Page 1 :

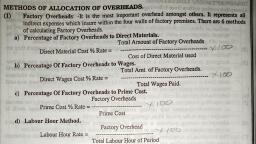

TYBCOM COST ACCOUNTING, Dr. Sumedha Naik, OVERHEADS COSTING, Computation of Overhead Rates, After allocation and apportionment of overheads to each cost centre, the next step is recovery of, overheads. It is also called as application or levy or recovery or absorption of overheads. For this, purpose, the overheads absorption rates are to be determined. Charging of overheads of cost centre to, different cost units, products, jobs or processes is called as absorption of overheads., Fixation of overheads rates 1. Facilitates absorption of overheads to cost units 2. Reduces the, fluctuations in the overheads rates. 3. Helps in quick computation of cost 4. Helps to estimate overheads, before production 5. Helps in prompt calculation of WIP., There are various methods for this determination. Each method has its merits and demerits. The, basic procedure is to divide the amount of overheads by the total number of units of the basis selected., While selecting proper method following points to be considered: 1. the method should not increase, clerical work 2. Rate should be stable 3. Less costly method. 4. Should be according to nature of product., Rate= Amount of Overheads ÷Quantity or Value Base, Amount of Overheads in a product= Units of the Base ×Overheads Rate, Actual Rate= Actual overheads expenses for the period ÷ Actual Quantity or Value Base for the, period, Pre- determined Rate= Budgeted overheads for the period ÷ Budgeted Base for the period, Blanket Rate= overheads cost for the factory ÷ total value of base, Multiple Rates= overheads cost apportioned to each department or cost centre or product ÷, corresponding base, Methods of absorption:, 1. Machine Hour Rate Method: The hourly machine rate is calculated department wise. This, method is adopted in those factories where Machine is prominent. Each machine or a group of machines, constitutes a cost centre. There are two ways to calculate Machine Hour Rate. In the first method,, overheads directly connected with the operation of the machine are considered e.g. repairs, power,, maintenance, Insurance. The second method considers the overheads not directly connected to the, operation of machine e.g. supervision, rent, shop general labour incurred for entire department. This, method considers time factor. It is logical and scientific. But it needs more clerical work., Steps:, 1. Each machine or a group of machines as a cost centre., 2. Compute fixed or standing charges., 3. Compute effective machine hours, 4. Fixed or Standing Charges per machine hour = Total Standing Charges ÷ Effective Machine, Hours, 5. Find out machine expenses for each machine on suitable basis, 6. Machine Expenses per Hour = Machine expenses of each machine ÷ Effective Machine Hours

Page 2 :

2. Labour Hour Rate Method: it is also known as Production Hour Rate Method. This method is, adopted in those factories where Labour is prominent. It is calculated for each category of workers. This, method considers time factor. It needs more clerical work., Direct Labour Hour Rate= Budgeted or Actual overheads ÷ Budgeted or Actual Labour Hours, Effective Labour hours = No. of average workers during the period × No. of factory working hours, 3. Percentage of Prime Cost Method: this is a simple method. It is adopted where Standard, product (requiring constant quantity of materials & labour hours) is produced. This method does not, consider time factor., Percentage of Prime Cost= (Budgeted or Actual overheads ÷ Budgeted Prime Cost) × 100, 4. Percentage of Direct Material Cost Method:, , Here the cost of material consumed is, , considered as basis for absorption of overheads. It is very simple method. No need to keep additional cost, records. It ignores time factor. It is not suitable when prices of material are not stable. It is not logical, because incidence of overheads is not related to material cost., Rate= (Budgeted or Actual overheads ÷ Budgeted or Actual Direct Material Cost) × 100, 5. Percentage of Direct Labour Cost Method: Under this method overheads are recovered on, the basis of predetermined or actual rate based on direct labour cost. This method is suitable when, production is uniform & workers hourly rate is same and labour is predominant. This method is simple, and less costly. It considers the time factor. It is not suitable when machinery is a predominant factor., Rate= (Factory overheads ÷ Direct Labour) × 100, 6. Combined Machine Hour and Labour Hour Rate Method: It is adopted where both machine, work and manual work is involved. The Machine related direct overheads are recovered on the basis of, Machine Hour Rate Method. And the others not related directly to running the machines are recovered on, the basis of Labour Hour Rate Method.