Page 1 :

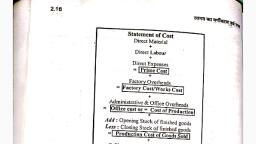

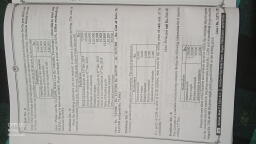

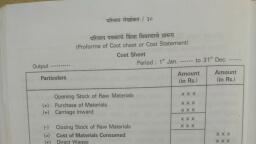

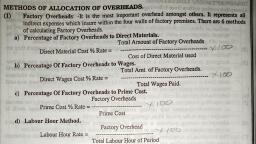

TYBCOM SEM V, Cost Accounting, Dr. Sumedha Naik, , Cost Classification, Cost Sheet, For ascertainment of total cost of production, a statement showing various elements of cost is prepared,, which is known as Cost Sheet. It is also known as Statement of Cost. The total cost of any job or operation, or order can be calculated by preparation of the cost sheet. A cost sheet can be prepared for a cost centre, or a cost unit., A cost sheet is related to a particular product. It shows the cost incurred during a particular period. It, shows total cost or cost per unit. It is based on actual data or estimated data., Cost sheet enables comparison with previous years’ cost data. It facilitates preparation of tenders and, quotations. It assists managments in deciding the selling prices of the products. It is helpful in cost, controlling., PROFORMA COST SHEET, Cost Sheet for the period_________, (Production, Units), Particulars, Rs, Unit Cost, Direct Materials Cost, Opening Stock of Materials, xx, + Purchases, xx, + Carriage Inwards, xx, + Custom Duty and Octroi, xx, Dock Charges, xx, Freight Inward, xx, xx, Less : Closing stock of Materials, xx, xx, xx, Direct Wages, xx, Direct Expenses/Chargeable Expenses, XXX, Prime Cost, Factory Overheads:, Factory Rent,Rate,Insurances, xx, Factory Supervision, xx, Motive Power, xx, Fuel & Oil, xx, Grease,Water etc., xx, Steam, xx, Welfare Expenses, xx, Laboratory Expenses, xx, Depreciation of plant & Machinery, xx, Depreciation of Factory Building, xx, Repairs & Maintenance of Factory, xx, Indirect Wages, xx, Estimation Expenses, xx, Technical Director’s Fees, xx

Page 2 :

Haulage, Royalty, Loose tools W/off, Materials handling Charges, Factory Stationary, Works Manager’s Salary, Works Clerical Staff’s Salary, Supervisor’s Salary, Store Keeper’s Salary, Service Department Expenses, Factory Clearing, All other Factory Expenses, Less : Scrap Sales, Add : Opening Work in Progress, Less : Closing Work in Progress, Factory Cost, Office & Administration Overheads, Office Rent Rate & Taxes, Staff Salaries, Office Lighting, Office Cleaning, Printing & Stationery, Postage & Telegram, Office Conveyance, Depreciation of Office Building & Furniture, Office Equipments, Office Repairs, Sundry Expenses, General Expenses, Legal Expenses, Audit Fees, Cost of Production, Add : Opening Stock of Finished Goods, Less : Closing Stock of Finished Goods, Cost of Finished Goods sold, Selling & Distribution Overheads, Selling:, Advertisement, Show Room Expenses, Travelling Expenses, Commision on sales, Sales Salaries, Discount allowed, Bad Debts, Samples & Gifts, After Sales, Service Expenses, , 2, , xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, , xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, , xx, xx, xx, xx, , xx, xx, xx, xx, xx, , xx, xx, xx, xx, xx, xx, xx, xx, xx, xx

Page 3 :

Demonstration Expenses, Packing Expenses, Loading Charges, Carriage on Sales, Rent of Warehouse, Insurance & Lighting of Warehouse, Expenses of Delivery Van, Salaries of Packing Department, Collection Charges, Cost of catalogues, Cost of mailing literature, Cost of tenders, Total Cost or Cost of Sale, Profit, Sales, , xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, , xx, , xx, xx, xx, , 1.2 COST SHEET( ALTERNATIVE FORMAT), For the period......., Particulars, Sch.No Amount, xx, Direct Cost, Direct material consumed, 1, xx, Direct or Productive wages, xx, Direct Expenses, xx, xx, Prime Cost, Add Factory overheads, 2, xx, xx, Works or Fatory Cost, Add office and administrative overheads, 3, xx, xx, Cost of Production, Add Opening stock of Finished goods, xx, xx, Less Closing stock of Finished goods, xx, xx, Cost of Goods Sold, Add Selling and Distribution overheads, 4, xx, xx, Cost of Sales, Add Profit(loss), xx, xx, Sales, Schedule 1 Direct Material Consumed, Particulars, Opening stock of Raw materials, Add : Purchase of Raw materials, Carriage Inwards, Custom and Octroi duty, Dock Charges, Freight inward, Less: Closing stock of Raw materials, Direct material consumed, , 3, , Rs., xx, xx, xx, xx, xx, , xx, xx, xx, xx

Page 4 :

Schedule 2 Factory Overheads, Particulars, Factory Rent,Rates and Insurance, Factory Lighting, Factory Supervision, Motive Power, Fuel and oil, Grease,Water etc., Stream, Welfare Expenses, Laboratory Expenses, Depreciation of plant and Machinery, Depreciation of Factory Building, Repairs and Maintenance of Factory, Indirect or Unproductive wages, Estimation expenses, Technical Directors Fees, Haulage, Royalty, Loose Tools written off, Materials handling charges, Factory Stationery, Works or factory Manager’s salary, Supervisors Salary, Drawing office salaries, Store keeper’s salary, Service Department expenses, Less:Scrap sales, Add: Opening Work in pprogress, Less:Closing work in Progress, , Rs, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, XXX, , Schedule 3 Office and Administrative Overheads., Office Rent and Taxes, Staff Salaries, Office Lighting, Office Cleaning, Printing and Stationery, Postage na Telegram, Office Conveyance, Depreciation of Office Building and Furniture, Office Equipment, Office Repairs, , 4, , Rs, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx

Page 5 :

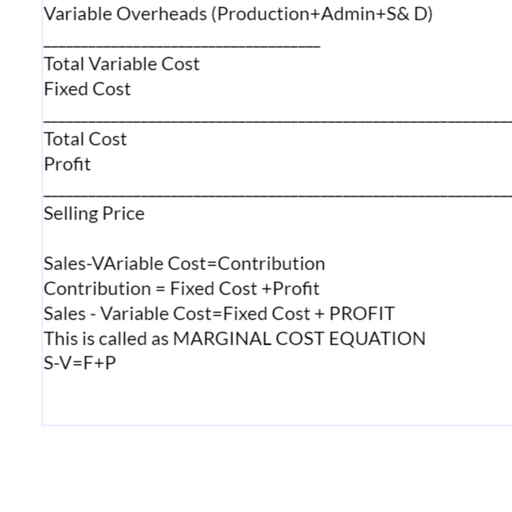

Sundry expenses, General expenses, Legal expenses, Audit fees, , xx, xx, xx, xx, XXX, , Schedule 4 Selling and Distribution Overheads, Particulars, Advertisement, Show room expenses, Travelling expenses, Commission on sales, Salesmen’s Salaries, Samples and Gifts, Service expenses, Demonstration Expenses, Packing expenses, Loading Charges, Carriage Outward, Warehouse Rent, Insurance, Lighting of Warehouse, Expenses of Delivery Van, Salaries of packing department, Collection Charges, Cost of Catalogues, Cost of Mailing Literature, Cost of Tenders, Depreciation on Delivery Van, , Rs, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, xx, XXX, , Divisions of Cost, 1. Prime Cost: It comprises of all direct materials, direct labour and direct expenses. It is also known, as Flat Cost., Prime Cost = Direct Materials+ Direct Labour + Direct Expenses, 2. Works Cost: It includes Prime Cost and Factory Expenses. It is also known as factory cost or cost, of manufacture., Works Cost = Prime Cost+ Factory Overheads, 3. Cost of Production: It represents works cost plus administrative expenses., Cost of Production = Works Cost + Administratative Overheads, , 4. Total Cost: It represents cost of production plus selling and distribution overheads., , 5

Page 6 :

Total Cost = Cost of Production + Selling & Distribution Overheads, 5. Selling Price: It is the price which includes total cost plus margin of profit or minus loss, if any., Selling Price = Total Cost + Profit, OR, Selling Price = Total Cost- Loss, , 6