Page 1 :

Financial Statements of, Not-for-Profit Organisations, , LEARNING OBJECTIVES, The study of this Chapter would enable students to understand:, “1 Meaning and Concept of Not-for-Profit Organisation, Characteristics or Features of Not-for-Profit Organisation, Difference between Not-for-Profit Organisation and Profit Earning Organisation, Meaning, Format and Features of Receipts and Payments Account, Difference between Receipts and Payments Account and Cash Book, Meaning and Features of Income and Expenditure Account, , 13), , i oC, , Difference between Income and Expenditure Account and Profit and Loss Account, Difference between Receipts and Payments Account and Income and Expenditure Account, Preparation of Balance Sheet, , Fund Based Accounting , Preparation of Income and Expenditure Account and Balance Sheet from, , ooooo eo, , Receipts and Payments Account with additional information, , 1.1, 1.2, 1.2, 1.3, 1.4, 1.7, 1.9, 1.10, 1.10, 1.13, , 1.34, , MEANING AND CONCEPT OF NOT-FOR-PROFIT ORGANISATION, , Enterprises (Business organisations) are profit-earning entities since their main objective is to earn, , profit. In contrast to these entities, there are also Not-for-Profit Organisations, whose main, , objective is to serve the society and its members and not to earn profit., , Not-for-Profit Organisations, also known as Non-profit Organisations are set up with the, , objective to further cultural, educational, health, religious, public services to public and/or, members, etc. not with the purpose of earning profit. Examples of such organisations are: schools,, colleges, public hospitals, literary societies, societies for promotion of sports, arts and culture,, , social welfare organisations, clubs, ete., , Funds required for the activities of a Not-for-Profit Organisation are normally sourced (contributed), , by its members, trustees, etc., as donations, membership fees and subscriptions., , Funds received by a Not-for-Profit Organisation may be:, , (a) Donation, (b) Membership Fee or Entrance Fee, (c) Subscription, (d) Loans, and, , (e) Grants (From Government and/or Institutions)., , { i,

Page 2 :

1.2 Double Entry Book Keeping—CBSE XII, , CHARACTERISTICS OR FEATURES OF NOT-FOR-PROFIT ORGANISATION, , L, 2., , Entity: Not-for-Profit Organisation is a legal entity separate from its promoters., 5 8 P, , Purpose: Their purpose is to further cultural, educational, religious, professional objectives, , and rendering service to people at large., Ownership: It is set-up by individuals or companies as charitable society or trust but it is, , not owned by them. It belongs to the society., Profit is not the Objective: Not-for-Profit Organisation does not function with the objective, , it does not mean that it cannot earn profit, termed as Surplus. Surplus, , of earning profit. But,, ctives for, , is necessary to maintain its assets and also operations. Surplus is used for the obje, which it is set-up and is not distributed among its members., , Management: Not-for-Profit Organisation is managed by a group of individuals often called, Trustees or Managing Committee., , Funds: Funds for its operations are given by its members and donors in the form of, Entrance Fee, Membership Fee, Subscription and Donations. It is supplemented by surplus, from operations., , Financial Statements: It prepares its financial statements every year and includes Receipts, and Payments Account, Income and Expenditure Account and the Balance Sheet., , Difference between Not-for-Profit Organisation and Profit Earning Organisation, , 1. Purpose for It is set-up with a purpose to further cultural, | Purpose is to earn profit. ;, , , , , , , , , , , , , , which set-up educational, religious, professional or publicservice., 2. Sources of They are raised by way of Membership Fee, | They are raised as capital by the proprietor,, Funds Subscription, Donations and Surplus from | partners (in the case of Partnership Firms) and, Operations. In the Balance Sheet, it is shown as | Share Capital or borrowed funds (in the case of, General Fund or Capital Fund or Corpus Fund. Companies). Profits not distributed to partners, and shareholders are shown as Reserves., 3. Financial Financial Statements prepared are Receipts and | Financial Statements prepared are Trading, Statements Payments Account, Income and Expenditure | Account, Profit and Loss Account and Balance, Account and Balance Sheet. Sheet., 4. Surplus/Profit | Balance of the Income and Expenditure Account | Balance of the Profit and Loss Account is either, is either Surplus or Deficit. Net Profit or Net Loss., 5. Distribution of | its profit is not distributed among its members. | Its profit is distributed among its members., Surplus/Profit ‘, , , , , , Financial Statements of Not-for-Profit Organisation, , Not-for-Profit Organisation prepares annual or final accounts showing the financial transactions, of the organisation for its members and to comply with statutory requirements., Financial Statements or Final accounts of a Not-for-Profit Organisation include:, , 1,, , 3., , Receipts and Payments Account,, 2. Income and Expenditure Account, and, , Balance Sheet.

Page 3 :

Chapter 1 - Financial Statements of Not-for-Profit Organisations 1.3, , 1. RECEIPTS AND PAYMENTS ACCOUNT, , , , Receipts and Poymer 's Account is a summary of cash ( including bank) receipts and payments during an, accounting period, receipts and payments being shown under appropriate heads of accounts. It begins, with Opening Cash and Bank Balances and ends with Closing Cash and Bank Balances of the, accounting period. Receipts are shown in the debit side whereas payments are shown in the, credit side of the account. Receipts and Payments of every nature are shown in this account,, ie., whether it is capital or revenue in nature or whether it relates to the current year, previous, , year or next year., , Format of Receipts and Payments Account, , RECEIPTS AND PAYMENTS ACCOUNT, Dr., , , , , , , , for the year ended... a, , Receipts ag Payments Lease, To Balance b/d (Opening Balance): By Balance b/d (Opening Balance) a, , Cash in Hand s (in case of Bank Overdraft) j, , Cash at Bank % By Salaries Z, To Subscriptions: By Rent | s, , For Previous Year(s) = | By Postage Expenses Neale, , For Current Year es By Advertisement Expenses | ., , For Next Year(s) nel Fe By Newspapers and Magazines, etc. | mo, To General Donations Ee By Repairs | ba, To Specific Donations = By Audit Fee | =, To Grant for Specific Purpose ba By Maintenance Expenses | cS, To Entrance/Admission Fees as By Insurance, To General Grants Be By Honorarium | e, To Sale of Newspapers, Grass, etc. a By Municipal Tax | a, To Sale of Old or Used Sports Materials et By Prize Distributed | ay, To Interest on Investments Es By Office Expenses ~, To Dividends ~ By Expenses on Show ee, To Rent Received = By Miscellaneous Payments a, To Interest Received = By Purchase of Fixed Assets (e.g., Furniture) LS, To Miscellaneous Receipts = By Sports Equipment ~, To Life Membership Fees oo By Investments 7, To Subscriptions for Specific Purpose ~ By Books es, To’ Legacies (General) ~ By Loan (Repayment) ma, To Legacies (Specific) x By Buildings 25, To Endowment Fund 5 By Balance c/d (Closing Balance):, To Sale of Fixed Assets es Cash in Hand iB, To Receipts on Account of Specific Fund, Cash at Bank* oS, , ie, Match Fund, Prize Fund, etc. ~, To Balance c/d (Bank Overdraft)* ee &, , , , , , , , , , , , , , “Either of the two will appear.

Page 4 :

1.4 ‘Double Entry Book Keeping—CBSE XIl, , Features or Characteristics of Receipts and Payments Account, 1, Nature: It is an Asset Account (Real Account as per Traditional Approach), it being a, , summary of cash receipts and cash payments including bank balance., ie., transactions which have, , Basis of Preparing; It is prepared on Cash Basis of Accounting,, been received or paid in cash are shown in the account. In the debit side amounts received, , are shown and in the credit side amounts paid are shown., Capital and Revenue Receipts and Payments: It shows all receipts and payments whether, , they are of revenue nature or capital nature., Period: It shows all cash and bank transactions whether it relates to current, previous or, , succeeding (next) accounting periods., , Opening and Closing Balances: Opening balance of this account shows cash in hand, and/or at bank in the beginning of the accounting period and closing balance shows cash, in hand and/or at bank at the end of the accounting period., , Adjustments: Adjustment for outstanding expenses, prepaid expenses, accrued income or, income received in advance, and depreciation are not made in this account as itis maintained, , on cash basis of accounting., Purpose: The purpose is to show amount received and paid under different heads during, , the accounting year., , Limitations of Receipts and Payments Account, (i) It does not differentiate between capital and revenue incomes and expenses as both are, , shown in Receipts and Payments Account., (ii) It does not show the incomes and expenses that have been earned during the year but, , are not received., (iii) It does not show surplus or deficit for the accounting period., (iv) It does not show whether the Not-for-Profit Organisation is able to meet its day-to-day, , expenses out of its income or not., , Difference between Receipts and Payments Account and Cash Book, , It is a summary of Cash Book and is prepared from] It records each transaction of receipt and payment, , 1. Basis, , , , the Cash Book. i separately., 2. Period Receipts and Payments Account is a summary) Cash Book is maintained on daily basis, i.e.,, prepared at the end of accounting year. transactions are recorded datewise in the Cash Book., , , , 3. Institutions | It is prepared by the Not-for-Profit Organisation. | It is prepared by all organisations be it Not-for-Profit, Organisation or an enterprise., , , , , , , , 4. Sides Under it, there are receipts and payments sides! Cash Book is divided i i i, instead of debit and credit sides. ae eea ce, 5. Ledger Folio | There is no column for Ledger Folio, Cash Book has a separate column for Ledger Folio.

Page 5 :

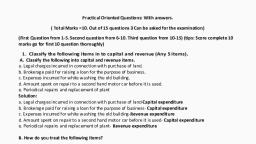

4, , Chapter 1 - Financial Statements of Not-for-Profit Organisations 1.5, , Illustration 1., , From the following particulars of Silver Charitable Society, prepare Receipts and Payments, Account for the year ending 31st March, 2019:, , , , , , , , , , , , , , , , , , , , , , , , , , Particulars z, Opening Balance:, Cash in Hand 40,000, Cash at Bank 2,10,000, Subscriptions Received (including € 15,000 for the year 2017-18) 3,05,000, Donations for Building 5,00,000, Postage and Stationery 25,000, Insurance Premium (including % 4,000 paid in advance) 28,000, Purchase of Investments 31,000, Life Membership Fees 30,000, Salaries Paid (including % 5,000 for the year 2019-20) 35,000, Tournament Expenses 15,000, Locker Rent 34,000, Closing Balance:, Cash in Hand 8,000, (CBSE 2020 C), Solution:, Dr. RECEIPTS AND PAYMENTS ACCOUNT for the year ended 31st March, 2019 Cr., Receipts < Payments z, To Balance b/d: By Postage and Stationery 25,000, Cash in Hand 40,000 By Insurance Premium (Including ¢ 4,000, Cash at Bank 2,10,000 | —2,50,000 paid in advance) 28,000, To Subscriptions (Including % 15,000 By Investments 31,000, for the year 2017-18) 3,05,000 | By Salaries (Including % 5,000 for the, To Donations for Building 5,00,000 year 2019-20) 35,000, To Life Membership Fees 30,000 | By Tournament Expenses 15,000, To Locker Rent 34,000 | By Balance c/d:, Cash in Hand 8,000, Cash at Bank (Bal. Fig.) 9,77,000 | 9,85,000, 11,19,000 1 000, , , , , , , , Illustration 2., , From the following information, prepare Receipts and Payments Account of Navrathan, Recreation Club for the year ended 31st March, 2021:, , , , , , , , , , , , Particulars zg Particulars z, Opening Balance: Salaries 75,600, Cash in Hand 20,000 | Rent Paid 4,800, Cash at Bank 50,000 | Electricity Expenses 7,600, Subscription Received: Books Purchased 20,000, 2019-20 7,000 10% Investments Purchased (Ist September, 2020) 30,000, 2020-21 1,21,600 | Interest on 10% Investments 1,750, 2021-22 5,200 | Entrance Fee 4,000, Donations for Building 70,000 | Closing Balance: 5, Donations for Match 14,000 | Cashin Hand 25,600, Match Expenses 6,000 | Cashat Bank 2