital Account., , ll., , 14., , Rajesh Company Ltd. issued 10,000, 10% debentures of Hs. '100 each at a discount of Rs.10 per debenture, payable as follows :a) Rs. 20 on application, b) Rs. 40 on allotment, c) Rs. 30 on first and final call., All the debentures were subscribed and the money duly received upto the stage of allotment., Pass the Journal Entries in the books of the company upto the stage allotment., , 15. lndian Co. Ltd. had the following on 31-3-2015., Current Assets { 4,B0,OOO, Current Liabilities < 1,20,000, Quick Assets, < 2,4O,OOO, Calculate :- i) Current Batio ii) euick, , Ratio, , Use e-papers for save trees-InyaTrust.com, , (p.T.o.)

Page 2 :

16. From the folowing, , tedger balances prepare, 12,000, 1,200, , Cash in hand, Periodicals Cos, Furniture bought, , <, {, {, , 40,000, , Postage, , t, {, <, <, t, , 500, 24,000, 10,000, 8,000, 1,000, , Subscriptions Received, Bent Paid, Salary paid, Electricity Charges, , 17., , R";p1;"d, , Payments Account of Cauvery Charitable Trust., , Explain five qualities of information., , Section - C, 4x14=56, questions., Each carrying Fourteen marks., lll. Answer any FOUR, years, ending, for, four, Account, Depreciation, and, prepare, Account, Machinery, 18. From the following information, 31-3-2015 under Diminishing balance method. Depreciation is being 1O"/" per annum., a) Machine X was purchased on 01-04-2011 for Rs. 1,00,000, b) Machine Y was purchased on 01-10-2013 for Rs. 1,50,000, c) Machine X was sold on 01-'10-2014 for Rs.70,000, , 1g. P.Q. and R are partners sharing prolits and losses, on 31-3-2015 was as under, Balance, Rs., Liabilities, 15,000, Creditors, 9,000, Bills payable, 20,000, Reserve Fund, Capitals, P - 50,000, Q - 30,000, 1,00,000, R - 20,000, , a), b), , c), , d), e), , zo., , in the ratio of 5:3:2. respectively. Their Balance Sheet as, , Sheet as on 31-3-2015, Rs., , Assets, Cash at Bank, , 16,000, 5,000, , Bills Receivable, , Debtors, Less : PBD, , 30,000, 1.000, , Stock, Machinery, Motor Car, P and L A/c, , 29,000, 20,000, 50,000, 14,000, 10,000, , 1,44,000, 1,44,000, Mr.Q retired. The following adjustments are to be made, Stock is revalued at Rs. 28,000, Provision for doubtful debts to be brought upto 10olo oo debtors., '107" respectively., Machinery and motor car depreciated by 5% and, Outstanding rent to be provided for Rs. 1,200, Goodwill of the firm was raised for Rs. 50,000 and it has to be retained in the book., Prepare :- a) Revaluation Account b) Partners Capital Account c) New Balance Sheet of the firm, , Chirag and Chintan are partners sharing profits and losses in the ratio of 3:2. They dissolved their firm on 31-, , 03-2015., , Liabilities, Creditor, Bills payable, Chirag's Loan, Reserve Fund, , P&LA/c, Capitals, , Balance Sheet as on 31-3-2015, Assets, Rs., Bank, 20,000, 25,000, 17,000, (-), l ooo, 21,000, , Debtors, PBD, , 10,000, 12,000, , :, , Chirag, , 50,000, Chintan 40,000, , 90,000, 1,70,000, , lnvestments, Stock, , Furniture, Motor Car, Computer, Buildings, , Rs., , 21,000, 24,O00, 10,000, 14,000, 16,000, , 30,000, 25,000, 30,000., 1,70,OOO, , Use e-papers for save trees-InyaTrust.com

Page 3 :

-3a), , b), c), d), e), 21, , ., , The details available are :Assets reaiised as follows :T 22,000, Debtors, { 16,000, Stock, Furniture { 14,000, { 25,000, Motor Car, Buildings { 40,000, lnvestment is taken over by Chirag at book value., Computer is taken over by Chintan at 10% less., All liabilities are paid in full., Realisation Expenses T 3000, ii) Partner Capital, Prepare :- i) Realisation A/c, , Prem Co. Ltd. issued 10,000 Equity shares at, 10 on Application, 50 on Allotment (lncluding premium), 30 on First Call, 20 on Final call, , T, <, t, t, , (, , A/c, , iii), , Bank A/c, , 100 each at a premium of Rs. 10 per share payable as follows:-, , All the shares were subscribed and the money duly received except on final call f0f 500 shares. The, Directors forfeited these shares and re-issued at t 90 each fully paid., Pass the necessary Journal Entries related to the above information., , 22., , From the following Trial balance of Ratna Trading Co. Ltd., Prepare the financial statements for the year, ending 31st March 2015., , Debit, , Sl.No., , Particulars, , 1", , Sale of goods, Office Rent, Opening inventories, Purchase of goods, Furniture, Trade payable, Plant & Machinery, Trade Receivable, Surplus (opening balance), 10% Debentures, lnterest on Debentures, Fixed Deposit (6 months term), Staff welfare expenses, Equity share capital 40,000 Share of Rs 10 each, Cash in hand and at Bank, Buildings, Rates & taxes, Salaries, Goodwill, General Fleserve, , 2., , 3., A, .+., , 5., 6., , 7., B., , I, , 10, 11, , 12, 13, 14, 15, 16, 17, 1B, , 19, 2., , t, , :- a), b), c), d), e), , t, , 5,50,000, , 1, 1, , 50,000, 35,000, 70,000, 85,000, 85,000, , 1, , 1, , 00,000, 60,000, 10,000, 1,00,000, 10,000, 70,000, 12,000, , 4,00,000, 63,000, 90,000, 25,000, 55,000, 1,25,000, 5,000, , 11,50,000, Adjustments, , Credit, , 11,50,000, , Closing inventories { 45,000, Create provision for taxation at 30%, Transfer to General Reserve ( 5,000, Directors proposed dividend ol 10/", Provide depreciation on plant and mabhinery at 10% and Buildings at 5%, (P.r.o.), , Use e-papers for save trees-InyaTrust.com

Page 4 :

23. From the following, , -4-, , Balance Sheet prepare common size Balance Sheet of KSM Co. Ltd. as on 31st March 2014, , and 2015., , Liabilities, , 31-03-14 <, , Share capital, General Reserve, P&L a/c, Long term loan, Creditors, Bills payable, Bank overdraft, O/S expenses, , 24., , 31-3-15, , t, , 2,00,000, 40,000, 16,000, 18,000, 5,000, 2,000, 15,000, 2,000, , 2,90,000, 43,500, 14,500, 20,000, 5,000, 2900, 14,500, 1,600, , 2,98,000, , 3,92,000, , Assets, , 31-3-14 <, , Land & Buildings, Plant & Machinery, , Furniture, Stock, Debtors, Bills Receivable, Cash, Prepaid expenses, , 31-3-2015, , {, , 50,000, , 70,000, , 1,00,000, , 1,00,000, , 30,000, 7.000, 40,000, 50,000, 10,000, 11,000, , 62,000, 8,000, 58,000, 43,500, 14,500, 36,000, , 2,98,000, , 3,92,000, , Following are the Balance Sheet and Receipts and payments Account of Mandya Sports club, manday., , Balance Sheet as on 31-03-20'14, , Liabilities, , Assets, , Rs., , O/S Rent, Capital Fund, , 3,600, 1,22,700, , Furniture, Sports Materials, O/s Subscriptions, Cash in hand, Cash at Bank, , 1,26,300, Receip, , Liabilities, , and payments A/c for the year endin 31-03-201s, , 17,100, 20,000, 10,900, 27,O00, 46,000, 1,060, 2,400, , ,24,460, Adjustments, , :-, , 17,600, 70,000, 1.600, 1 7,1 00, 20,000, 1,26,300, , Rs., , To Cash balance, To Bank balance, To entrance fee, To Donations, To Subscriptions, To lnterest, To Sports fee, , Rs., , Assets, By Salary, By Rent and Taxes, By Legal Charges, By General expenses, By Sports materials, By Office expenses, By lnvestments, By Cash Balance, By Bank Balance, , Rs., , 21,000, .17,800, , 1,700, 3,500, 12,000, 8,600, 30,000, 13,860, 16,000, , 1,24,460, , a) O/s Subscriptions t 3,600, b) Ols Rent t 1800 and legal charges due {, , 300, are to be capitalised., d) Depreciate sports materials by { 8000 and Furniture by 1200, a) lncome and expenditure Account b) Balance Sheet, , c) Donations, , Prepare, , :-, , ., , Section -D (Practical Oriented Questions), Answer any TWO questions, each carrying Five marks., , lV., 25., , 26., 27., , 2x5=10, , How do you treat the following in the absence of partnership deed?, a) lnterest on capital of partners, b) lnterest on Drawings of padners, c) lnterest on loan from partners, d) Distribution of profit or loss, e) Salary or commission to partners, Prepare Executors loan account with imaginary figures showing the repayment in two annual equal installments, along with interest., Prepare the tree diagram of hierarchical data base model., , Use e-papers for save trees-InyaTrust.com