Page 1 :

Remuneration, Methods, DR SUMEDHA NAIK, , S . K . P AT I L S I N D H U D U R G M A H A V I D YA L A YA, M A LV A N, , This Photo by Unknown Author is licensed under CC BY-SA-NC

Page 2 :

Learning objective, 1., , Meaning of Wages, , 2., , Factors affecting wages, , 3., , Elements of Wages, , 4., , Methods of Labour remuneration, , 5., , Incentive Plans, , 6., , Bonus

Page 3 :

Wages, Wages are paid to direct and indirect labour as the reward of services rendered by them., Wages can differ according to various categories of workers in a concern., Proportion of labour cost in total cost can differ from industry to industry., Every industrial enterprise should carefully formulate a sound wage policy.

Page 4 :

Good Wage Plan should:, 1. Be based on, scientific studies, of time, motion, and fatigue, , 2. Guarantee, minimum wages, , 3. Maintain, labour turnover at, a desirable level, , 4. Be acceptable, for management, & workers, , 5. Promote, industrial peace, , 6. Ensure, monetary reward, for efficient, workers, , 7. Be flexible, , 8. Reduce labour, absenteeism, , 9. Achieve largest, production with, lower cost, , 10. Be, economical, , 11. Be easy to, understand.

Page 5 :

Factors affecting Wages:, 1. Supply & Demand, 2. Existing Wages, 3. Legal Provisions, 4. Ability to Pay, 5. Labour Union, 6. Productivity, 8. Cost of living, 9. Attractive Wages

Page 6 :

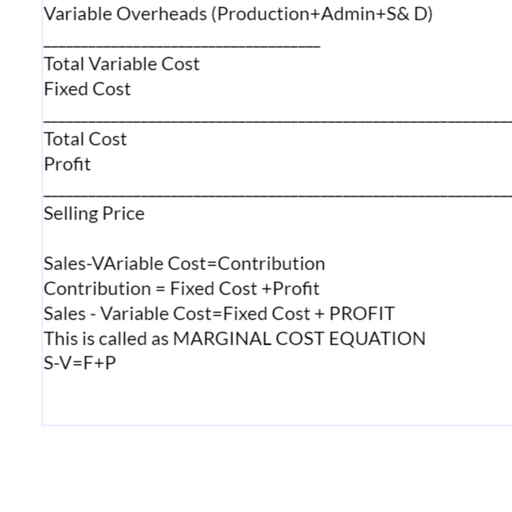

Elements of Wages, Wages= Basic pay + Cash Benefits + Fringe Benefits, Cash Benefits: Discount Allowed, HRA, CCA, Shift allowance, over time allowance, uniform alw,, conveyance alw, medical alw, bonus, Employer’s contribution to PF & ESI, leave Salary, gratuity,, pension, sickness benefits, Fringe Benefits: medical, accommodation, transport, canteen, entertainment, educational, refresher, training facilities

Page 8 :

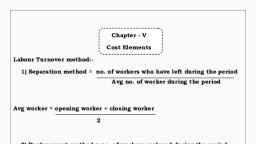

Methods of Labour remuneration, Time Rate Method of Wages: in this, method, the worker is paid at a specified rate, on the basis of attendance. The wage rate, may be determined as per hour, per day, per, week, per fortnight or per month., Wages = Actual Time Denoted × Time Rate

Page 10 :

Time Rate Methods, a. Flat Time Rate (Time Rate at ordinary levels): Workers are paid at a flat rate on the, basis of time they spend on work. Workers get overtime wages at the ordinary/double/1.5, times of ordinary rate., b. High Wage System: A high wage rate is fixed which is higher than the average rate in the, industry. It attracts and retains competent workers. Here no overtime is permitted. Workers, need to achieve specified target of output., c. Graduated Time Rate/Measured Day Work: In this method wages consist of two, elements: Fixed and Variable. The fixed element is based on the nature of the job. The, variable element is based on his merit rating and cost of living index.

Page 11 :

Piece Rate Method:, Under this method labour is, remunerated on the basis of production, only., Wages are based on the performance, and merit., , It is also known as piece work system,, piece wage or payment by result system.

Page 13 :

Piece Rate Methods:, a. Straight piece rate method: The worker receives a flat rate of wages per unit of output. This is the, simplest method., , Earnings = No. of Units × Rate per Unit, b. Piece rate with graduated time rates: They are paid on the basis of piece rate with a fixed, dearness allowance or cost of living bonus.

Page 14 :

Incentive Plans, Incentives are defined as the stimulation of, effort and effectiveness., It may be monetary or non monetary., , Incentives may be provided individually or, collectively., It improves productivity and efficiency.

Page 15 :

A good incentive plan should be, Simple, economical, fair, permanent and, flexible., It should improve morale of workers, ensure, fixed wages and reduce absenteeism and, labour turnover., It should give incentives to efficient workers,, be approved by workers and suitable for, management.

Page 16 :

Bonus, The additional monetary benefit provided to the worker is, named as bonus., It motivates the workers to work hard and achieve higher, production., It decreases the cost of production per unit.

Page 18 :

Bonus Schemes, 1. Differential Piece Rate:, The rate per piece or the rate per standard hour of, production is increased as the production level increases., This scheme was first introduced by F. W. Taylor in USA, (Father of Scientific Management)

Page 19 :

a. Taylor’s Differential Piece Rate, System:, There are two different piece rates of wages:, , 1. Low piece rate for output below Standard, 2. High Piece Rate for output above Standard., It motivates efficient workers and discourages below average workers., , Inefficient: Actual output × Normal Piece Rate × 83%, Efficient: Actual output × Normal Piece Rate × 120%

Page 20 :

b. Merrick Differential or Multiple, Piece Wage Plan:, Merrick uses 3 rates of remuneration:, Output upto 83.33% : 100% of Ordinary Piece Rate, , Output upto 83.33 to 100% : 110% of Ordinary Piece Rate, Output over 100%: 120% of Ordinary Piece Rate

Page 21 :

c. Gantt Task Bonus Plan:, It is a combination of time, bonus and differential piece rate principle., It removes limitations of earlier schemes., It provides incentive to efficient workers and also encourages and protects the less skilled workers., , If Actual output < Standard output: Actual hours × Time Rate, If Actual output = Standard output: (All × Time Rate) × 120%, If Actual output > Standard output: (Actual output × Piece Rate) ×120%

Page 22 :

2. Premium Bonus Schemes:, It is also known as Individual Bonus System., It combines time rates with piece rates., The premium bonus is calculated on the hours saved by the worker., For this purpose Standard time is to be set., When the worker completes his work before the Standard time, he gets bonus in addition to normal wages., Due to this efficiency of workers increases and the production cost per unit decreases., There are various schemes of individual bonus.

Page 23 :

a. Halsey Premium Plan:, This plan is introduced by F. A. Halsey in 1891., , This plan ensures the worker a minimum wage per hour., Amount of bonus is equal to 50% of wages for time saved., If the worker completes his work in less than Standard time, he is paid a fixed percentage (between 30, to 70%) of the time saved., Total Wage = Taken Time X Standard Rate + ( Saved Time X Standard Rate) X 50/100

Page 24 :

b. Halsey – Weir Premium Plan:, The Halsey plan was modified by G.T. Weir., , This plan is the same as Hales premium plan except in the manner of, calculation of bonus., Under this scheme a work gets a bonus of 30% of time saved as against 50% in, the case of Halsey plan., Total Wage = Taken Time X Standard Rate + ( Saved Time X Standard Rate) X, 30/100

Page 25 :

c. Rowan System:, This incentive wage plan was made by James Rowan, in 1901. Formula of this plan is below., Total Wage = Time taken X standard rate + ( time, taken X time saved X standard rate ) / standard time

Page 26 :

d. Barth Variable Sharing Plan:, Under this plan, wages are not guaranteed., This system is suitable to beginners and learners., , The earning is computed by multiplying the rate per hour by the, geometric mean of standard hours and actual hours worked.

Page 27 :

e. Emerson Efficiency Bonus:, This plan has been named after Harrington Emerson; the innovator of this plan., Under this plan every worker is guaranteed his day wages irrespective of his performance., A standard output is fixed, and it represents 100% efficiency., According to the plan upto 66 2/3 the guaranteed time wages are paid to the workers, after this they, are paid bonus at stated ratio of the time wages., Emerson used 32 empirical bonus percentages for efficiency beyond 66 2/3% ., Under this plan, the bonus starts from 0.01% above 66 2/3% efficiency and increases to 20% at, maximum efficiency., After this point the bonus is 20% above the basic wages plus 1% for each 1% increase in efficiency.

Page 28 :

f. Bedaux Point Premium System:, Standard time for a job is determined by time study. Standard production per hour is determined and, the unit of measurement is minute. An hour is taken as sixty minutes. Each minute of standard time or, allowed time is called a point Bedaux point., The number of points is being determined in respect of each job., If actual time is more than the standard time, the worker is paid on hourly basis., Excess production is counted in points, for which a bonus of 75% is allowed to the worker and, remaining 25% goes to the employer., Thus hourly rate plus 75% of the points saved, multiplied by one-sixtieth of hourly rate is the earnings, of a worker.

Page 29 :

g. Accelerating Premium Plans:, Under this premium plan, bonus increases at a faster and faster rate as output increases., The plan offers a higher incentive to the workers., The efficiency is determined on the basis of time saved or increased output., The plan is complex one.

Page 30 :

h. Baum Differential Plan:, This plan is a combination of Taylor’s differential piece rate system and Halsey system and is also, known as the Milwaukee Plan., It involves a lot of clerical work., , It provides strong incentives to the workers.

Page 31 :

3. Group Bonus Plans:, Sometimes it is difficult to measure the output of individual worker, but group output can be, measured., In this case total bonus is determined as per the productivity and shared by the workers., , It builds team spirit.

Page 32 :

Major schemes of group bonus:, a. Budgeted Expense Bonus: The bonus is paid for the savings in actual, expenditure compared with the total budgeted expenditure. The rate of bonus, is decided in advance., , b. Cost Efficiency bonus or Scanlon plan: The first Scanlon plan was instituted, by Joseph N. Scanlon . The Scanlon plan is a gain sharing program in which, employees share in pre-established cost savings, based upon employee, effort. Financial incentives under the Scanlon Plan are ordinarily offered to all, employees including managers and sometimes executives.

Page 33 :

Major schemes of group bonus:, c. Priestman System: Production Standard is fixed in advance. If actual output exceeds the, Standard, all workers get bonus during following month. This plan is suitable in industries, engaged in mass production of standardized products and production without interruption., , d. Towne Gain Sharing Plan: This plan was introduced by H. R. Towne in 1886. Bonus is, calculated on the basis of reduction in cost. The Standard labour cost is predetermined., Part of bonus is given to supervisors, too., e. Waste Reduction Bonus: This scheme provides incentive to workers to reduce wastage of, materials. It is applied in the industries where cost of production is too high.

Page 34 :

Bonus schemes for Indirect, Workers:, It is difficult to measure the output of indirect workers., So they are excluded from the incentive systems., The indirect workers like checkers, inspectors, etc. can be paid bonus based on the output of related, direct workers., The others like maintenance men, ambulance men, canteen workers, sweepers, etc. can be paid bonus, based on output of whole factory, job evaluation, efficiency, etc., Bonus Schemes for foremen and supervisors can be paid bonus based on departmental production, time, savings, cost savings, product quality, reduction in wastage and reduction of labour turnover., Bonus to clerical staff and executives can be provided incentives based on the Standards of work., Executives are paid bonus on the basis of department efficiency.

Page 35 :

Other Incentives:, Profit Sharing: It is a voluntary agreement by the employer to share profits with the, employees., Co-partnership/Co-ownership: Here employees participate in management by getting, shares of the company.

Page 36 :

Fringe Benefits, Such benefits are called by various names such as ‘fringe benefits’, ’employee welfare’, ‘wage, supplements’, ‘sub-wages’, ‘supplementary compensation’, ‘social security’, etc., Fringe benefits are the tangible or intangible perks that institutions provide their workforce in, addition to their salaries., The main motive behind giving these perks is to keep the employees happy and satisfied., productivity of employees in the workplace., Some common fringe benefits include perks like access to the company car, company cell, gyms, subsidized cafeteria plans, and more.

Page 37 :

Fringe Benefits, Fringe benefits refer to those benefits and services that are extended by the employer to his/her, employees over and above their wages and salaries, such as, housing facility, transportation, facility, subsidised meals, medical care, paid holidays, insurance cover etc., The various types of fringe benefits protect employees from risks that could jeopardize their, health and financial security. They provide coverage for sickness, injury, unemployment, and old, age and death.