Page 1 :

Joint products and by-products, joint products: the term joint products is used for two or more products of, almost equal value which are simultaneously produced from the same, manufacturing process and the same raw material., According to ICMA(London) “two or more products separated in processing, each having sufficiently high saleable value to merit recognition as a main, product., Examples of joint products:, 1. Oil refining: joint products are petrol, diesel, kerosene, grease,etc, 2. Dairy: joint products are cream, skimmed milk, , Characteristics of joint products:, 1. Joint products are produced from the same material in definite(nature), proportions, 2. They are produced simultaneously by a common process, 3. They are comparatively of almost equal value, 4. They may require further processing after their point of separation., , Joint cost and subsequent costs:, Joint cost: joint(common) costs are those costs which are incurred before, that stage in manufacture at which product get separated., , subsequent cost: are those costs which are incurred after the separation, or split-off point, , By Products:, By products are products of relatively small value which are incidentally and, unavoidable produce in the course of manufacturing the main product., By-products may be sold in their original form without further processing or, some may require further processing in order to saleable.

Page 2 :

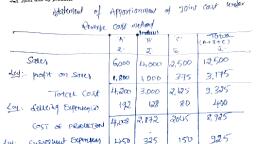

Example of by products:, Rice mill-husk, Edible oil mill-oil cake, In cotton textile- cotton seed, In sugar manufacturing- ‘bagase’(residual of sugarcane after the juice is, extracted), ‘Molasses’(residual of sugarcane juice after the impurities are taken, out), and ‘press mud’, , Difference between joint products and by-products, 1. Joint products are more or less of equal economic importance or, commercial value. But By-products are of lesser economic importance, 2. Joint products are produced together in a process. But, By-products are, produced from the scrap or discarded materials of the main products., , Methods of apportionment of joint costs:, 1., 2., 3., 4., , Average cost method, Marginal costing method, Market value method, Reverse cost method (Net realisable value method): in this method,, the joint cost is apportioned on the basis of net value of each, product., The net value is calculated as follows:, Sales, xx, Less: estimated profit margin on sales, xx, Less: selling and distribution costs (if any), xx, Less: after split off processing costs, xx, Share in joint cost, xx

Page 3 :

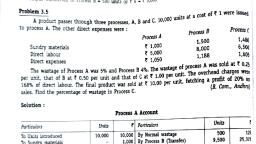

Illustration: 1 (Nov/Dec -2017), In processing a basic raw material, three joint products A, B, and C are, produced. The joint expenses of manufacturing are: materials Rs.10,00, Labour, Rs.8,000, overhead Rs.9000 (total Rs.27,000)., Subsequent expenses are as follows:, X, Y, Z, Rs., Rs., Rs., Material, 2,000, 1,600, 1,800, Labour, 2,500, 1,400, 1,700, Overhead, 2,500, 1,000, 1,500, _______________________________, Total, 7,000, 4,000, 5,000, ____________________________________, Sales value, 42,000, 20,000, 18,000, Estimated profit on sales, 50%, 50%, 33.33%ss, Show how would apportion the joint costs of manufacture by reverse cost, method, Illustration-2:(Nov-2018 BU), In the processing a raw material, on main product X and a by-product Y are, produced. The joint expenses of manufacturing are:, Materials: Rs. 12,000, Labour :, Rs. 6000, Overheads : Rs.2,800, Total :, Rs.20,800, Subsequent expenses are as follows:, Particulars, X, Y, Materials, 6,000, 3,000, Labour, 2,800, 2,000, Overheads, 1,200, 1,000, Total, 10,000, 6,000, sales value, 32,000, 16,000, estimated profit on sales, 25%, 20%, show the apportionment of joint costs of manufacture using reverse cost, method.

Page 4 :

Illustration-3:, A Ltd. Manufactures product B, which yields two by-products C and D. The, actual joint expenses of manufacture for a period were ₹ 8,000. It was, estimated that profits on each product as a percentage of sales would be 30%,, 25% and 15% respectively., B, C, D, ₹, ₹, ₹, Material, 100, 75, 25, Direct wages, 200, 125, 50, Overheads, 150, 125, 75, Total, 450, 325, 150, Sales, 6,000, 4,000, 2,500, Prepare a statement showing the apportionment of the joint expenses of, manufacture over the different products. Also presume that selling expenses, are apportioned over the products as a percentage to sales., Illustration -4 (Nov/Dec-2017 BU), The following details are extracted from the costing books of chandru Copra, Oil products Ltd. For the year ended 31-03-2017, Particulars, Crushing, Refining, Finishing, Process, Process, Process, Cost of labour, 5,500, 2,200, 3,300, Electric power, 1,320, 792, 3,300, Sundry material, 220, 4,400, ----Repairs to plant & machinery, 616, 726, 308, Steam, 1,320, 990, 990, Factory expenses, 2,904, 1,452, 484, Cast of casks, --16,500, 3200 tonnes of crude oil were produced, 2600 tonnes of oil were produced by, the refining process, 2500 tonnes of refined oil were finished for delivery., Copra sacks sold for ₹ 880, 1925 tonnes of copra residue sold for ₹ 24,200, loss, in weight in crushing 275 tonnes, 500 tonnes of by-products obtained from, refining process were valued at ₹ 14,850., You are required to show the account of each of the following process, concerned for the purpose of arriving at cost per ton of each process., a) Crushing process, b) Refining process, c) Finishing process including casks

Page 5 :

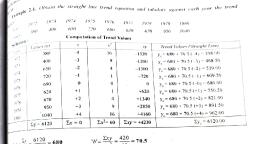

Illustration-05:, In an oil refinery, the product passes through three distinct processes., The following information is available for the month of January 2020., Crushing, Refining, Finishing, Raw materials (500 tons of copra) (Rs.) 2,25,000, Wages (Rs.), 8,000, 5,900, 5,875, Power (Rs.), 1,200, 1,000, 1,500, Sundry materials (Rs.), 500, 1,900, ----Factory expenses (Rs.), 600, 1,000, 950, Cost of drums for storing finished oil was ₹ 21,025., 200 tons of cakes were sold for ₹ 15,000 and 275 tons of crude oil were, obtained. Sundry by-products of the crushing process fetched ₹ 900 ., By-products after refining the oil was sold for ₹ 900 (20 tons) and 250 tons of, refined oil were obtained., 240 tons of finished oil were stored in drums and 10 tons were sold for ₹1,200., The establishment expenses for the period amounted to ₹ 3,500 which are to, be charged to three process in proportion of 3:2:2., Prepare the process accounts