Page 1 :

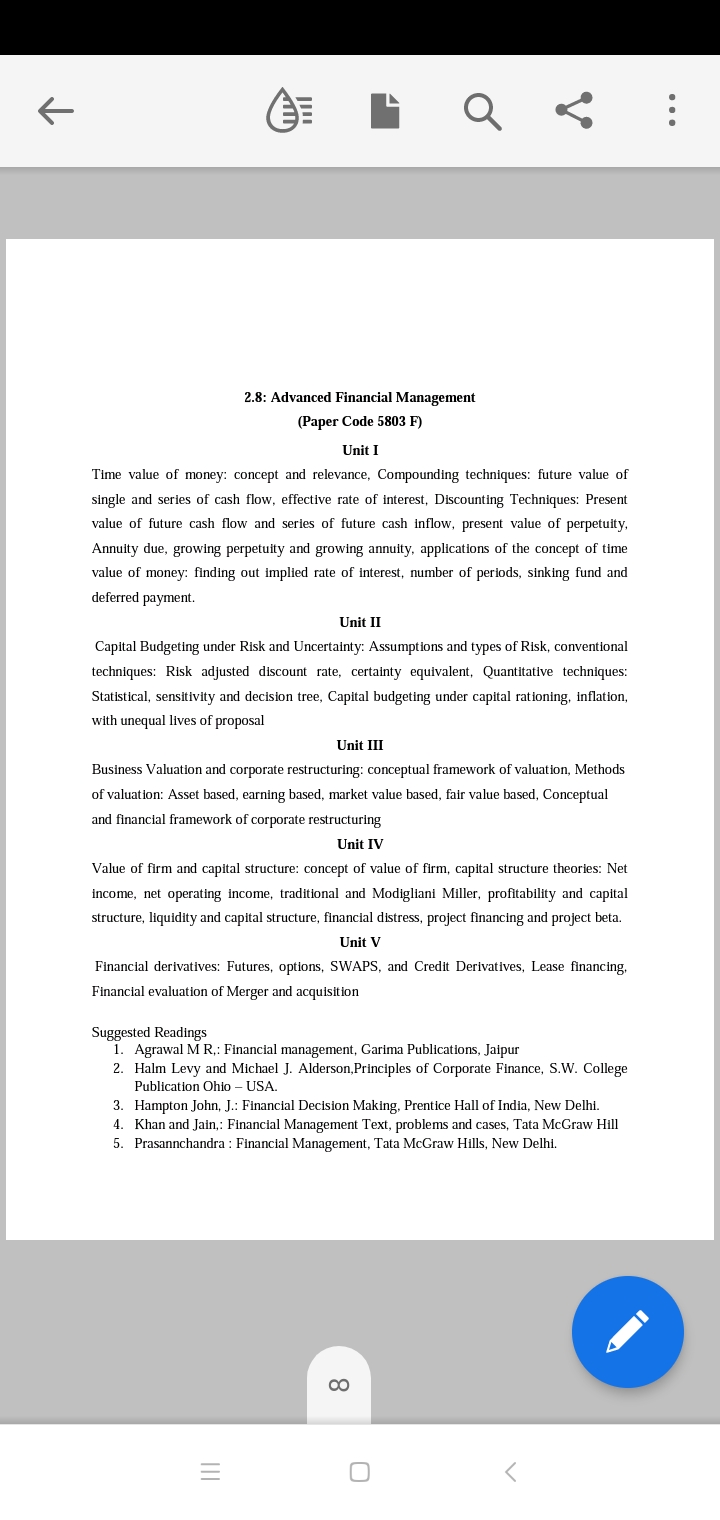

2.8: Advanced Financial Management, (Paper Code 5803 F), , Unit 1, Time value of money: concept and relevance, Compounding techniques: future value of, single and series of cash flow, effective rate of interest, Discounting Techniques: Present, value of future cash flow and series of future cash inflow, present value of perpetuity,, Annuity due, growing perpetuity and growing annuity, applications of the concept of time, value of money: finding out implied rate of interest, number of periods, sinking fund and, deferred payment., , Unit 1, Capital Budgeting under Risk and Uncertainty: Assumptions and types of Risk, conventional, techniques: Risk adjusted discount rate, certainty equivalent, Quantitative techniques:, Statistical, sensitivity and decision tree, Capital budgeting under capital rationing, inflation,, with unequal lives of proposal, , Unit 11, Business Valuation and corporate restructuring: conceptual framework of valuation, Methods, of valuation: Asset based, earning based, market value based, fair value based, Conceptual, and financial framework of corporate restructuring, , Unit IV, Value of firm and capital structure: concept of value of firm, capital structure theories: Net, income, net operating income, traditional and Modigliani Miller, profitability and capital, structure, liquidity and capital structure, financial distress, project financing and project beta., , Unit V, Financial derivatives: Futures, options, SWAPS, and Credit Derivatives, Lease financing,, , Financial evaluation of Merger and acquisition., , Suggested Readings, 1. Agrawal M R,: Financial management, Garima Publications, Jatpur, 2. Halm Levy and Michael J. Alderson,Principles of Corporate Finance, S.W. College, Publication Ohio — USA., Hampton John, J.: Financial Decision Making, Prentice Hall of India, New Delhi,, Khan and Jain,: Financial Management Text, problems and cases, Tata McGraw Hill, Prasannchandra : Financtal Management, Tata McGraw Hills, New Delhi.