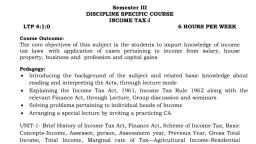

Page 1 :

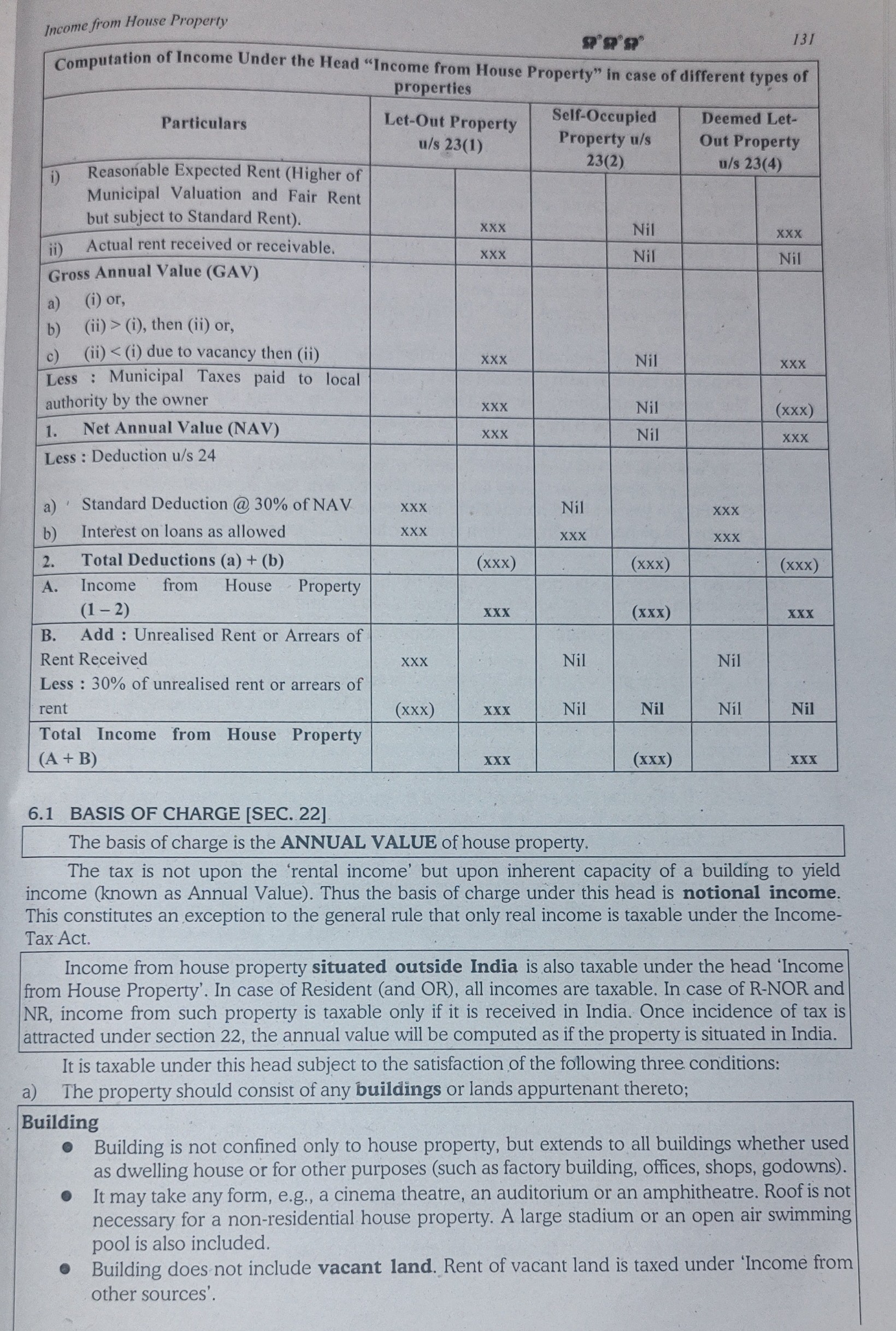

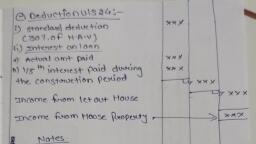

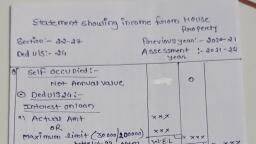

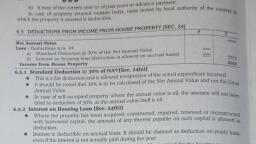

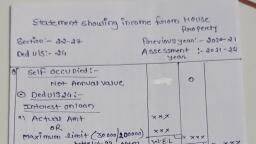

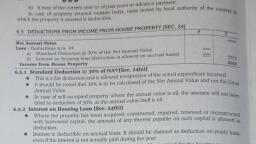

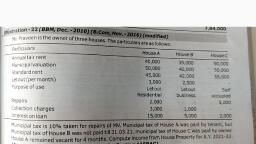

Income from House Property : : : : ., , ree iI, “Income from House Pro e ‘y” aitterent (vi :, nroperties perty” in case of different types of, , , , , , , , , , , Computation of Income Under the Head, , , , , , , , , , , ~ Deemed LetOut Property, , Self-Occupied, Property u/s, , , , , Particulars Let-Out Property, , w/s 23(1), , , , , , , i) Reasonable Expected Rent (Higher of, Municipal Valuation and Fair Rent, but subject to Standard Rent)., ii) Actual rent received or receivable,, Gross Annual Value (GAY), , a) (i) or,, , b) (ii) > @), then (ii) or,, , c) (ii)< (i) due to vacancy then (ii), Ppess : Municipal Taxes paid to local, authority by the owner, , 1. Net Annual Value (NAV), , Less : Deduction u/s 24, , , , , , , , , , , , , , , , , , , , , a) ' Standard Deduction @ 30% of NAV XXX, , —, , , , , , b) _ Interest on loans as allowed XXX, , 2. Total Deductions (a) + (b) | (xxx), Income from House ~ Property, (1-2), , Xxx, , , , B. Add: Unrealised Rent or Arrears of, , Rent Received XXX, , Less : 30% of unrealised rent or arrears of, rent, , | Total Income from House Property, (A+B), , , , , , , , , , , , 6.1 BASIS OF CHARGE [SEC. 22], , The basis of charge is the ANNUAL VALUE of house property. . a, , The tax is not upon the ‘rental income’ but upon inherent capacity of a building to yield, income (known as Annual Value). Thus the basis of charge under this head is notional income., This constitutes an exception to the general rule that only real income is taxable under the Income, , , Tax Act., , Income from house property situated outside India is also taxable under the head ‘Income, from House Property’. In case of Resident (and OR), all incomes are taxable. In case of R-NOR and, NR, income from such property is taxable only if it is received in India. Once incidence of tax is, attracted under section 22, the annual value will be computed as if the property is situated in India., , It is taxable under this head subject to the satisfaction of the following three. conditions:, , a) The property should consist of any buildings or lands appurtenant thereto;, , _ |Building, , @ Building is not confined only to house property, but extends to all buildings whether used, as dwelling house or for other purposes (such as factory building, offices, shops, godowns)., , © It may take any form, e.g., a cinema theatre, an auditorium or an amphitheatre. Roof is not, necessary for a non-residential house property. A large stadium or an open air swimming, pool is also included., , @ Building does not include vacant land. Rent of vacant land is taxed under ‘Income from, other sources’.