Page 1 :

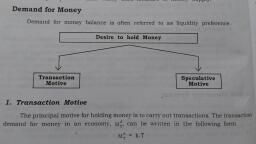

Where T 18 the total value of (nominal) transactions in the economy over wm, , ol and kK is Positive iraction, rhe number of times a unit of money changes hands during the unit period, } i by ga ; : *, | ia called the velocity of circulation of mone, Equation can be written as, |, h,, Where, \ 1/k is the veloc ity of circulation. Note that the term on the right, , Mv" 7, 2 Mo a ‘, , hand side of the above equation. T, is a flow of variable. ui, is stock of money. v-M, measures the total value of monetary transactions that has been made with the stock, in the unit period of time., , There exists a stable, positive relationshp between value of transactions and the, nominal GDP., , die, i ae « Ms kPY, Y = Real GDP., , P = The general price level or the GDP deflator., , Transaction demand for money is positively related to the real income of an, economy and also to its average price level., , 2. Speculative Motive, , Wealth can be held in the form of landed property, bullion, bonds, money, etc., Let all assets other than money be called ‘bonds’. Bonds are papers holding the promise, of future monetary returns over a period of time. Bonds are issued by governments, or firms for borrowing money from the public and they are tradable in the market., The price of a bond is inversely related to the market rate of interest., , If you expect interest rate to rise in future bond prices will fall. Loss occurring, from falling bond prices is called a capital loss to the bond holder. You will try to, sell your bond and hold money instead. Thus speculations about future movements, in interest rate and bond prices lead to the speculative demand for money., , The speculative demand for money is inversely related to the rate of interest., The speculative demand for money is, , f= 7, , min, , Where r = the market rate of interest and r,., and r_,. = the upper and lower, limits of r, both positive constants. It is evident from equation that as r decreases, , from r___ to r_., the value of M@ increases from 0 to »., max min S, , However, if the market rate of interest is at a certain low level then everybody, expects it to rise in future. Everyone in the economy will prefer money balance to, bonds. Whatever money is injected to the economy will be held as liquid balances., Such a situation is called a liquidity trap. The speculative money demand function, ‘8 infinitely elastic here.