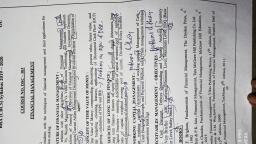

Page 1 :

http://www.ccsustudy.com, Question Paper Code : 1741, B.B.A. (Semester-IV) Examination, 2018, FINANCIAL MANAGEMENT, [ BBA-402 ], Time : Three Hours], [Maximum Marks : 70, Note : Answer five questions in all. Question No. 1 is, compulsory and it carries 30 marks. Attempt one, question, which carries 10 marks from each Unit., 1., Answer the following questions :, [3x10 = 30], %3D, (a), What do you mean by 'Shareholders Wealth, Maximization' ?, (b), What are factors affecting working capital ?, (c), Briefly explain stable dividend policy., (d), Is retained earnings free of cost ? Comment., (e), Find out the present value of the following:, (i), Rs. 1,500 receivable in 7 years at discount, rate of 15%., 1741/1200, (1 ), [P.T.O.]

Page 2 :

http://www.ccsustudy.com, (ii), An annuity of Rs. 1,000 starting at the end, of an year at a discount rate of 20%., (ii), A perpetuity of Rs. 750 per year forever, at a discount rate of 18%., (f), What is payback period ?, (g), Ansh Ltd. has just paid a dividend at the rate of, 10% on the equity shares of Rs. 20 each. The, expected growth rate of dividends is 7%. Find out, the cost of equity share capital. Present market, price of the share is Rs. 25., (h), What shall be the repercussions if a firm has, paucity of working capital ?, (i), What are the factors which must be considered, while designing capital structure ?, (G), What is interest tax shield ?, UNIT-I, 2., Explain the core decision areas of Finance Manager. [10], 3., A company requires an initial investment of Rs. 40,000., The estimated net cash flow are as follows :, [10], 1741/1200, ( 2 )

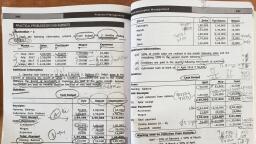

Page 3 :

http://www.ccsustudy.com, Year, 1, 2, 4, 7, 8, 9, 10, Net, cash, 7,000 7,000 7,000 7,000 7,000 8,000 10,000 15,000 10,000 4,000, flow, Rs., Using 10% as the cost of capital (rate of discount), determine the following :, (1), Net present value, (ii), Profitability index, (ii), Discounted payback period, (iv), Internal rate of return, UNIT-II, 4., [10], The following is the capital structure of XYZ Ltd :, Source, Book value, Market, C/C, Amount, value, 14% preference capital, Rs. 2,00,000 Rs. 2,30,000 14%, Equity capital, Rs. 5,00,000, 7,50,000 17%, 10% debt, 3,00,000, 2,70,000 8%, Reserves and surplus, 1,00,000, 16%, 11,00,000, 12,50,000, 1741/1200, ( 3 ), [P.T.O.]

Page 4 :

http://www.ccsustudy.com, Calculate the weighted average cost of capital, K, using, 7., (a), What are the costs associated with receivables ?, book value weights and market value weights., 5., A Ltd. has a share capital of Rs. 1,00,000 divided into, (b), What are the motives of holding cash ?, [5], share of Rs. 10 each. It has a major expansion program, UNIT-IV, requiring an investment of another Rs. 50,000. The, 8., (a), What do you mean by the liquidity of a firm ? How, management is considering the following alternatives for, can the liquidity of a firm be assessed ?, [5], raising this amount :, [10], (b), What is meant by 'Analysis of Financial, (1), Issue of 5,000 equity share of Rs. 10 each, Statements' ? Discuss its objectives., [5], (ii), Issue of 5,000, 12% preference shares of Rs. 10, 9., From the following Profit and Loss Account prepare a, each, common size Income Statement:, [10], (ii), Issue of 10% debentures of Rs. 50,000., Year, Year, Year, Year, The company's present earnings before interest and tax, Particulars, 2004, 2005, Partciulars, 2004, 2005, (EBIT) are Rs. 40,000 per annum subject to tax @ 50%., Rs. 12000 15,000 By net sales Rs.16000 20,000, To cost of goods sold, To administrative expenses, You are required to calculate the effect of each of the, Rs. 400, 400, To selling expenses, 600, 800, above financial plan on the earnings per share if the level, To net profit, Rs. 3,000 3,800, of EBIT remains same after expansion., 16,000 20,000, UNIT-III, -----, 6., "The equity share is different from a preference share.", Illustrate this statement in the light of preferences available, to preference shareholders., [10], 1741/1200, ( 4 ), 1741/1200, ( 5 )