Page 2 :

RECONCILIATION-NEED, Cost Accounting, , Cost & Financial, Accounting, , Separate, Books, Financial Accounting, , Integral, Accounting, , Non-integrated, Accounting System

Page 3 :

RECONCILIATION, , ‘Reconciliation is a process whereby profits, revealed by two sets of books are tallied after, ascertaining the reasons for disagreement of, the two profits’

Page 4 :

REASONS OF DIFFERENCE, , 1Items Shown in, Cost Accounts Only, , Notional Rent of Own Building, Notional Interest on Capital Employed, , Notional Salaries, Notional Depreciation

Page 5 :

REASONS OF DIFFERENCE, , 1Items of Expenses, and losses Shown, in Cost Accounts Only, , •Abnormal Wastage of Materials, , Abnormal Losses, , •Loss By Fire or theft ( not insured), •Cost of Abnormal idle time, •Exceptional Bad Debts

Page 6 :

REASONSOF, DIFFERENCE, Interest rec. on Loans, deposits,, investments, , 2Items(INCOME) Shown, Only in Financial Accounts, , Dividend Received, Dividend Receivable, Profit on Sale of Assets, , Transfer Fees, Brokerage, Commission,, Discount Received

Page 7 :

REASONSOF DIFFERENCE, , 3Items of Expenses, and losses Shown, in Fin. Accounts Only, , •Interest on Loan and Debentures, , •Discount on Issue of Shares & Debentures, , Financial Expenses, , •Cash Discount, •Fines & Penalties, •Loss On Sale of Fixed Assets, , •Donations, Subscriptions etc

Page 8 :

REASONS OF DIFFERENCE, , 3Items of Expenses, and losses Shown, in Fin. Accounts Only, Dividend & Bonus to Share holders, Appropriation of, Profits, , Transfer to Gen. Reserve, Sinking Fund, Taxes on Income & Profits, Excess Provision against Depreciation

Page 9 :

Reasons Of Difference, , 4 Under or Over absorption, of Overheads

Page 10 :

Reasons Of Difference, , 5 Valuation of Stocks

Page 11 :

Reasons Of Difference, , 6, , Different Methods Of Depreciation

Page 12 :

RECONCILIATION-PROCEDURE, , 1 Ascertainment of profit as per Cost Accounts, 2 Ascertainment of Profit as per Financial, Accounts, , 3 Reconciliation of both the profits

Page 13 :

RECONCILIATION- PROCEDURE, , Reconciliation Statement, , Reconciliation Account

Page 14 :

RECONCILIATION PROCEDURE, , 1Ascertain the points of differences between CA &, FA, 2Start with the profit as per Cost Accounts 3, , Add items which have reduced Profit in CA, Deduct items which have increased profit in CA

Page 15 :

RECONCILIATION PROCEDURE, 4 (a) Items of Expenses & Losses, Add : items overcharged in CA- PROFIT IS LESS in CA, Deduct :Items Undercharged in CA- Profit is more, , (b) Items of Incomes & Gains, Add Income under-recorded or not recorded in CA- profit is less, deduct: Income over recorded in cost Account - profit is more

Page 16 :

RECONCILIATION PROCEDURE, 4 (c) Valuation of Stock, (i) Opening Stock, Add :Amount of Overvaluation in Cost Accounts- profit is less, Deduct :Amount of Under Valuation in Stock—Profit is more, , (ii) Closing Stock, Add : Amount of Under Valuation in CA— profit is less, Deduct : Amount of Over valuation In Stock— profit is more

Page 17 :

Reconciliation Statement, PARTICULARS, Profits as per Cost Accounts, Add Incomes not recorded in CA, Expenses only recorded in CA, Overheads over absorbed in CA, Overvaluation of op. stock in CA, Undervaluation of Cl. stock in CA, , Less Expenses not recorded in CA, Overheads Under absorbed in CA, Undervaluation of op. stock in CA, Overvaluation of Cl. stock in CA, Profit as per Profit & Loss A/c (Balance), , Rs, , Rs, , Costing Profit, Is less, Increase it, , Costing Profit Is, More Decrease, it

Page 18 :

RECONCILIATION ACCOUNT, Particulars, , To Exp. Not recorded in CA, , Rs, , Particulars, , ---- By Profit as per CA, , By Incomes Not, Recorded in CA, To undervaluation of OS in CA --- By Expenses not, Recorded in CA, TO Overvaluation of CS in CA --By OH over absorbed in CA, By Overvaluation of OS/CA, To Profit, as per Profit & loss A/c, ---- By undervaluation of CS/CATo OH under absorbed in CA, , Total, , Rs, ---, , ----, , ---, , Total, , ------------, , ---

Page 19 :

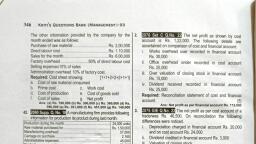

ILLUSTRATION, The net profit as per FA amounted to Rs 18,550 while the profits as, per cost accounts were Rs 28,660.On reconciling the figures,the, Following differences were noted:, Rs, Directors fees not charged in cost Accounts, A provision for bad & doubtful debts, , Bank interest credited, Provision for Income tax, Over recovery of overheads in CA, Prepare Reconciliation Statement & M R statement, , 1050, 970, , 30, 8,300, 180

Page 20 :

PARTICULARS, Profits as per Cost Accounts, Add:, Bank interest credited in, Over recovery of OH in CA, , RS +, , RS 28660, , 30, 180, , Less:, Directors fees not charged, , 1050, , Provision for Bad and Doubtful Debts, , 970, , Provision for Income Tax, , 8300, , Total, , 28870, , Profit as per Financial Accounts (28870-10320), , 18550, , 10320