Page 1 :

2 MANAGERIAL DECISIONS, , , , , , , , PULL Ven MMU ton oe, , , , , , (@ OUTLINE 1), No. Topic pee, 1. Marginal Costing and Decision Making 52, , 1.1. Decision Regarding Pricing, 1.2 Decision Regarding Optimum Product-mix, 1.3. Decision Regarding Key Factor/Optimum Level, 1.4. Decision Regarding Special Office/Discontinue Product etc., 2. Costs Used in Decision Making 55, 2.1. Marginal Cost, 2.2 Opportunity Cost, 2.3. Replacement Cost, 2.4 Imputed Cost, 2.5 Sunk Cost, 2.6 Controllable Cost, 2.7 Relevant Cost, 2.8 Normal Cost, 2.9 Abnormal Cost, 2.10 Avoidable Costs, 2.11 Unavoidable Costs, 212 Differential Cost, _ 3. Differential Costing 57, 4. Solved Problems 59, 4.1 Pricing, 4.2 . Product Mix, 4.3 Key Factor, 4.4 Special Offer, 4.5... Optimum Level, 4.6 Cost Control / Profit Planning, 4.7. Make or Buy, Alternative Methods of Production, ‘ 4.8 s

Page 2 :

Mana, gerial Decisions, 59, , , , , , | It is used in short-term and medium, , term decision making, It can be used for all short, medium and, , long-term decisions depending on the, nature of problem., , cae analysis using the It can be used both under Absorption, Costing and Marginal Costing systems., , , , , , , , , , , , , , , , , , 4. SOLVED PROBLEMS, , Pee, , Illustration 1:, , The Financial Accountant of PSC Ltd. has presented the following Product P, Teed Wok eee wing Product Performance Report for, , , , , , , , , , Particulars Fa, Sales @ % 10 per unit 10,00,000, Total Variable Cost 7'00,000, Fixed Cost ees , 2,00,000, Profit HeBisthlateoses 1,00,000, , , , , , The Marketing Manager of the company has come up with a proposal that if the selling price of the, product is reduced by 10% the quantity sold will go up by 25%. On the other hand the Costing, Department is of the opinion that as most of the competitors have higher prices, the selling price, should be increased by 10%. The Marketing Manager has apprehension that if the selling price is, increased by 10% the quantity sold will fall by 20%., , You are invited by the company to analyse the situation and advise the company to take a decision, with reasons., , Whether :, , 1. The Selling Price should be increased or, , 2. The Selling Price should be reduced or, , , , , , , , , , , , , , , , 3. The Selling Price should be left unchanged. (April 2012, adapted), Solution :, , Particulars Present Situation |Marketing Manager| Costing Department, Units 1,00,000 1,25,000 80,000, Sales 10 |10,00,000 9]11,25,000 11] 8,80,000, - Variable Costs 7| 7,00,000 7| 8,75,000 7| 5,60,000, Contribution 3] 3,00,000 2] 2,50,000 4] 3,20,000, - Fixed Cost 2,00,000 2,00,000 2,00,000, Profit 1,00,000 50,000 *1,20,000, , , , , , , , , , , , “Decisions : It is advised to go with its decision of costing department as profit is more by ¥ 20,000., Ulustration 2 : (Evaluating Effect of Price Reduction & Advertising), Acompany, which manufactures and sells three products, furnishes the following details for a month:, , , , , , , , , , , , Products A 8 Cc, , No. of units budgeted 1,00,000 38,000} 46,000, Selling Price per unit = 50 80 60, Variable Costs per unit = 34 52 24, , , , , , In has been proposed that an intensive advertisement campaign involving an expenditure of =, 1,20,000 per month and reduction of selling prices will increase the sales of production C as under:, , (1) If the selling price is reduced to = 55 per unit, the sales will increase to 59,000 units per month., (2) If the selling price is reduced to = 51 per unit, the sales will increase to ¥ 65,000 units per month., The fixed costs of the company amount to % 34,20,000 per month.

Page 3 :

Required :, (1) Calculate the current m, (2) Evaluate the two propos:, , onthly break-even sales value of the company., als and adviso which of the proposals should be implemented., (CA May 2002, adapteq), , , , , , , , , , , , , , , , , , , , , , Solution :, (1) Current monthly break-even sales value of company [WN 1], = Fixed Costs of the Company = _ &34,20,000 _ £ 85,50,000, P/V Ratio A0%, , (2) (a) Evaluation of Proposal (i) :, , Particulars z, , Total contribution of Product C (59,000 units x % 31) [WN 2 (a)] 18,29,009, , Contribution of Product A and B [WN 1: 16,00,000 + 10,64,000] 26,64,009, Pat eo, , Total Contribution 44,93,000, , Less : Advertisement Cost 1,20,000, ay, , Net Contribution 43,73,000, , (b) Evaluation of Proposal (ii):, , Particulars =, , Total Contribution on Product C (65,000 units x = 27) [WN 2 (b)] 17,55,000, , Contribution of products A and B [WN 1 : 16,00,000 + 10,64,000] 26,64,000, , Total Contribution 44,19,000, , Less : Advertisement Cost 1,20,000, , Net Contribution 42,99,000, , , , , , Decision : Proposal (i), to reduce selling price to 55 is better as it increases the net contribution by, % 74,000 & 43,73,000 - ¥ 42,99,000), Working Notes :, , , , , , , , , , , , , , , , , , (1) Statement of Total Contribution, Sales Revenue and P/V Ratio, Products A pecn, Cc Total, A. Units 1,00,000 38,000 46,000), B. Selling Price per unit () 50 80 60, C. Variable Costs per unit () 34 52 24, D. Contribution per unit (®) (B - C) 16 28 36, E. Total Contribution (%) (Ax D) 16,00,000] 10,64,000} 16,56,000 43,20,000, F. Sales Revenues (@) (A x B) 50,00,000] 30,40,000 27,60,000}1,08,00,000, Contribution % 43,20,000, i -_ ——— x100 = ——=—"—_ x 100 = 40%, PIN Ratio (%) Sales %1,08,00,000 —, , (2) (a) Contribution per unit of product C under proposal (i), Contribution per unit of product C will be 31, when its selling price is ¥ 55 and variable cost, per unit is % 24., (b) Contribution per unit of product C under proposal (ii), Contribution per unit of product C will be % 27, when its selling price is 51 and variable cost, per unit is % 24. 2, , Ilustration 3 : (Reduce Selling Price), The price structure of an Electric Fan made by the Vijaya Electric Company Ltd. is as follows:, , , , , , , , , , , , Particulars ati, ; v, Materials s, Labour ae, Variable Overheads : soo

Page 4 :

ERS Bee eae sl as:, , , , Fixed Overhead 500, profit 500, selling Price 2,000, , , , , , This cost is based on manufacture of 1,00,000 fans p.a. The company expects that due to competition,, they will have to reduce the selling price. However, they want to keep the total profit intact., , You are required to prepare a statement showing the position, if, , (1) Selling price is reduced by 10% and, , (2) Selling price is reduced by 20%. (Oct. 2000, adapted), Solution :, Profit at present = 1,00,000 fans x % 500 per fan = 2 5 Crores., Fixed cost atpresent = %5 Crores., (1) ‘If selling price is reduced by 10%., P. V. Ratio = emma x100 = ne oe x100 = 44.44%, , Therefore, Sales required for profit of = 5 Crores, Fixed Cost + Desired Profit %5Crores + %5Crores, - P.V. Ratio = 44.44%, , b f fi bi pee r00,00;0007 = 1,25,000 Fans, Number of fans to be sold = @1,800perfan |, , = % 22.50 Crore, , (2) If selling Price is reduced by 20%, Contribution 1,000 - 400, , , , P. V. Ratio = ————— x100 = ~——___ = 37.59, Sales 2,000 - 400 eR eoe ne, Sales required for profit of % 5 crores., = Fixed Cost + Desired Profit = % 5 crores. + % 5 crores = %26,26,66,667, P..V.Ratio 37.5%, 26,66,66,667, , oe =1,66,667 fans., Number of fans to be sold = 3 600 per fan, , Statement of Sale and Profit for April, , , , , , , , , , , , , , , , , , , , Particulars (i) Selling Price reduced (ii) Selling Price reduced, : by 10% (1,25,000 fans) | by 20% (1,66,667 fans), : Per Fan Per Fan, , v = < z, Sales 22,50,00,000 1,800 | 22,66,67,200 1,600, Less : Material 7,50,00,000 600 | 10,00,00,000 600, Labour 2,50,00,000 200 3,33,33,400 200, Variable Overheads 2,50,00,000 200 3,33,33,400 200, Contribution 10,00,00,000 800 6,00,00,400 600, Less : Fixed Overheads 5,00,00,000 400 5,00,00,000 300, Contribution 5,00,00,000 400 1,00,00,400 300, , , , 4.2 PRODUCT MIX, , Illustration 4: (2 Products, 3 Mixes), , From the following date you are required to present., , (1) The marginal cost of product x and y and the contribution per unit., , (2) The total contribution and profits resulting from each of the suggested sales mixtures., , , , , , , , , , , , , , Particulars Product } -Per.unit, Direct Materials x 10.50, Direct Materials Y 8.50, Direct Wages X 3.00, Direct Wages Y 2.00

Page 5 :

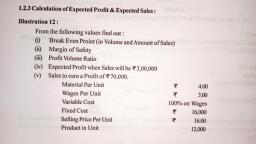

a a ee), , Variable expenses 100% of direct wages per product., Fixed expenses (total) = 800, Sales Price X % 20.50 and, ¥, = 14.50, Suggested sales mixes :, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , Alternatives No of Units, , x V4, A 100 200, B 150 150, Cc 200 109, Solution : (Oct. 97, adapteq), (1) Marginal Cost & Contribution, Particulars i Product X| Product y, , @ ©, Direct Materials 10.50 8.50, Direct Wages 3.00 2.00, Variable Expenses (100% of direct wages) 3.00 2.00, Marginal Cost per unit 16.50 12.50, Selling Price per unit 20.50 14.50, Less : Marginal Cost 16.50 12.50, Contribution per unit 4.00 2.00, (2) Contribution & Profits of Sales Mix, Sales Mix (A), Particulars : : %, Contribution from 100 Units of Product X @ = 4 $8 bevswigeapees 400, Contribution from 200 Units of Product Y @ = 2 aan ators 400, Total Contribution ame eRe 800, Less : Fixed Expenses ne vis cemiaomeseys 800, Profit Paeiteneeeecs nna Nil, Sales Mix (B), Particulars =, Contribution from 150 Units of Product X @ = 4 600, , , , , , , , , , , , , , Contribution from 150 Units of Product Y @ = 2 300, Total Contribution 900, Less : Fixed Expenses teeta 800, Profit Se OE Ee 100, Sales Mix (C), , Particulars C, Contribution from 200 Units of Product X @ = 4 woe wees aes Wee a, Contribution from 100 Units of Product Y @ %2 BEM, GA a, Total Contribution be, Less : Fixed Expenses 0, , , , Profit, , , , 3) Advice : aoe ;, ‘Mix C should be adopted because it gives the maximum contribution and profit., a