Page 1 :

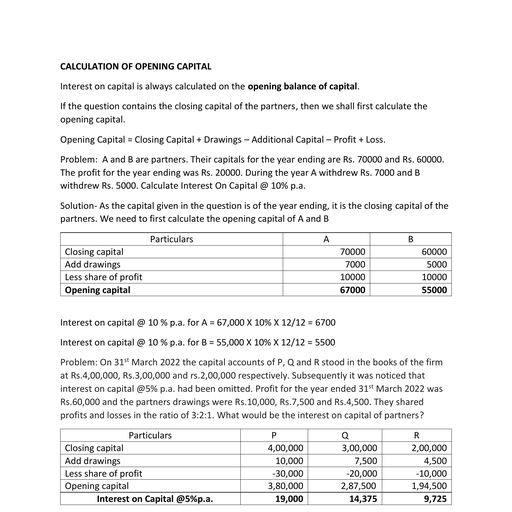

Important Working Notes helpful to prepare P&L Appropriation account:, 1] Note on Interest on capital: Interest on capital is allowed to partners at a rate specifically, provided in the partnership deed. However, if Partnership deed provides for interest on capital but, does not specify the rate of interest, interest will be paid @ 6%p.a. Further, interest is paid only out of, profits. Therefore, interest cannot be paid if there is loss during an accounting period., Interest on Capital = Capital X, , X, , OR Capital X Rate % X, , Period is number of months from the date of investment to the closing date., Important tips:, (a) Interest on Capital is allowed with due allowance for any addition or withdrawal of capital during, the accounting period. ie, with respect to the period amount invested in the business as follows:, (i) On the opening balance of the capital accounts of partners, interest is calculated for the whole, year (or 12 months);, (ii) On the additional capital brought in by any partner during the year, interest is calculated from, the date of introduction of additional capital to the last day of the financial year., (iii) On the amount of capital withdrawn (other than usual drawings) during the year, interest for, the period from the date of withdrawal to the last day of the financial year is calculated, and deducted from the total of the interest calculated under points: (i) and (ii) above., Alternatively, it can be calculated with respect to the amounts remained invested for the relevant, periods., (b) If the firm has incurred losses during an accounting year, no interest on capital will be, allowed to any partner., (c) If the profit for the year is insufficient, ie, less than the amount of interest on capital due to, partners, interest will be paid to the extent of available profit in the ratio of original interest on capital, or ratio of capitals., (d) If opening capital balances are not given in the problem, it can be found out as follows:, Particulars, Closing Capital, Add Drawings debited, Add Net Loss debited, Less Additional Capital credited, Less Net Profit credited, Opening Capital, , 2] Interest on Drawings = Drawings X, , A, , B, , X, , Period is number of months from the date of drawing to the closing date. Number of months is, calculated as given below in different situations:, S No, , Type of withdrawal, , Period, , Explanation

Page 2 :

1, , Date of drawings is not, mentioned, , 6, months, , Withdrawal could be on the first day itself or last day., Therefore, number of months could be 12 or 0. As the, date is not clearly given, consider 6 months which is, average of 12 and 0., , 2, , When a fixed amount is, withdrawn, at, the, beginning of each month, , 6.5, months, , For first withdrawal interest of 12 months, second for, 11 months and so on., 12+11+10+9+8+7=6+5+4+3+2+1=78, 78 / 12 = 6.5, , 3, , When a fixed amount is, withdrawn at the end of, each month, , 5.5, months, , For first withdrawal interest of 11 months, second for, 10 months and so on., 11+10+9+8+7=6+5+4+3+2+1+ 0=66, 66 / 12 = 5.5, , 4, , When a fixed amount is, withdrawn in the middle, of each month, , 6, months, , For first withdrawal interest of 11.5 months, second, for 10.5 months and so on., 11.5+10.5+9.5+8.5+7.5+6.5+5.5+4.5+3.5+2.5+1.5+, 0.5 = 72, 72 / 12 = 6, , 5, , When a fixed amount is, withdrawn, at, the, beginning of each quarter, , 7.5, months, , For first withdrawal interest of 12 months, second for, 9 months and so on., 12+9+6+3 =30, , ( A quarter refers to 3, months.), 6, , When a fixed amount is, withdrawn at the end of, each quarter, , 30/ 4 =7.5, 4.5, months, , For first withdrawal interest of 9 months, second for 6, months and so on., 9+6+3+0 =18, 18 / 4 =4.5, , 6, , When different amounts, Use, Date of, are withdrawn at varying product withdrawal, periods, method, , Amount, , Period in, months, , Product, , Find Total Product of all withdrawals. Calculate, interest on drawings for ONE month.

Page 3 :

3] Sharing of Profit or Loss in a ratio: Suppose the divisible profit of a firm is Rs. 60,000 and the, profit and loss sharing ratio is 3:2, profits of partner ‘A’ will be 60000 X 3/5 = 36,000 and partner, ‘B’ will be 60000 X 2/5 =24,000, 4] Salary/Rent to partner must be calculated for a year. In case monthly/quarterly/ half yearly salary is, given convert them into yearly amounts as follows:, Monthly salary, , X, , 12, , Quarterly salary, , X, , 4, , Half yearly salary X, , 2, , 5] If Commission to partner is allowed on turnover (sales) of the period, it is calculated as follows:, Commission = Turnover X, If Commission to partner is allowed on net profit, it is calculated as follows:, Commission = Net Profit X, (If commission is charged as a percentile after charging such commission, multiply by, , ), , 6] Whenever net profit is given after adjusting salary and commission to partner, such amount, allowed must be added back to net profit while preparing P&L Appropriation account. However, as, rent to partner is a charge, it should not be added back if it is already adjusted in the P&L account. On, the other hand, Rent must be deducted from the Net Profit if it is not adjusted.