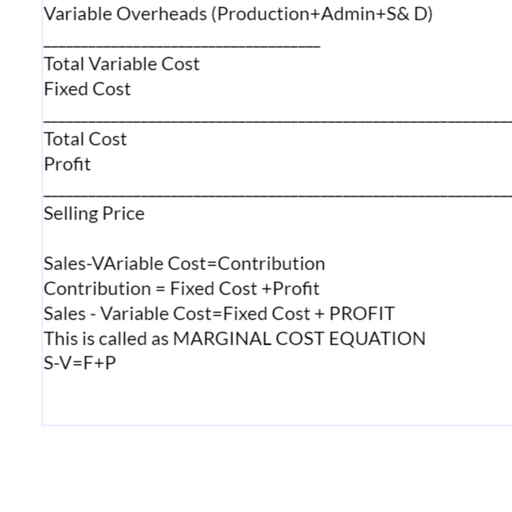

Page 1 :

Chapter 5 Labour Cost, , , Direct Labour: the amount of wages paid to the workers engaged on production line. • Indirect Labour: the, amount of wages paid to workers engaged in departments other than production., Time Keeping, Time keeping department: Need, Objectives and Importance: • need to control the time by a worker • to ensure, discipline, punctuality • suitable for large scale factory • accurate recording of each worker’s time • records, opening time, closing time, lunch break, overtime , etc.• accurate and full proof method of recording attendance, of day workers and daily wages workers • useful for providing statistical data, Methods of recording time1. Hand written register- a. Time Book b. Time Register, 2. The Check, Token or Disk Method- simple to operate. Each worker is given an identification number. This, number is engraved on a metal disc. All the tokens are hung on a board at the gate or at the entrance of the, department. The late-comers collect their discs and hand over the same personally to the time keeper. The, discs not removed from the boards represent the absentee workers. This is economical method. It is suitable, for small factory., 3. Time recording Clock Method- Under this method, the attendance is marked by a time recording clock on a, card. Every worker is allotted a time card usually for one week duration. These time cards are serially arranged, in a tray at the gate of the factory. On arrival the worker picks up his card from the tray and inserts the same, into the time recording clock which prints the exact arrival time at the space provided on the card against the, particular day., 4. The dial time recorder is a machine which records the correct attendance time of the worker automatically., It has a dial around the clock with a number of hold (usually about 150), each of which bears a number, corresponding to the identification number of the worker concerned., Requisites of a good time keeping system, An efficient system of time keeping should ensure the following:, (i) The system should not allow proxy for another worker., (ii) A responsible officer should be present at the factory gate to have proper supervision., (iii) Piece rate workers should also record attendance time like time rate workers to maintain discipline and to, ensure proper flow of production,, (iv)Time of arrival and time of departure should be recorded., (v) Mechanical methods of recording time should be followed., (vi) Late-comers should record late arrivals without any relaxation., (vii) No one should be allowed to go out of the factory without the permission of the proper authority., (viii) The system should be simple, smooth and quick to avoid unnecessary queuing at the gate., Time Booking: Time booking is a method of recording time spent by a worker on a job, order or process. The, main objectives of time booking are: (i) To ascertain the cost of work done. (ii) To ensure that the time paid for, is properly utilised. (iii) To ascertain and minimise idle time within limit. (iv) To determine the rate of, absorption of overhead expenses based on direct labour. (v) To know the efficiency of workers by comparing, the actual time taken with the time allowed for completing a job., Time may be booked manually or mechanically. Small organisations book the time manually, while large, organisations book the time mechanically. The following methods are generally used for time booking:, 1. Daily Time Sheet:, Under this method, each worker is allotted a time sheet to record the time on each job during a day. The, worker is supposed to enter the work order no a description of work done, the 'quantity produced, and time at, which he starts and iii at which he finishes., 2. Weekly Time Sheet:, This method of recording time is improvement over the daily time sheet since the number of documents to be, prepared is considerably reduced. Time sheets are prepared for a week in place of everyday., 3. Job Cards:, A job card is a card which contains all the details regarding the time spent by a worker or a group of workers, on a particular job. It authorises a worker to carry out the specified assignment. Whenever a worker takes up, the job, he is given this card and he records the hours worked on the job. Generally four different types of job, cards are used and these are: (a) Job card for each job- As the job progress the card moves from worker to, worker along with the job. (b) Job card for each worker- This card gives a complete record of the time spent by, each worker on different jobs during a particular period. It also facilitates reconciliation between the time of, attendance and time booked against each job. (c) Combined Time and Job Card (d) Piece work card, Sometimes there is discrepancy between the gate time (time keeping) and time booked (time booking), to different jobs. It is necessary to reconcile., Pieceworkers: Worker is paid a fixed piece rate for each unit produced or action performed regardless of time., There is need to keep separate job card for each job. Time record of piece workers is necessary for various reasons., Casual Workers: Worker who works in place of an absent worker is known as casual worker. Wages paid to them, are treated as overhead expenses. Wages paid by the foreman or the clerk in the head office.

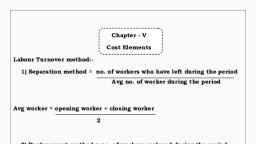

Page 2 :

Outworkers: workers in addition to regular workers. Need to keep close control on their time. Their attendance, record should be kept. The out work sheets are to be filled in by them or by the foreman., Pay Roll Accounting, It involves preparation of pay roll and pay slip at periodic intervals. Pay Roll shows: Gross Wages, Deductions, and, Net Wages for each worker. Pay Slip shows Gross Wages, Deductions, and Net Wages of individual worker., Acts related to pay roll: •Payment of Wages Act 1963 • Payment of Bonus Act 1965 • The Employees Provident, Funds Act • The Employees’ State Insurance Act 1948 • The Maternity Benefit Act 1961 • Payment of Gratuity Act, 1972, , Chapter 6 Labour Turnover, , Labour Turnover: “Labour Turnover refers to the movement into and out of an organisation by the work-force”., High labour turnover is costly for the business. There are 2 types of Causes: 1. Avoidable 2. Unavoidable, Avoidable Causes: • Dissatisfaction with Job, wages, working environment, hours of work, personnel policies •, Lack of facilities, proper placement, foresight & manpower planning, protection against accidents • Inadequate, training facilities, Unavoidable Causes: • Better opportunities •Family Causes • Economic & Social Factors •Retirement • Death, •Illness • Disability •Marriages •Dismissal •Redundancy •National Service, Cost of labour turnover: It is treated as part of overheads., Types1. Preventive Costs 2. Replacement Costs, Preventive Costs: This is the cost incurred to keep the employee working and to discourage him to leave. It is, charged to respective departments in proportion of labour strength., a. Personnel Administration- Cost of Keeping separate personnel department for recruitment, training and, maintain good repo with employees., b. Medical Services- Cost of Medical services for the labour and his family members., c. Welfare Services- Cost of providing welfare services e.g. sports facility, laundry, canteens, co-operative stores,, housing schemes, transport and educational facilities, d. Miscellaneous Schemes- Pension scheme, better scales, bonus, perquisites, provident fund, etc., Replacement Costs: This is the cost incurred for the recruitment, training and absorption of new workers. It is, charged to respective departments in proportion of labour strength or directly charged to the product., a. Loss of Production: Due to lag in joining new worker, extra cost is to be paid for the overtime of other workers, for finishing scheduled production., b. Personnel department: Cost of Advertising, recruitment, selection, training and induction of new workers, incurred by the personnel department, c. Low Productivity of new worker due to inefficiency turns into extra cost., d. Cost of Tools and Machine Breakage during the training period of new worker., e. Cost of Accidents due to inexperienced new worker., f. Cost of scrap and defective work caused by new worker., , Labour Turnover Cost= Total Cost of Labour Turnover ÷ Average No. of workers Employed or, Replace, How to reduce the labour turnover?, 1. Data Collection: The firm should collect the statistical data of leaving workers. This data is to be classified and, analysed carefully. It would bring forward the causes of turnover., 2. Standardized Procedures for recruitment, selection, placement and follow up can reduce the labour turnover., 3. Job Analysis and Evaluation can ensure the selection and placement of a right man for a right job. It will reduce, the rate of labour turnover., 4. Exit Interviews indicates the real causes of labour turnover. Exit questionnaire also can be applied., 5. Joint Committee consisting of labour representatives of management and workers can review the grievances of, labour in their meetings and can offer suggestions., 6. Other Measures include improving quality of labour supervision, labour relation, promotional policies, health, and safety measures, training facilities, recreational facilities, etc., Measurement of Labour Turnover, Separation Method, Labour Turnover Rate= (No. of separations in a period ÷ avg. no. of workers during the period)× 100, Basis of Avoidable Separation Method, LTR= (Avoidable separation in the period ÷ avg. working force during the period)× 100, Basis of Accession, LTR= (Accessions ÷ avg. working force)× 100, Replacement Method, LTR= (No. of workers replaced in a period ÷ avg. no. of workers during the period) × 100, Flux Method, LTR= [(No. of separations in a period + No. of workers replaced in a period) ÷ avg. no. of workers during the, period] × 100

Page 3 :

Chapter 7 Remuneration Methods, Wages: Wages are paid to direct and indirect labour as the reward of services rendered by them. Wages can differ, according to various categories of workers in a concern. Proportion of labour cost in total cost can differ from, industry to industry. Every industrial enterprise should carefully formulate a sound wage policy., Good Wage Plan should: 1. Be based on scientific studies of time, motion and fatigue 2. Guarantee minimum, wages 3. Maintain labour turnover at a desirable level 4. Be acceptable for management & workers 5. Promote, industrial peace 6. Ensure monetary reward for efficient workers 7. Be flexible 8. Reduce labour absenteeism 9., Achieve largest production with lower cost 10. Be economical 11. Be easy to understand., Factors affecting Wages: 1. Supply & Demand 2. Existing Wages 3. Legal Provisions 4. Ability to Pay 5. Labour, Union 6. Productivity 6. Cost of living 7. Attractive Wages, Elements of Wages= Basic pay + Cash Benefits + Fringe Benefits, Cash Benefits: Discount Allowed, HRA, CCA, Shift allowance, over time allowance, uniform alw, conveyance alw,, medical alw, bonus, Employer’s contribution to PF & ESI, leave Salary, gratuity, pension, sickness benefits, Fringe Benefits: medical, accommodation, transport, canteen, entertainment, educational, refresher training, facilities, Methods of Labour remuneration, Time Rate Method of Wages: in this method, the worker is paid at a specified rate on the basis of attendance. The, wage rate may be determined as per hour, per day, per week, per fortnight or per month., Wages = Actual Time Denoted × Time Rate, a. Flat Time Rate (Time Rate at ordinary levels): Workers are paid at a flat rate on the basis of time they spend, on work. Workers get overtime wages at the ordinary/double/1.5 times of ordinary rate., b. High Wage System: A high wage rate is fixed which is higher than the average rate in the industry. It attracts, and retains competent workers. Here no overtime is permitted. Workers need to achieve specified target of output., c. Graduated Time Rate/Measured Day Work: In this method wages consist of two elements: Fixed and Variable., The fixed element is based on the nature of the job. The variable element is based on his merit rating and cost of, living index., Piece Rate Method: Under this method labour is remunerated on the basis of production only. Wages are based on, the performance and merit. It is also known as piece work system, piece wage or payment by result system., a. Straight piece rate method: The worker receives a flat rate of wages per unit of output. This is the simplest, method. Earnings = No. of Units × Rate per Unit, b. Piece rate with graduated time rates: They are paid on the basis of piece rate with a fixed dearness allowance, or cost of living bonus., , Incentive Plans, Incentives are defined as the stimulation of effort and effectiveness. It may be monetary or non monetary., Incentives may be provided individually or collectively. It improves productivity and efficiency. A good incentive, plan should be simple, economical, fair, permanent and flexible. It should improve morale of workers, ensure, fixed wages and reduce absenteeism and labour turnover. It should give incentives to efficient workers, be, approved by workers and suitable for management., Bonus, The additional monetary benefit provided to the worker is named as bonus. It motivates the workers to work hard, and achieve higher production. It decreases the cost of production per unit. There are various schemes for, providing bonus:, 1. Differential Piece Rate: The rate per piece or the rate per standard hour of production is increased as the, production level increases. This scheme was first introduced by F. W. Taylor in USA (Father of Scientific, Management), a. Taylor’s Differential Piece Rate System: There are two different piece rates of wages: 1. Low piece rate for, output below Standard 2. High Piece Rate for output above Standard. It motivates efficient workers and, discourages below average workers., Inefficient: Actual output × Normal Piece Rate × 83%, Efficient: Actual output × Normal Piece Rate × 120%, b. Merrick Differential or Multiple Piece Wage Plan: Merrick uses 3 rates of remuneration., Output upto 83.33% : 100% of Ordinary Piece Rate, Output upto 83.33 to 100% : 110% of Ordinary Piece Rate, Output over 100%: 120% of Ordinary Piece Rate, c. Gantt Task Bonus Plan: It is a combination of time, bonus and differential piece rate principle. It removes, limitations of earlier schemes. It provides incentive to efficient workers and also encourages and protects the less, skilled workers., If Actual output < Standard output: Actual hours × Time Rate, If Actual output = Standard output: (All × Time Rate) × 120%, If Actual output > Standard output: (Actual output × Piece Rate) ×120%, 2. Premium Bonus Schemes: It is also known as Individual Bonus System. It combines time rates with piece, rates. The premium bonus is calculated on the hours saved by the worker. For this purpose Standard time is to be

Page 4 :

set. When the worker completes his work before the Standard time, he gets bonus in addition to normal wages., Due to this efficiency of workers increases and the production cost per unit decreases. The various schemes of, individual bonus are explained as below:, a. Halsey Premium Plan: This plan is introduced by F. A. Halsey in 1891. This plan ensures the worker a minimum, wage per hour. Amount of bonus is equal to 50% of wages for time saved. If the worker completes his work in less, than Standard time, he is paid a fixed percentage (between 30 to 70%) of the time saved., Total Wage = Taken Time X Standard Rate + ( Saved Time X Standard Rate) X 50/100, b. Halsey – Weir Premium Plan: The Halsey plan was modified by G.T. Weir. This plan is the same as Hales, premium plan except in the manner of calculation of bonus. Under this scheme a work gets a bonus of 30% of time, saved as against 50% in the case of Halsey plan., Total Wage = Taken Time X Standard Rate + ( Saved Time X Standard Rate) X 30/100, c. Rowan System: This incentive wage plan was made by James Rowan in 1901. Formula of this plan is below., Total Wage = Time taken X standard rate + ( time taken X time saved X standard rate ) / standard time, d. Barth Variable Sharing Plan: Under this plan, wages are not guaranteed. This system is suitable to beginners, and learners. The earning is computed by multiplying the rate per hour by the geometric mean of standard hours, and actual hours worked., e. Emerson Efficiency Bonus: This plan has been named after Harrington Emerson; the innovator of this plan., Under this plan every worker is guaranteed his day wages irrespective of his performance. A standard output is, fixed, and is represents 100% efficiency. According to the plan upto 66 2/3 the guaranteed time wages are paid to, the workers, after this they are paid bonus at stated ratio of the time wages. Emerson used 32 empirical bonus, percentages for efficiency beyond 66 2/,3% under this plan, the bonus starts from 0.01% above 66 2/3% efficiency, and increases to 20% at maximum efficiency. After this point the bonus is 20% above the basic wages plus 1% for, each 1% increase in efficiency., f. Bedaux Point Premium System: Standard time for a job is determined by time study. Standard production per, hour is determined and the unit of measurement is minute. An hour is taken as sixty minutes. Each minute of, standard time or allowed time is called a point Bedaux point. The number of points is being determined in respect, of each job. If actual time is more than the standard time, the worker is paid on hourly basis. Excess production is, counted in points, for which a bonus of 75% is allowed to the worker and remaining 25% goes to the employer., Thus hourly rate plus 75% of the points saved, multiplied by one-sixtieth of hourly rate is the earnings of a worker., g. Accelerating Premium Plans: Under this premium plan, bonus increases at a faster and faster rate as output, increases. The plan offers a higher incentive to the workers. The efficiency is determined on the basis of time saved, or increased output. The plan is complex one., h. Baum Differential Plan: This plan is a combination of Taylor’s differential piece rate system and Halsey system, and is also known as the Milwaukee Plan. It involves a lot of clerical work. It provides strong incentives to the, workers., 3. Group Bonus Plans: Sometimes it is difficult to measure the output of individual worker, but group output can, be measured. In this case total bonus is determined as per the productivity and shared by the workers. It builds, team spirit. The measure schemes are explained below:, a. Budgeted Expense Bonus: The bonus is paid for the savings in actual expenditure compared with the total, budgeted expenditure. The rate of bonus is decided in advance., b. Cost Efficiency bonus or Scanlon plan: The first Scanlon plan was instituted by Joseph N.Scanlon . The, Scanlon plan is a gain sharing program in which employees share in pre-established cost savings, based upon, employee effort. Financial incentives under the Scanlon Plan are ordinarily offered to all employees including, managers and sometimes executives., c. Priestman System: Production Standard is fixed in advance. If actual output exceeds the Standard, all workers, get bonus during following month. This plan is suitable in industries engaged in mass production of standardized, products and production without interruption., d. Towne Gain Sharing Plan: This plan was introduced by H. R. Towne in 1886. Bonus is calculated on the basis of, reduction in cost. The Standard labour cost is predetermined. Part of bonus is given to supervisors, too., e. Waste Reduction Bonus: This scheme provides incentive to workers to reduce wastage of materials. It is, applied in the industries where cost of production is too high., Bonus schemes for Indirect Workers: It is difficult to measure the output of indirect workers. So they are, excluded from the incentive systems. The indirect workers like checkers, inspectors, etc. can be paid bonus based, on the output of related direct workers. The others like maintenance men, ambulance men, canteen workers,, sweepers, etc. can be paid bonus based on output of whole factory, job evaluation, efficiency, etc., Bonus Schemes for foremen and supervisors can be paid bonus based on departmental production, time, savings, cost savings, product quality, reduction in wastage and reduction of labour turnover., Bonus to clerical staff and executives can be provided incentives based on the Standards of work. Executives are, paid bonus on the basis of department efficiency., Profit Sharing: It is a voluntary agreement by the employer to share profits with the employees., Co-partnership: Here employees participate in management by getting shares of the company.