Page 1 :

INTERNATIONAL FINANCIAL REPORTING STANDARDS, (IFRS), SOLVED QUESTION PAPER – NOV / DEC 2018, SECTION – A (2 MARKS), , a. What do you mean by accounting standards?, An accounting standard is a common set of principles, standards and procedures, that define the basis of financial accounting policies and practices. In the United States, the, Generally Accepted Accounting Principles form the set of accounting standards widely accepted for, preparing financial statements., b. What is investment property accordance to Ind AS -40?, An investment property is real estate property purchased with the intention of earning a return, on the investment either through rental income, the future resale of the property, or both., The property may be held by an individual investor, a group of investors, or a corporation., c. What are non-current assets? Give two examples., Noncurrent assets are a company's long-term investments for which the full value will not be, realized within the accounting year. Examples of noncurrent assets include investments in other, companies, intellectual property (e.g. patents), and property, plant and equipment., Examples, of, noncurrent, assets, include investments in, other, companies,, intellectual property (e.g. patents), and property, plant and equipment. Noncurrent assets appear on, a company's balance sheet., d. What is subsidiary?, A subsidiary, subsidiary company or daughter company is a company that is owned or, controlled by another company, which is called the parent company, parent, or holding company., The subsidiary can be a company, corporation, or limited liability company. In some cases it is a, government or state-owned enterprise., e. What do you mean by related party disclosure?, A related party is a person or entity that is related to the entity that is preparing its financial, statements (referred to as the 'reporting entity'), (i) has control or joint control over the reporting entity;, (ii) has significant influence over the reporting entity; or.

Page 2 :

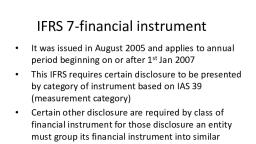

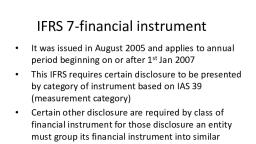

f. What do you mean by unrealized profit?, An unrealized gain is a potential profit that exists on paper, resulting from an investment. It, is an increase in the value of an asset that has yet to be sold for cash, such as a stock position that, has increased in value but still remains open. A gain becomes realized once the position is sold for, a profit., g. What is event after the reporting period as per Ind. AS-10?, Events after the Reporting Period, defines 'Events after the reporting period' as those events,, favorable and unfavorable, that occur between the end of the reporting period and the date when the, financial statements are approved by the Board of Directors in case of a company., , SECTION – B (6 MARKS), , 2. List of any nine IRFS issued by IASB., Ind AS 101, Ind AS 102, Ind AS 103, Ind AS 104, Ind AS 105, Ind AS 106, Ind AS 107, Ind AS 108, Ind AS 109, Ind AS 110, Ind AS 111, Ind AS 112, Ind AS 113, Ind AS 114, Ind AS 115, Ind AS 1, Ind AS 2, Ind AS 7, IndAS 8, Ind AS 10, Ind AS 12, Ind AS 16, Ind AS 116, Ind AS 19, Ind AS 20, , First-time Adoption of Indian Accounting Standards, Share-based Payment, Business Combinations, Insurance Contracts, Non-current Assets Held for Sale and Discontinued Operations, Exploration for and Evaluation of Mineral Resources, Financial Instruments: Disclosures, Operating Segments, Financial Instruments, Consolidated Financial Statements, Joint Arrangements, Disclosure of Interests in Other Entities, Fair Value Measurement, Regulatory Deferral Accounts, Revenue from Contracts with Customers, Presentation of Financial Statements, Inventories, Statement of Cash Flows, Accounting Policies, Changes in Accounting Estimates and Errors, , Events after the Reporting Period, Income Taxes, Property, Plant and Equipment, Leases, Employee Benefits, Accounting for Government Grants and Disclosure of Government Assistance

Page 3 :

Ind AS 21, Ind AS 23, Ind AS 24, Ind AS 27, Ind AS 28, Ind AS 29, Ind AS 32, Ind AS 33, Ind AS 34, Ind AS 36, Ind AS 37, Ind AS 38, Ind AS 40, Ind AS 41, , The Effects of Changes in Foreign Exchange Rates, Borrowing Costs, Related Party Disclosures, Separate Financial Statements, Investments in Associates and Joint Ventures, Financial Reporting in Hyperinflationary Economies, Financial Instruments: Presentation, Earnings per Share, Interim Financial Reporting, Impairment of Assets, Provisions, Contingent Liabilities and Contingent Assets, Intangible Assets, Investment Property, Agriculture, , 3. Mention the list of close members of the family as per Ind. AS-24., A Close member of the family includes person's children, spouse or domestic partner, brother, sister,, father and mother, children of that person's spouse or domestic partner and dependents of that, person's or person's spouse or domestic partner., • Close members are those who may be expected to influence, or be influenced by, that person, including:, • That person’s children, spouse, domestic partner, brother, sister, mother, father;, • Dependent of that person’s spouse/ domestic partner;, • Children of that person’s spouse/ domestic partner., • Entity is related to another entity if :, • i) Entity and RE are members of same group (i.e., Parent, Subsidiary, fellow subsidiary) A, Group is a parent and all its subsidiaries., • ii) Associate or JV of the entity covered under (i) (i.e., associate or JV of member of group), • iii) Both entities are JV of same third party, • iv) JV and Associate of the same third party, • v) Entity is post-employment benefit plan of either the RE or an entity related to RE. If RE is, itself such a plan, the sponsoring employers are also related to RE., • vi) Entity is controlled / jointly controlled by Person identified under

Page 4 :

4. Ganesh Ltd. Ordered a laptop in flip kart. The price of laptop is Rs.40,000 allowed 10%, discount at time of purchases and charged 18% GST which is not refundable. Shipping, charges Rs.500, software installation charges Rs.3,000 and annual service charges Rs.3,000., Calculate the initial cost of laptop., CALCULATION OF INITIAL COST OF LAPTOP, PARTICULARS, Estimated price, LESS: 10% Discount, Shipping charges, Software installation charges, Annual service charges, INITIAL COST, , AMOUNT, , 40,000, 4,000, , 36,000, 500, 3,000, NIL, 39,500, , 5. Harsha Ltd, acquires 70% of the equity shares of Meena Ltd on 1st January 2012. On that, date, paid up capital of Meena Ltd, was 10,000 equity shares of 10 each, accumulated reserve, balance was Rs.1,00,000. Harsha Ltd, paid Rs.1,60,000 to acquires 70% interest in the Meena, Ltd, Assets of Meena Ltd, were revalued on 1.1.2012 and a revaluation loss of Rs. 20,000 was, ascertained. Calculate the value of goodwill., CALCULATION OF GOODWILL OF Mr. Harsha Limited, PARTICULARS, 70% of Equity share capital (10,000 x 10 = 1,00,000 x 70%), 70% of Accumulated Reserve (1,00,000 x 70%), % of Revaluation Profit, TOTAL, LESS: 70% of Revaluation loss (20,000 x 70%), Value of Goodwill, , AMOUNT, 70,000, 70,000, NIL, 1,40,000, 14,000, 1,26,000, , REVALUATION LOSS:, GOODWILL = Paid amount to purchase assets – Value of Goodwill, GOODWILL = 1,60,000 – 1,26,000, GOODWILL = 34,000, , 6. From the following particulars XYZ Co, prepare statement of P/L for the year ended 31 st, march, 2018 as per schedule III of companies’ act, 2013., PARTICULARS, Revenue from operations, Cost of material consumed, Other income, Changes in inventory, , AMOUNT, , 39,000, 24,500, 6,000, 2,500

Page 5 :

Changes in WIP, Finance cost, Employees Benefits, Depreciation and amortization, Other expenses, Income tax expenses, Non-Controlling interest, , 1,500, 1,000, 2,000, 3,000, 500, 1,200, 4,000, , STATEMENT OF PROFIT AND LOSS ACCOUNT OF MR. XYZ COMPANY AS ON 31ST, MARCH 2019, , PARTCULARS, 1. Revenue from operations, 2. ADD: Other incomes, 3. TOTAL REVENUE (A), 4. EXPENSES, Cost of material consumed, Changes in inventory, Changes in WIP, Finance cost, Employee benefit, Depreciation and amortization, Other expenses, TOTAL EXPENSES (B), 5. Profit before tax (3 - 4 ) / (A – B) (45,000 – 35,000), 6. Tax during the year, 7. Profit after tax (5 – 6) (10,000 – 1,200), Profit attributable to:, 1. Owners of the parent (B/F) (8,800 - 4,000), 2. Non – Controlling interest, TOTAL, , AMOUNT, , AMOUNT, , 39,000, 6,000, 45,000, 24,500, 2,500, 1,500, 1,000, 2,000, 3,000, 500, 35,000, 10,000, 1,200, 8,800, 4,800, 4,000, 8,800, , SECTION – C (14 MARKS), 7. a. Briefly explain the disclosures of EPS – Ind. AS -33., Earnings per share is a method used to review the performance of an entity. As the term itself denotes, it simply means determining the profit attributable to each share., Such information is required to understand the return on investment for the shareholders and, prospective investors.

Page 6 :

•, , •, , An entity shall calculate basic earnings per share attributable to ordinary equity holders of the, entity and, if presented, profit or loss from continuing operations attributable to those equity, holders., Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary, equity holders of the entity (numerator) by the weighted average number of ordinary shares, outstanding (denominator) during the period., , DISCLOSURE, If EPS is presented, the following disclosures are required :, •, •, •, , •, , The amounts used as the numerators in calculating basic and diluted earnings per share, and, a reconciliation of those amounts to profit or loss attributable to the entity for the period., The weighted average number of ordinary shares used as the denominator in calculating basic, and diluted earnings per share, and a reconciliation of these denominators to each other., Instruments (including contingently issuable shares) that could potentially dilute basic, earnings per share in the future, but were not included in the calculation of diluted earnings, per share because they are antidilutive for the period(s) presented., A description of those ordinary share transactions or potential ordinary share transactions,, that occur after the reporting period and that would have changed significantly the number of, ordinary shares or potential ordinary shares outstanding at the end of the period if those, transactions had occurred before the end of the reporting period., , EXAMPLE INCLUDE :, •, •, •, , An issue of shares for cash, Redemption of ordinary shares outstanding, Issue of options, warrants, or convertible instruments., , 7. b. Describe the relevance and challenges in the implementation of convergence of Indian, Accounting Standards (Ind. AS) with IFRS., Difference in GAAP and IFRS. Adoption of IFRS means that the entire set of financial statements, will be required to undergo a drastic change. ..., Interaction between Legislation and Accounting. ..., Training and Education. ..., Fair Value Measurement., •, , Interaction between Legislation and Accounting, There are concerns about the compatibility of local laws with IFRS in certain matters, pertaining to accounting, such as formats and presentation requirements. Similarly, there is, uncertainty over tax treatments of items arising from convergence such as unrealized gains, and losses and the move from a tax basis for depreciation to one of useful economic life, (IFRS)., , •, , Training and Education

Page 7 :

Lack of training facilities and academic courses on IFRS is also a challenge. A key, challenge is to ensure companies, auditors, regulators and the investment community is, appropriately skilled to apply and interpret IFRS., •, , •, •, •, •, •, , Fair Value Measurement, IFRS uses fair value as a measurement base for valuing most of the items of financial, statements. The use of fair value accounting can bring a lot of volatility and subjectivity to, the financial statements. It also involves a lot of hard work in arriving at the fair value and, valuation experts have to be used., Variations in GAAP and IFRS, Legal and regulatory considerations, Taxation, Re-negotiation of contract, Reporting system, , 8. a. Mention the disclosure requirements of operating segments under Ind. AS – 108., An entity shall disclose information to enable users of its financial statements to evaluate the, nature and financial effects of the business activities in which it engages and the economic, environments in which it operates., An operating segment is a component of an entity:, That engages in business activities from which it may earn revenues and incur expenses, (including revenues and expenses relating to transactions with other components of the same, entity), Whose operating results are reviewed regularly by the entity's chief operating decision, maker to make decisions about resources to be allocated to the segment and assess its performance, and for which discrete financial information is available, Disclosure requirements, •, , General information about how the entity identified its operating segments and the types of products, and services from which each operating segment derives its revenues., , •, , Judgements made by management in applying the aggregation criteria to allow two or more, operating segments to be aggregated., , •, , Information about the profit or loss for each reportable segment, including certain specified revenues, and expenses such as revenue from external customers and from transactions with other segments,, interest revenue and expense, depreciation and amortisation, income tax expense or income and, material non-cash items., , •, , A measure of total assets and total liabilities for each reportable segment, and the amount of, investments in associates and joint ventures and the amounts of additions to certain non-current, assets ('capital expenditure')

Page 8 :

•, , An explanation of the measurements of segment profit or loss, segment assets and segment, liabilities, including certain minimum disclosures, e.g. how transactions between segments are, measured, the nature of measurement differences between segment information and other, information included in the financial statements, and asymmetrical allocations to reportable, segments., , •, , RTeconciliations of the totals of segment revenues, reported segment profit or loss, segment assets,, segment liabilities and other material items to corresponding items in the entity's financial, statements., , •, , Some entity-wide disclosures that are required even when an entity has only one reportable segment,, including information about each product and service or groups of products and services., , •, , Analyses of revenues and certain non-current assets by geographical area – with an expanded, requirement to disclose revenues/assets by individual foreign country (if material), irrespective of, the identification of operating segments, , 8. b. State the needs and objectives of Accounting Standards., • Accounting standards (AS) are general policy files. Their major goal is to make certain, transparency, reliability, consistency, and comparability of the monetary statements. They, achieve this through standardizing accounting insurance policies and concepts of a, nation/economic system. So, the transactions of all companies will probably be recorded in, an identical method in the event that they follow these accounting standards., , OBJECTIVES AND NEED OF ACCOUNTING STANDARDS:, • Accounting is most of the time viewed the language of trade, as it communicates to others the, monetary role of the company. And like every language has specified syntax and grammar, principles the identical is right here., • These principles in the case of accounting are the Accounting requirements. They're the, framework of principles and laws for accounting and reporting in a nation. Let us see the, essential goals of forming these necessities., • The foremost goal is to fortify the reliability of financial statements, • Now considering that the financial statements ought to be made following the requisites the, customers can rely on them., • They recognize that now not conforming to those specifications can have severe, consequences for the businesses., • Then there is comparability. Following these standards will allow for inter-company and, intra-corporation comparisons.

Page 9 :

• This enables us to investigate the growth of the company and its function in the market., • It additionally appears to provide one set of accounting policies that comprise the, indispensable disclosure standards and the valuation methods of quite a lot of fiscal, transactions., • To provide a standard for the diverse accounting policies and principles., • To put an end to the non-comparability of financial statements., • To increase the reliability of the financial statements., • To provide standards which are transparent for users., • To define the standards which are comparable over all periods presented., • To provide a suitable starting point for accounting., • It contains high quality information to generate the financial reports. This can be done at a, cost that does not exceed the benefits., • For the eradication the huge amount of variation in the treatment of accounting standards., • To facilitate ease of both inter-firm and intra-firm comparison., , 9. a. X Limited, was taken Machinery on lease from Y Limited, the information is as under., Lease term 4 years, fair value at inception of lease Rs.20,00,000, lease rent Rs.6,25,000, p.a. at the end of year, guaranteed residual value Rs. 1,25,000, Expected residual value –, 3,75,000, Implicit interest rate 15%. Calculate the value of the lease liability., YEAR, , Present value, , 1, 0.8696, , 2, 0.7561, , 3, 0.6575, , 4, 0.5718, , CALCULATION OF VALUE OF THE LEASE LIABILITY, SL.NO, , 1, 2, 3, 4, , CASHFLOWS Discount factor (15%) Present value, PARTICULRS, Fair value at Inception value 20,00,000, 0.8696 17,39,200, Lease rent, 6,25,000, 0.7561 4,72,563, Guaranteed residual value, 1,25,000, 0.6575, 82,188, Expected residual value, 3,75,000, 0.5718 2,14,425, VALUE OF THE LEASE LIABILITY, 25,08,376, , 9. b. From the following details, prepare other comprehensive income for the year ended 31 st, March, 2018 of ABC Ltd., PARTICULARS, Gains on property revaluation, Losses on investment in Equity Instruments, Remeasurement losses on defined pension plans, Share of gain on property revaluation, Items that may be reclassified subsequently to profit or loss, Exchange difference on translating foreign operations, , AMOUNT, , 12,000, 22,000, 600, 1,000, 5,000, 3,000

Page 10 :

Cash flow ledger, Income tax relating to items that may be reclassified, Profit for the year, Controlling interest (Owner), , 600, 2,000, 50,000, 39,000, , CALCULATION OF COMPREHENSIVE INCOME STATEMENT FOR THE YEAR ENDED AS ON 31st, March 2019, of Mr. ABC Ltd., , PARTICULARS, , AMT, , Profit for the year, , AMT, , 50,000, , ITEMS THAT WILL NOT BE RECLASSIFIED TO PROFIT AND LOSS, ACCOUNT, , Gains on property revaluation, Loss on Investment in Equity Instruments, Remeasurment losses on defined pension plans, Share of gain on property revaluation, Income tax related to items that will not be reclassified, TOTAL (A), , 12,000, (22,000), (600), 1,000, 5,000, (4,600), , ITEMS THAT MAY RECLASSIFIED SUBSEQUENTLY TO PROFIT AND LOSS, ACCOUNT:, , Exchange differences on translating foreign operations, Cash flow ledger, Income tax relating to items that may be reclassified, TOTAL (B), 1. Other comprehensive income for the year Net of Tax (A+B), (-4,600+ 5,600), 2. Total comprehensive income (Profit for year + Other, Comprehensive income) (50,000 + 1,000), PROFIT ATTRIBUTED TO:, 1. Owners of the parent, 2. Non – Controlling interest (51,000 – 39,000) (B/F), TOTAL, , 3,000, 600, 2,000, 5,600, 1000, 51,000, , 39,000, 12,000, 51,000, , 10. a. PQR company, constructing power generation plant. This project requires totally 12, crores, which are raised as follows:, a. Rs. 4 crores from IFCI for 10 years at 11% interest rate., b. Rs. 2 crores of loan from HDFC bank for 6 years at 10% interest rate., c. Rs. 2 crores of loan from SBI bank for 4 years at 12% interest rate., d. Rs.3 crores form 10% debentures for 5 years at 5% discount., e. Rs. 1 crore as overdraft from corporation bank at 4% interest rate., f. Out of total borrowed fund Rs. 5 crores are kept in HUDCO bank as short term deposit, for 6 months at 5% rate.

Page 11 :

g. IFCI bank loan is borrowed through consultation and the consultancy charges are 2% of, total loan amount., Calculate total borrowing cost accordance with Ind. AS-23., CALCULATION OF TOTAL BORROWING COST, SL.NO, , a, b, c, d, e, f, g, , PARTICULARS, IFCI Loan (4,00,00,000 x 11%), HDFC Bank loan (2,00,00,000 x 10%), SBI bank (2,00,00,000 x 12%), Debentures (3,00,000 x 10%), 30,00,000, LESS: Discount (3,00,00,000 x 5%), 15,00,000, Overdraft from corporate bank (1,00,00,000 x 4%), Income from investment (5,00,00,000 x 5% x 6/12), Consultancy charges (4,00,00,000 x 2% / 10), TOTAL BORROWING COST, , AMOUNT, , 44,00,000, 20,00,000, 24,00,000, 15,00,000, 4,00,000, (12,50,000), 80,000, 95,30,000, , 10. b. From the following Trail Balance of MN Co. Ltd, as 31.3.2018, Prepare SOFP as per, Ind. AS – 1. (Schedule III Companies act of 2013), AMOUNT, AMOUNT, DEBIT, CREDIT, Plant, Property, Equipment 8,00,000 Equity shares capital, 5,00,000, Intangible assets, 3,00,000 Capital redemption reserve, 50,000, Current investments, 1,00,000 Non- current liabilities, 8,00,000, Other non-current assets, 2,00,000 P & L A/c, 40,000, Inventories, 90,000 Current Liabilities, 6,00,000, Cash and cash equivalents, 4,00,000, Trade receivables, 1,00,000, Total, 19,90,000 Total, 19,90,000, , STATEMENT OF FINANCIAL ANALYSIS OF Mr. MNC LIMITED AS ON 31st MARCH 2018, , PARTICULARS, EQUITY AND LIABILITIES, Equity share capital, Capital redemption, Non-current liabilities, Profit and loss account, Current liabilities, TOTAL LIABILITIES, ASSETS, Plant Property Equipment, Intangible assets, , AMOUNT, , AMOUNT, , 5,00,000, 50,000, 8,00,000, 40,000, 6,00,000, 19,90,000, 8,00,000, 3,00,000

Page 12 :

Current investments, 1,00,000, Other non-current assets, 2,00,000, Inventories, 90,000, Trade receivables, 1,00,000, Cash and cash equivalents, 4,00,000, TOTAL ASSETS, 19,90,000, _______________________________________________________, 11. a. H Company ltd, acquired 4,000 equity shares of S company ltd, as on 1st April, 2017 the following are the balance sheet of the two companies as on 31.03.2018., H Ltd, S Ltd, ASSETS, Land and Buildings, 5,00,000 4,50,000, Investments: Shares of S ltd, 5,00,000, Sundry Debtors, 50,000, 60,000, Inventories, 75,000, 50,000, Bills Receivable, 40,000, 5,000, Cash, 2,50,000 1,60,000, TOTAL, 14,15,000 7,25,000, Equity and Liabilities, Equity share capital (Rs.100), 10,00,000 5,00,000, General Reserves (1.4.2017), 2,00,000 1,00,000, P/L a/c (1.4.2017), 50,000, 30,000, Profit during the year (2017 – 18) 1,00,000, 40,000, Sundry creditors, 65,000, 55,000, TOTAL, 14,15,000 7,25,000, Calculate NCI and Goodwill / Capital Reserves, , STEP 1 : CALCULATION OF RATIO, PARTICULARS, Number of Shares in Selling Company (‘Y’ Limited) (5,00,000 / 100), (Table value), Number of Shares in Purchasing / Acquiring Company ‘X’ Limited, (Adjustment value), Minority Shareholders (Selling company – Acquiring company), (4,000 – 5,000), Ratio = (Acquiring company ratio: Minority shares), (4,000 : 1,000) (4 : 1) (1 x 4 = 4) (1 x 1 = 1), , AMOUNT, , 5,000, 4,000, 1,000, , STEP 2 : CACLUATION OF NON CONTROLLING INTEREST, AMOUNT, AMOUNT, PARTICULARS, Share capital / Minority Shareholders (1,000 x 100), 1,00,000, ADD: SHARES OF CAPITAL PROFITS, , 1. Profit and Loss account as on 01 - 04 – 2016 (Selling company,, Table value), , 30,000

Page 13 :

2. Reserves as on 01 -04 – 2016 (Selling company, Table value), 3. Profits during the year (Adjustment value), , 1,00,000, NIL, 1,30,000, , TOTAL SHARES OF CAPITAL PROFITS, , Capital Profit = Capital Profit Amount X Minority shares ratio), (1,30,000 x 1/5), SHARES OF REVENUE PROFITS, 1. Profits during the year 2016 -2017 (Selling company, Table, value), , 26,000, , 40,000, , TOTAL SHARES OF REVENUE PROFIT, , Revenue Profit = Revenue Profit Amount X Minority shares ratio), (40,000 x 1/5), NON CONTROLLING INTEREST (NCI), , 8,000, 1,34,000, , GOOD WILL CALCULATION / CAPITAL RESERVE, AMOUNT, PARTICULARS, Share Capital of purchasing company (Selling company, Table, , AMOUNT, , 5,00,000, , value), , LESS: 1. Face value of share (4,000 x 100) (Adjustment value), 2. Capital Profits (1,30,000 x 4/5) (Ratio of purchasing company), GOODWILL / CAPITAL RESERVE, , 4,00,000, 1,04,000 5,04,000, 4,000, , 11. b. A company acquired whole of the shares in B company on 1.4.2017. The Balance sheet, as on 31.03.2018 were as follows., LIABILITIES, , A Ltd, B Ltd, 4,30,000 4,00,000, 2,70,000, 7,00,000 4,00,000, , Sundry Assets, Investments : Shares in B ltd, Total Assets, Equity and Liabilities, Shares Capital shares of Rs.10 each, 5,00,000 3,00,000, General Reserves, 1,00,000, 50,000, P and L a/c, 50,000, 25,000, Sundry Creditors, 50,000, 25,000, Total Liabilities, 7,00,000 4,00,000, From the above Balance sheet. Calculate Capital Reserve., STEP 1 : CALCULATION OF RATIO, PARTICULARS, Number of Shares in Selling Company / Table value (‘B’Ltd) (3,00,000/10), Number of Shares in Acquiring Company (Table value) (Investments) H ltd, (2,70,000/10), Minority Shareholders (Selling company – Acquiring company) (30,000 –, 27,000), Ratio = (Acquiring company ratio: Minority Shares) (27,000 : 3,000) ( 27 : 3), (9 : 1), , AMOUNT, , 30,000, 27,000, 3,000

Page 14 :

STEP 2 : CACLUATION OF NON CONTROLLING INTEREST, AMOUNT, AMOUNT, PARTICULARS, Share capital / Minority Shareholders (27,000 x 10), 2,70,000, ADD: SHARES OF CAPITAL PROFITS, , 1. Profit and Loss account / (Selling company, Table value), 2. Reserves / (Selling company, Table value), TOTAL SHARES OF CAPITAL PROFITS, , Capital Profit = Capital Profit Amount x Minority shares ratio, 75,000 x 1/10, SHARES OF REVENUE PROFITS, Profit and Loss account / (Selling company, Table value), , 25,000, 50,000, 75,000, 7,500, , 25,000, , TOTAL SHARES OF REVENUE PROFIT, , Revenue Profit = Revenue Profit Amount x Minority shares ratio, 25,000 x 1/10, NON CONTROLLING INTEREST (NCI), , 2,500, 2,80,000, , FORMAT FOR GOOD WILL CALCULATION / CAPITAL RESERVE, AMOUNT, AMOUNT, PARTICULARS, 1. Share Capital (Purchasing company, Table value), 5,00,000, LESS: 1. Face value of share (Share capital) Investment, 2,70,000, 2. Capital Profits (Capital Profits x Percentage of shares 67,500, 3,37,500, / Ratio of purchasing company) (75,000 x 9/10), GOODWILL, 8,87,500