Page 2 :

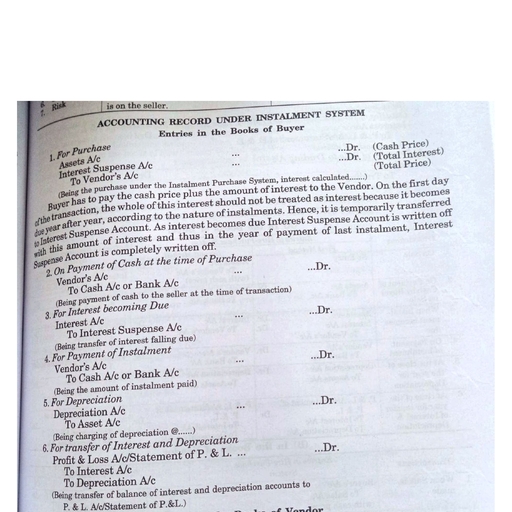

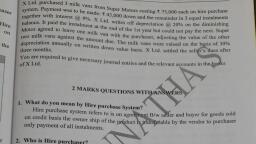

—, , ee — ee, , , , 3. The legal ownership of the goods is passed on to the hire purchaser, only after the final instalment is paid., , 4. As the legal ownership of the goods is not passed on to the. hire, purchaser until the last instalment is paid, if the hire purchaser fails to, pay any of the instalments, the hire seller can reposses the goods from, the hire purchaser., , 5. For the same reason (i.¢., as the legal ownership of the goods is not, passed on to the hire purchaser until the last instalment is paid), the, hire purchaser also can return the goods to the hire seller and terminate, the hire purchase agreement any time before the last instalment is, paid., , " 6. If either the hire seller takes back the goods from the hire, purchaser on the hire purchaser's failure to pay any of the instalments, or if the hire purchaser returns the goods to the hire seller any time, before the last instalment is paid, the hire seller need not return to the, hire purchaser the instalments already paid by him (i.e., the hire, purchaser), as the instalments already paid by the hire purchaser to, the hire seller are treated as mere hire charges for the use of goods by, the hire purchaser till then (i.e., till the date of repossession or return)., , 7. The total amount payable by the hire purchaser to the hire seller,, called the hire purchase price, is always more than the cash price of, the goods purchased. The difference between the hire purchase price, , and the cash price of the goods is the interest on the delayed payment, in form of instalments., , 8. As the hire purchase price payable by the hire purchaser to the, hire selleris more than the cash Price, and as the hire purchase price is, paid in several instalments, naturally, each instalment paid by the hire, purchaser to the hire seller represents payment towards both the cash, Price of the goods and the interest for the unpaid balance of the cash, Price of the goods., , 2. Write short notes on, , Hire Purchase Agreement, Hire Purchase Price, Cash Price, Down, Payment., , Ans.: (i) Hire Purchase Agreement: An agreement under which, 90ods are let on hire and under which the hire has on option to, Purchase them in accordance with the terms of the agreement, , (ii) Hire Purchase Price: Hire purchase price is the price eevee, , orthe Purchase of an asset on hire purchase system. It Ropes the, Scanned with CamScanner

Page 3 :

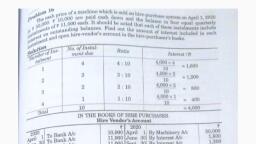

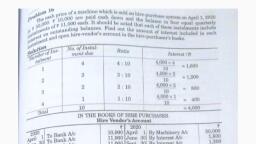

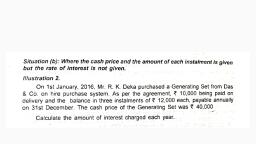

e interest payable on the unpaid balance, { the period of hire purchase agreement., asset is the price, , h price of the asset plus th, , of the cash price till the end o, (iii) Cash Price: Cash price or cash value of an, , payable on the outright purchase of that asset., , (iv) Down Payment or Advance Payment: Cash down paymignt,, down payment or advance payment means the advance paid or the, cash payment made at the date of signing the hire purchase agreement., , 5. From the following information calculate the internal and cash, , price of the motor cycle., , Mrs. A purchased a Motor Car on hire purchase system on 1st, | Jan. 2008 and paid €10,000 down and balance in four annual, | instalments of 10,000 each at the end of each year. Interest is, , charged at 5% p.a., Statement showing Cash Price and Interest, , , , Year| Amount |Instal-| Total amt. Interest Prinipal or, due at the} ment | due at the due amount due at, endofthe} paid |endofthe the beginning of, , year year the year, , , , 2011] mil 10000] 10000 | 8. x10000=476 | 10000-476 = 9524, 2010] 9524 | 10000] 19524 | 18. x19524=930 | 19524-930=18594 |, , 2009} 18594 | 10000] 28594 Tos x28594= 1362 28594-1362=2723,, , , , , , , , , , , , , , , , 2008} 27232 | 10000] 37232 _ | xom x97232=1773 | 37232-1773 =35459}, , , , Cash price of the Motor Car amount due at the, beggining of 2008 35,459, +) pawn payment , il 10,000, f € aid pity i 45,459 —, t number of instalment given,, , , , , , , , , , C, , , , hire purchase, %56,000. John, sabaiesdl, , Scanned with CamScanner

Page 5 :

Statement showing calculation of interest, , , , , , , , Cash price of the machine on 1-1-2010 y a, —) Down payment Bl, % - Outstanding amount , . jenna 41,000., +) Interest on outstanding amount of 1st year 2,050, (41,000x5%) ‘, Outstanding amount 43,050, - (-) 1st Instalment paid. 15,000:, - Outstanding amount 28,050, (+) Interest on outstanding amount : she 1,403, (28,050x5%), Outstanding amount : 29,453, (-) 2nd Instalment paid i 15,000, Outstanding amount ‘ 14,453, (+) Interest on outstanding amount 547, (15,000-14,453), Outstanding amount 15,000, (-) 3rd Instalment paid zl 15,000, Outstanding amount os, , , , Note: When payment is made for the final instalment, the interstis, not calculated by applying the percentage but by deducting the, balance of cash price from the instalment to be paid., , SECTION - B (12 marks questions), , 1. M. Manufacturing Co. Ltd. purchased lathe machines on ‘4st, January, 2017 on the hire purchase system. The cash price of the lathe, machines was < 29,800. The terms of payment were % 8,000 half yearly, instalments over 2 years, the first instalment to be paid on 30th June,, 2017. The rate of interest payable was 6% per annum. M, Manufacturing, Co. Ltd. closed its books on 30th June every year and decided to write, off depreciation on the lathe machines at the rate of 10% per annum on, , i mametan down vale; ; F : eG, , L :, Scanned with Camecanner