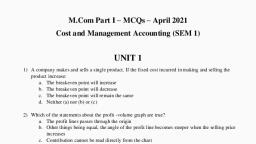

Page 1 :

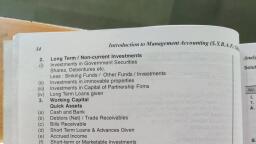

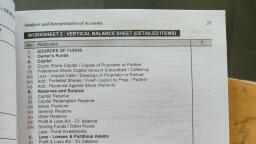

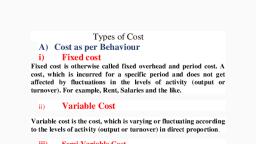

wroduction to Cost Accounting, , p. An example of fixed cost is :, (a) Materials consumed (b) Depreciation, (c) Factory power (d) Packing material, 3. A cost per unit which increases or decreases when volume of output increases or decreases is, known as, (b) Variable cost, , , , , , , , , , , , , , , , , (i) The Fir, i inancial A, (ii) Financial 0 E (a) Fixed cost, 1 hot s (¢) Semi-variable cost (6) None of the above, eh of the fllowing would nat be considered a fixed cost ?, : (b) Depreciation, , Rent, he in the production of soft drinks, , (c) Cost of bottles used i, , (d) Property taxes, an example of vati, , , , , jable cost is, (b) Interest on capital, , , , , , , , , , , , , , , , , , , , , , , , , , , , , 2., il Ac 4 (a) Property taxes ton L, a re Ae nts v ene (c) Direct material cost (d) Depreciation of machinery, a COR L: ; a fg, Variable cost per unit ‘, eon 7 ° {a) varies when output varies (b) remains constant, one ai ial Eee n (c) increases when output increases (d) decreases when output decreases, ( Boe al a | a 47.Which of the following is not an example of a variable cost 2, et ec a ’ “(@) straight-line depreciation on @ machine expected to last five years, 4 eid aa Be (e)iExtemal users (b) Piece-rate wages paid to manufacturing workers, - Which of the following is not a as % ecennlsers 4 {e) Wood used to make a m ure a, \ ung 7 Commissions paid to sales person ‘, o following costs will vary directly with the level of production?, (b) Total cost of sales, , , , , , , 1g. Which of the, , Total manufacturing costs, o (d) Variable product costs, , (a) Cost ascertainment, it, i ) © (b) Planning and contro!, , , , , , , , , , , , , , , , , , , (c) Decision-makin, , ; 9 a {, 5. Cost information facilitate | |_ (6) Extemal reporting, (a) Introduction of a prod decisions except (6) Variable selling costs, , (c) Rate of divi (b) Whether to make 9.1 the level of activity increases,, a ead _ ~ (d) Exploration of an cae (a) variable cost per unit and total fixed costs increase, on ee {b) fixed cost per unit and total variable cost increase, dd fixed cost per unit will decrease, , , , increase an, it and total cost increase, , produced, variable costs a!, , (c) total cost will, (d) variable cost per uni, 20.When 10,000 units are, are produced, , (a) variable costs will total & 1,20,000, (b) variable costs will total € 60,000, , (c) variable unit costs will increase to € 12 per unit, , (d) variable unit costs will decrease to & 3 per unit, 21. Costs which are ascertained after they have been incurred are known as, (b) Sunk costs, , , , 6. Measurement, in m, , in moneta:, ges orrenderiig Sora imount of resources used for the purpose of pl, ) Revenue ex, - 3 ’, ‘ Bendiiire “am (b) Capital expenditure, 7. rca of ascertainment of costs jown Ee Ne ees, (a) Costin, Ec, hey'Cbat ae (b) Cost reporting, (d) None of th, , The guidance and regulatic Ris ° aboie, re ee gulation by executive action of the costs of operating an undertaking, , re 6 per unit. Therefore, when 20,000 units, , , , , , , , , , , , , , , (a) Operating costi, Cee cere {b) Cost reduaaa (a) imputed cost, ‘ (d) None of the ab a) ees, 9 te Accounting covers id (c) Historical costs (d) Opportunity costs, 1@ preparation of statistical data 22. Prime costs plus variable overhead is known as, (a) Production cost (b) Marginal costs, (d) Cost of sales, , (c) Total cost, f rent is, , (b) the application of cost control methods, 23. When premises are owned, a charge in lieu o|, (b) an imputed cost, , (c) the ascertainment of the profitability of activities carried out or planned, , , , , , , , , , (d) all the above, 10., 10. * ea hie pans Statements is true 7 (a) an opportunity cost, st” has the same meaning in all sit : ki (c) a sunk cost ) idabl, situation ich it i (a) an avoidable cost, este: coniiauihand classifications are used i pene i We used 24. Costs which are not relevant for decision-making and are not affected by increase or decrease, TaiEtEEtlite came typos of cos! in volume are, e (a) Imputed costs (b) Sunk costs, (c) Historical costs, (d) Opportunity costs, rawn for financing a project, the loss of interest on, , , , 25.When amount deposited in a bank is withd!, , |year are always useful in the following year(s), bank deposit will be referred to as, , (a) Sunk cost (b) Pre-production cost, (c) Opportunity cost () Replacement cost, , the level of activity, manufacturing, trading, or service company ~, or period costs won

Page 2 :

Cost Accounting (T.¥.B.Com, ; SEM., ae), , , , , , , ‘ device that is necessary if a special order is accepted is a, nae, we (b) Sunk cost, (d) Opportunity cost, , entre is ic ad, Acost 6 duct or service in relationto which costs are ascertained, , An amount of expenditure attributable to an activity, , A production or service location, function; attivity or item of equipment for which costs a, mulated . re, , phe which an individual budget is drawn up, , (dA centre for, , st unit is 7, aa our of operating a machine, , the cost per h, a the cost per unit of electricity ‘consumed, (c) a unit of product or service in relation to which costs are ascertained, , (d)a measure of work output ina standard hour, , | 99. Costs that can be easily traced to a specific department are called, . (b) Indirect costs, , | (a) Direct costs ¢, | () Overheads (d) Processing costs, 30. The three majo! re‘all except, (a) Direct materials (b) Factory overhead, (c) Direct labour «(d) Indirect labour, 31. Indirect costs, (a) can be traced to a cost object, (c) are not important, 32. Indirect costs are known as, (a) Variable costs \(b) Fixed costs, (c) Overheads \(d) None. ofthe above, 33. A functional classi jassify “depreciation on office equipment” as a, (a) Product cost *(b) Administrative expense, (c) Selling expense (d) Variable cost, |. Direct material is a, §(a) Manufacturing cost, {c) Selling and distribution cost, cular cost is classified as, Stivity increases by 20%?, ays the same, , r elements of product costs a’, , (b) cannot be traced to a particular cost object, , »(d) are always variable costs, , , , , , , , , , , , , , , , , , , fication of costs would cl, , , , (b) Administration cost, , (d) Any of the above, being semi-variable: What is the effect on the TOTAL COST if, , F ‘“(bpDecreases by less than 20%, , ncreases by 20% (d) Increases by less than 20%, that change in response to alternative courses of action are called, , 4 (b) Differential costs, 2 4 (d) Sunk costs, , ctio er paid salary of = 700 per month plus an extra, , e month. This labour cost is best described io, , (b) A variable cost, , er (d) A step fixed cost, , ional classification of costs include the following except, , (b) Production cost, , (d) Marketing cost, , ZScfor each unit produced, , (a) Salaries of general office staff, ) Office supplies and expenses, , (b) Salaries of foremen, (d) Postage, stationary, telephone, etc., , e — given the cost and volume information below :, i. Cost, 10 units ‘ “, , _ 100 units A : 1 sop

Page 3 :

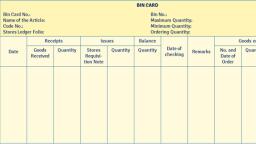

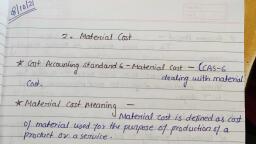

i the tethni, Plain how in e IQUES Used for Inventory Contr, rol, , 21. Explain in bret - nt k Verification, 4, Continuous Stock Ve, , 22. Describ, and distingui:, 23. Describe guish between the two mai Li, and distingui ‘0 main Inventory Acc f, Quish between the two main methods used for maining ne Pa, ing the stock, [Ani lee, , 23. What do you mean by Inventory Turnover Ratio ? What are the objectives ? How is, (ou me:, y Invent ver Ratio ? WI tr ives ?, 7, , SPs, edd) eS, , Write a Short Note on 1. The Principles of Material Cost, Types of Materials, , , , faluation of Issue of Materials, 4. Stock Verification, , 15. Inventory Control, 16. Stock Levels (Oct. 14, Nov. 2017), , 17. Minimum Level, 18. Maximum Level, , , , , , , , 28. Jnventory Turnover Ratio (April 2016,, , , , ae ‘Conceptual, most.of the manutacturing industries, the most important element of cost is, (b) Labour, , 4a) Material (d) None of the above, , we, 7-\ Overheads, , eva, Explain any one in detail. fan,, , Para 13,, , , , Cost Accounting (TY¥B.Com, 4,, a 1S, , , , , , , ae, , 3, 122), , interprete, [Ans.: Pana, , , , 19. Reorder Level, 20. Economic Order Quantity (EOQ) (Nov. 2014, Oct. 2015, Apr. 2016, 2017) [Ans.: Para, 21.ABC Classification Ans. Para, 22. Perpetual Inventory [Ans.: Para 10], 23. Continuous Stock Verification [Ans.: Para 11), 24, Stock Ledger [Ans.: Para 12.1], 25.Bin Card (April 2015) Para 12.1], 26. FIFO Basis [Ans.: Para 12., 27. Weighted Average Basis [Ans.: Para 122], Nov. 2016) [Ans.: Para a, , material Cost, 2. continuous stock taking is a part of, (a) Annual stock taking pies nnies twas, (o) ABC analysis (8) None of the above, 3, Which of the following is considered to be a normal loss of material?, (b) Pilferage, , Loss due to accidents, (5 Loss due to careless handling of material (2) Loss due to breaking the bulk, 4. Bin card is maintained by the, (a) Accounts department, , (o) Stores, , sain card contains, f the price of raw material lying in the Bin, , fa) Details of, f the price and quantity of raw material lying in the Bin, , (b) Details 0, {c) Details of quantity of material lying in the Bin, , {d) None of the above, Which of the following assump, (a) Anticipated usage of material in units is known, , {b) Cost per unit of material is constant and known, (¢) Ordering cost per order is fixed, , (a) Allthe above, , which of the following is an accoun, (a) Bill of Materials, , (c) Stores ledger, , Which of the following documents is used for, , (a) Purchase Requisition Note, (c) Goods Received Note, Which of the following mett, of materials ?, (a) Perpetual inventory system, (b) Materials turnover, (c) Maximum, minimum and re-order level setting, (d) ABC analysis, 10. The classification of items in, (a) Investment value of materials, (c) Quantity of materials consumed, 11. The storekeeper should initiate a pure, (a) Minimum level, (c) Re-order level, 12. Which of the following material losses sI, (a) Loss by evaporation, (c) Loss due to breaking the bulk, 13.A written request to a supplier for spec, (a) Purchase order (b) Receiving report, (c) Purchase requisition (d) Materials requisition form, 14.Which of the following documents in a cost accounting system is designed, over the delivery of and accurate recording of the receipt of goods?, (b) Material requisition, , (a) Goods received note, (c) Order to the supplier (d) Purchase requisition, , 15.A purchase requisition is raised, ee rot the supaier the quantity and quality of new material required, , (b) when the stock of raw material has fallen to the recorder level, , (c) when goods are received from a supplier, (4) to let the accounts department know that an invoice, , (a), , (b) Costing department, (d) None of the above, , tions are made for the calculation of Economic Order Quantity?, , ting record ?, (b) Bin card, , (d) All of these, , issuing materials to production departments ?, (b) Stores requisition Note, , (d) Stores Credit Note, centrating efforts on selected items, , hods of stock contro! aims at con, , ‘ABC analysis is made on the basis of, (b) Consumption value of materials, (d) All of these, , hase requisition when stock reaches, (b) Maximum level, (d) Average level, , hould be transferred to Costing P, (b) Loss due to improper storage, (d) All of these, , ified goods at an agreed upon pric, , rofit and Loss Account ?, of materials, , 3@ is called a:, , to exercise control, , should be expected from a supplier

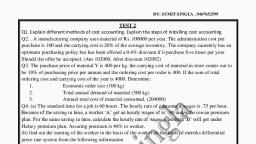

Page 4 :

HUnits that should be ordered, , entory when next order should be Placed, Nic order ‘quantity, (c), , , , , , , , (b) Ordering costs, , i | (d) Carrying costs, sts of preparing, issuing, and placing pi, , luded in orders is:, , , , (b) Ordering costs, (d) Carrying costs, , He Costs that result when a company holds an inventory of goods for sale: |, b a, , @) Purchasing costs (b) Carrying costs, , 3) Opportunity costs (d) Interest costs, , D:The costs associated with storage are an example of which cost eategory?,, , + @) Quality costs (b) Labour costs i, , (©) Ordering costs (d) Carrying costs, , 21..I{ there is increase in the size of inventory orders, Number of orders per year, , (a) increase (b) decrease F, , (c) remain same (d) change depending on other, , 2. If there is increase in the size of inventory orders, Total annual carrying costs:, , (a) increase (b) decrease ', , (c) remain same (d) change depending on other fa, , there is increase in the size of inventory orders, Total annual ordering costs, increase (b) decrease, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , uous stock taking is a part of, nual stock taking (b) Perpetual inventory fi, , rial control involves control over, sumption of material, , ‘{e) Purchase of material, 26. Material requisition is meant for, , (a) Purchase of material (b) Supply of material from stores, , (c) Sale of material (d) Storage of material :, 27. Perpetual inventory system involves, (a) Bin card and Stores ledger, (c) Purchase requisition and purchase order (d) Inward and Outward invoices, 28. FIFO is, , {a) Fast Investment in Future Order (b) First In First Out, , {(¢) Fast In Fast Out » (d) Fast Issue of Fast Order, , 1 is issued.by store keeper against, | nn tos (b) Material order, ‘ (d) Purchase requisition, , (b) Issue of material i, (d) Purchase, storage and issue of;, , , , , , , , 4p), (b) Essential Order Quantity, » (d) Essential Output Quantity, eiving/and inspecting material, dnote, , urchase orders, plus receiving ang, , faa. if the E, , 45.A factory requ, , 96-37. Expecter, , (d) change depending on other fa¢t, , IC analysis (d) Inventory Turnover Ratio analysis, , (b) Bill of material and Material requis, , , , , raterial Cost, , Numerical MCQ_/ Answer in Brief (Internal Tests), unit @ 150, annual consumption 2,000 units, ordering cost % 300 per order and 01, 10% of cost. What should be the quantity of each order?, (b) 200 units, , 15 units (d) None of the above ;, , Oe ‘anual demand is equal to 500 units, ordering costis equal to 40 and carying cost s equal, pa. lithe a!, , it EOQ is, to % 4 per unit, the (e)31.62, , (a) 10 (4) 37.5, , © oon 15.400 units, the ordering cost is € 0.20, the carrying cost € 20, how many orders are, i 3, , placed per year? ‘oye, : ve The cost of placing and following up, eo units of a component every year. The cost of pl ;, , der is @ te he ‘Horage cost per annum is @ 40. The Economic order Quantity (EOQ), an order i, , is units. feo, (20 Oe 000 units and the economic, Oe materials is 2,00,000 units an, , i ‘of each unit is 500 and the cost to place are, , , , th, , , , price Pet, charges 2, (a) 150 units, , , , , , , , , , , .d annual usage of a particular ra, , Srder quantity is 10,000 units. The invoice cos, , order is & 80. ;, 36. The average inventory is, (a) 1,00,000 units, , , , (b) 5,000 units, (d) 7,500 units, , (c) 10,000 units: a aie, ir annual order co:, 37 Hala (b) € 10,000, (c) € 3.200 (a)25.008, , ' ; ee, 98.0 Lid. maintains the inventory records under perpetual systern of invertor Consider the following, data pertaining to inventory of O Ltd. held for the mot, Date Particulars Quantity Cost Per unit %), Mar. 1 Opening Inventory 15,400, Mar.4 Purchases eee, Purchases 10, ;, Tie coineny sold 32 units on March 24, 2014, closing inventory under FIFO method is, (a) 5,200 we pet, c) @ 5,800 ,, 39 te following are the details regarding purchases of a certain item during the month of January., January1 Purchases 200 units @ %7 = 1,400, January 8 Purchases 900 units @ &8 % 7,200 |, January 25 Purchases 300 units @ & 9 @ 2,700, January 30 Purchases 400 units @ & 10 % 4,000, 15,300 Le, A physical inventory of the items taken on January 31 shows that there are 700 units in hand., The valuation of inventory as per FIFO method is:, (a) 5,400 (b) % 6,700, (c) ® 8,600 (4) % 5,000, 40. The annual demand of a’certain component bought from the market is 1,000 units. The cost of, placing an order is % 60 and the carrying cost per unit is % 3 p.a. The Economic Order Quantity, for the item is __., (a) 200 (b) 400, (c) 600 (d) 300, 41.A firm requires 16,000 Nos. of a certain component, which it buys at @ 60 each. The cost of, placing an order and following it up is & 120 and the annual storage charges works out to 10% of, , the cost of the item. To get maximum benefit the firm should place order for —___— units at a, time,

Page 5 :

is measured by, por of workers replaced average number of workers, er of workers left /number in the beginning plus number at the end., Nutger of workers jointing / number in the’ beginning of the period., ul, , tumover i, , (b) Efficiency of the labour, (d) Total cost of the labour, , ixation of standard time, , jent of wo! J, ent of actual hours ‘ascertainment of labour cost, , , , , , , , , , a) Measurer™, ) ascertain, , , , , (b) time spent by workers in office, , ‘kers in factory oe, i (d) time spent by workers on their job, , cers off their work, , , , ie is, jt by wo, a) time spen, i time spent BY worké, time 1S, / ‘actual hours being more than normal time, (a) ual hours being more than standard time, 0 sing more than actual hours, , ) Standard hours Bel |, (©) sa rnours being less than standard time, , 1g refers to, it by worker on their job, workers without work, , spent by workers in the factory, spent by workers off their job, , (b) time, (a) time si, , , , , , , , , , , , , , , , , (a) time spen', {c) time spent by, ime booking refers to ;, (a) ime spent by worker on their job, , (Gime spent by workers without work (9) ti, Fg pilference between attendance time-and job time is, ia) Standard Time (b) Overtime, (¢) Actual Time @ idle time, iz Aece workers are paid on the basis of, {a} Output sold, (c) Output in stock, Time wages are paid on the basis of, @Actual time, (¢) Time saved, (b), Time role St 1g feretial piece wages means, ia Piece work system _ (d) Halsey premium system Pee ran wages for different level of performance, lime arising due to non-availability of raw materials is Si, Lcoutnr ot and Lees Ale (0) charged to factory overioad ciflerent wages for different time consumed, PUG the wage ta .., (2) pored eatin (0) diferent wages for diferent types of workers, rfime is required for meeting urgent orders, overtime premium hal (d) different wages for different types of industries, Se eee ee ee a) Charged w octheal ola 2) For calculation of labour turnover under separation method, ‘ainaraiea {a) only the number of employees left from the organisation is considered, Boa ts number of employees replaced are considered, onl i, (sonoma dant Es be nba of eres So etait, goonoting ae) {te cost which is incurred to prevent the labour turnover, , , , , , , (b) time spent by workers in the factory, ir job, , (d) time spent by workers off the!, , , , , , , , , , , , Halsey plan (b) Rowan plan, Taylor's diferential piece rate system _(d) Gant’s task and bonus system, Uider the high wage plan, a worker is paid ¢, (a) at a time rate higher than the usual rate (b) according to his efficiency, at a double rate for overtime (d) normal wages plus bonus, h of the following methods of wage payment is most suitable where quality, of primary importance ?, , , , , , , , , , , , , , Output produced, (d) Input received, , , , , , (b) Standard time, (d) Overtime, , , , , , , , , , , eal Glace Cost (o) Replacement Cost, reventive Cost (d) Compensation Cost, (aybngineering department }?2Tformal idle time, , ty lp measured by compari °, er &: on be avokied (b) can be minimised, eet be aveised (d) can be controlled, i, sriotoyen is eligible for getting overtime wage if he / she works for more than, she (b) 8 hours a day, , ates day (d) 12 hours a day, , , , , TERT