Page 2 :

What is Macroeconomics?, Basic concepts in macroeconomics: consumption, , goods, capital goods, final goods, intermediate, goods; stocks and flows; gross investment and, depreciation., Circular flow of income (two sector model);, Methods of calculating National Income - Value, Added or Product method, Expenditure method,, Income method., Aggregates related to National Income: Gross, National Product (GNP), Net National Product, (NNP), Gross Domestic Product

Page 3 :

(GDP) and Net Domestic Product (NDP) - at, , market price, at factor cost; Real and Nominal, GDP., GDP and Welfare

Page 4 :

What is Macroeconomics?, In macroeconomics, we study the economic behaviour, of the economy as a whole by focusing our attention on, aggregate measures such as total output, employment, and aggregate price level., Here, we are interested in finding out how the levels of, these aggregate measures are determined and how the, levels of these aggregate measures change over time., Some of the important questions that are studied in macroeconomics are as follows:, • What is the level of total output in the economy?, • How is the total output determined?, • How does the total output grow over time?

Page 5 :

• Are the resources of the economy (e.g. labour) fully, employed?, • What are the reasons behind the unemployment of, resources?, • Why do prices rise?, Thus, instead of studying the different markets as is done in microeconomics, in macroeconomics, we try to, study the behaviour of aggregate or macro measures of, the performance of the economy.

Page 6 :

1.1, Some Basic Concepts of, National Income Accounting

Page 7 :

Final Goods and Intermediate Goods, Goods are classified as final goods and intermediate goods on the basis of the end use of the goods., , Final Goods, If goods are purchased for consumption, i.e., for satisfaction of wants, or for investment, these are called final, goods (or final products)., Expenditure on them is called final expenditure., Examples:, (i) Machine purchased by a firm for installation in, factory is a final good because it is purchased for, investment.

Page 8 :

(ii) Milk purchased by households is a final good as, it is purchased for consumption., (iii) Furniture purchased by a school is a final product because it is purchased for investment., (iv) Computers installed in an office is a final product because it is purchased for investment., (v) Printer purchased by a lawyer for office use is a, final product because it is purchased for investment., (vi) Blackboard used in a school is a final good because it is for investment. It is not used up completely in a year but remains for production of, educational services., (vii) Second hand car purchased by a house hold is a, final good because it is purchased for consumption.

Page 9 :

Intermediate Goods, Goods and services purchased by a production unit from other production units with the purpose of reselling or with the purpose of using them completely during the same year are called intermediate goods (or, intermediate products)., , , , Top Tip, , • Raw materials or non-factor inputs purchased for producing, goods are intermediate goods., • Intermediate goods are also called ‘single use producer goods’., • The expenditure on the intermediate goods is called intermediate cost or intermediate consumption.

Page 10 :

Examples:, (i) Steel sheets used for making automobiles and copper used for making utensils are intermediate, goods since they are purchased with the purpose, of using them completely during the same year for, production of steel gates/utensils., (ii) Mobile sets purchased by a mobile dealer are intermediate products because these are purchased for, resale., (iii) Chalks, dusters, etc. purchased by a school are intermediate products because these are used up, completely during the same year in the production, of educational services., (iv) Paper purchased by a publisher is an intermediate

Page 11 :

(v), (vi), , (vii), (viii), , product because it is used as raw material for production of books in the same year., Purchase of rice by a grocery shop is an intermediate product because it is purchased for resale., Coal used by a manufacturing firm is an intermediate product because it is used as a nonfactor input for production of other commodities, during the same year., Fertilisers used by the farmers are intermediate, products because these are used up completely, for producing grains during the same year., Cotton used by a spinning mill is an intermediate, product because it is used for further production, of clothes during the same year.

Page 12 :

, , Top Tip, , National income includes the value of final goods only., The value of intermediate goods is not included in the, national income estimates because it is already included, in the value of the final goods. Including intermediate goods separately will inflate or overestimate the national, income.

Page 13 :

Consumption Goods and Capital Goods, Final goods produced in an economy in a given period, of time are either in the form of consumption goods, (both durable and non-durable) or capital goods. As final, goods they do not undergo any further transformation at, the hands of any producer. Thus, of the final goods, we, can distinguish between consumption goods and capital, goods.

Page 14 :

Consumption Goods, The final goods which are consumed (or used) for satisfaction of wants by the consumers are called consumption goods* or consumer goods, e.g., food, clothing, television sets, etc., Those consumer goods like television sets, automobiles, home computers, etc. which are of durable, character are called consumer durables., Those consumer goods like food, clothing, etc. which are extinguished by immediate or short period, consumption are known as consumer non-durable goods., *This also includes services like recreation which are consumed but for convenience, we may refer to them as consumer goods.

Page 15 :

Capital Goods, The final goods of durable character which are used in, the production of other goods and services are called, capital goods or investment goods, e.g., machines, tools and equipments., Capital goods are also called durable use producer, goods having a long span of life, say 5 years or 10, years.

Page 16 :

, , Top Tip, , Basis of classification of final goods into consumption, goods and capital goods, The same good can be consumption good and also capital, good. It depends on the economic nature of its use. For, example, a machine purchased by a household is a consumption good whereas, if it is purchased by a firm for use, in the business, then it is a capital good. Similarly, a car, purchased by a household is a consumption good whereas if it is purchased by a firm for use in business, then it is, a capital good.

Page 17 :

Stocks and Flows, Stocks, , Stocks are economic variables measured at a given point of time., For example, Capital, Wealth, Money supply, Population,, Inventories, Foreign debts, Buildings and machines in, a factory, Balance in a bank account, etc. are stock, variables since they are measured at a particular point, of time.

Page 18 :

Flows, Flows are economic variables measured over a period, of time., National income or Gross domestic product (GDP) or, Production or Output, Sales, Savings, Expenditure, Profits, Losses, Exports, Imports, Net capital formation, or net investment, Depreciation, Interest, Change in, inventories, Change in money supply, Value added, etc. are flow variables since they are measured over a, period of time.

Page 19 :

, , Top Tip, , An example to understand the difference between stock, variables and flow variables, Suppose a tank is being filled with water coming from a tap., The amount of water which is flowing into the tank from the, tap per minute is a flow. But how much water there is in the, tank at a particular point of time is a stock concept.

Page 20 :

Gross Investment and Depreciation, Investment, , In economics, the term ‘investment’* is defined as, addition to the stock of fixed capital (such as machines) and change in inventories during a year., That part of final output which comprises of capital, goods constitutes gross investment of an economy. For, example, machines, tools and implements, buildings,, office spaces, store houses or infrastructure like roads,, bridges, airports or jetties, etc., * The term ‘investment’ must not be confused with the commonplace notion of, investment which implies using money to buy physical or financial assets. Thus, use of, the term investment to denote purchase of shares or property or even having an, insurance policy has nothing to do with how economists define investment.

Page 21 :

Depreciation, A part of the capital goods produced this year goes for, maintenance or replacement of existing capital goods, because the existing capital stock suffers wear and tear, and needs maintenance and replacement. This portion, of the capital goods produced is not an addition to the, stock of capital goods and its value needs to be subtracted from gross investment to arrive at net investment. This deletion made from the value of gross investent in order to accommodate regular wear and tear of, capital, is called depreciation., Depreciation is an annual allowance for normal wear, and tear and foreseen obsolescence of a fixed capital, asset.

Page 22 :

New addition to capital stock in an economy is called, net investment (or net capital formation)., Thus, investment is defined as capital formation, a gross, or net addition to capital stock., Let us examine the concept of depreciation a little more, in detail:, , Example: Suppose a new machine is purchased for, `20 lakh having useful life of service 10 years, after, which it falls into disrepair and needs to be replaced., Suppose, the scrap value of the machine will be nil, after 10 years.

Page 23 :

Therefore, Depreciation on the machine, =, , lakh per year., , Thus, the machine is gradually used up in each year’s, production process and each year 1/10th of its original, value, i.e. `2 lakh gets depreciated. So, instead of, considering a bulk investment for replacement after 10, years, we consider an annual depreciation cost every, year., Note that depreciation does not take into account, unexpected/unforeseen, obsolescence, or, sudden, destruction or disuse of capital as can happen with, accidents, natural calamities or other such extraneous, circumstances. This is called ‘capital loss’.

Page 24 :

, , Top Tip, , Depreciation is also defined as:, 1. Consumption of fixed capital, 2. Value of capital consumption, 3. Current annual replacement cost of fixed capital assets, 4. Annual replacement investment to keep the value of fixed, capital assets constant, 5. Annual allowance for normal wear and tear and foreseen, obsolescence, 6. Annual maintenance and replacement cost of existing capital goods, 7. Regular wear and tear of capital, 8. Part of capital stock used up in each year’s production process

Page 25 :

Industrial classification – Primary,, Secondary and Tertiary Sectors, Industrial classification means grouping production, units into distinct industrial groups, or sectors. This is, the first step required to betaken in estimating national income, irrespective of the method of estimation. It, is statistically more convenient to estimate national, income originating in a group of similar production, units rather than for each production unit separately., It is now a matter of general practice to group all the, production units of a country into three broad groups, – primary sector, secondary sector and tertiary sectors., Each of these sector can be further subdivided into, smaller groups depending upon the requirement. Let

Page 26 :

us now explain each sector., , Primary Sector, Primary sector includes production units exploiting, natural resources like land, water, subsoil assets, etc., Growing crops, catching fish, extracting minerals,, animal husbandry, forestry, etc. are some examples., Primary means of first importance. It is primary because it is a source of basic raw materials for the secondary sector.

Page 27 :

Secondary Sector, Secondary sector includes production units which are, engaged in transforming one physical good into another, physical good. Such an activity is called manufacturing, activity. These units convert raw materials into finished, goods. Factories, construction, power generation, water, supply, etc. are some examples., It is called secondary because it is dependent upon the, primary sector for raw materials.

Page 28 :

Tertiary Sector, Tertiary sector includes production units engaged in, producing services. Transport, trade education, hotels, and restaurant, finance, government administration,, etc. are some examples., This sector finds third place because its growth is mainly dependent on the primary and secondary sectors.

Page 29 :

Indirect Tax and Subsidy, Indirect Tax, , Indirect tax is a tax imposed by government on production and sale of goods and services. It is a tax where, the payer and the bearer of the tax are different people., Examples: Goods and services tax (GST),* excise tax,, customs duties (export duty and import duty), service, tax, sales tax etc., Imposition of indirect taxes by the government increases the market prices of goods and services., * In India, Goods and Services Tax (GST) has replaced various indirect taxes,, levied by the Central and State/UT Governments. Some of the major taxes that, were levied by Centre were Central Excise Duty, Service Tax, Central Sales Tax,, etc. The major State taxes were VAT/Sales Tax, Entry Tax, Luxury Tax, Octroi,, Entertainment Tax, etc. These have been subsumed in GST.

Page 30 :

Subsidy, Subsidy is a from CBSE 2020 assistance given by the, government to the firms and households, with a motive of general welfare., Examples: Cash grants, interest-free loan to the firms,, subsidy on price of cooking gas to the households, etc., Subsidies granted by the government reduce the market prices of goods and services.

Page 31 :

Market Price and Factor Cost, Market Price, , Market prices are the prices as paid by the consumers., Market prices also include indirect taxes., , Factor Cost, , Factor cost refer to the prices of products as received, by the producers. In other words, factor cost is what is, actually available to production units for distribution, of income among the owners of factors of production., Indirect taxes are deducted from and subsidies are, added to market price to calculate what production, units actually receive., OR,, , Factor Income and Transfer Income

Page 32 :

Factor Income and Transfer Income, Factor Income, , The payment for the services rendered to the production, units by the owners of factors of production is called factor payment or factor income. Examples: Wages and, salary, rent, interest profit, etc.

Page 33 :

Transfer Income, Any payment for which no service is rendered is called, a transfer payment or transfer income. It does not involve any production of goods and services., Examples: Gifts, donations, charity, etc., , , , Top Tip, , National income includes only factor payments which are received in return for the factor services provided in production, of goods and services., On the other hand, transfer payment is not included in national income. This is because national income is a measure of, the value of production activity of a country, whereas transfer, payment does not involve any production activity.

Page 34 :

Inventory and Change in Inventories, Inventory, , The stock of unsold finished goods, or semi-finished, goods, or raw materials which a firm carries from one, year to the next is called inventory., Inventory is measured at a given point of time, e.g. value of inventory in the beginning of the year or value, of inventory at the end of the year. So, it is a stock variable.

Page 35 :

Change in Inventories, Change in inventories equals closing inventory minus, opening inventory., Change in inventories (or stock) takes place over a, period of time. Therefore, it is a flow variable., , , , Top Tip, , Inventory is treated as capital. So, it is a stock variable. On the, other hand, change in the inventory of a firm is treated as, investment, i.e., addition to the stock of capital of a firm. So, it, is a flow variable.

Page 36 :

Net product taxes and Net production, taxes, Net product taxes, , Product taxes and subsidies are paid or received per, unit of product, e.g., excise tax, service tax, export and, import duties, etc.

Page 37 :

Net production taxes, Production taxes and subsidies are paid or received in, relation to production and are independent of the, volume of production, e.g. land revenues, stamp and, registration fee.

Page 38 :

, •, , •, •, , Top Tip, Market prices include both Net Product taxes and Net, Production taxes., Basic prices include net production taxes but not net, product taxes., Factor cost includes only the payment to factors of, production, it does not include any tax.

Page 39 :

Key Terms, Final goods—Goods purchased for final consumption, i.e., for, satisfaction of wants, or final investment., Intermediate goods—Goods purchased by a production unit from, other production units with the purpose of reselling or with the, purpose of using them completely during the same year., Consumption goods—The final goods which are consumed (or, used) for satisfaction of wants by the consumers., Capital goods—The final goods of durable character which are, used in the production of other goods and services., Stocks—Economic variables measured at a given point of time,, e.g. capital, wealth, etc., Flows—Economic variables measured over a period of time, e.g., income, output, etc., Gross investment—That part of final output which comprises of, capital goods such as machines., Depreciation—An annual allowance for normal wear and tear and, foreseen obsolescence of a fixed capital asset.

Page 40 :

Net investment—New addition to capital stock in an economy is, called net investment or net capital formation.

Page 41 :

RECAP, , Macroeconomics, In macroeconomics, we study the economic behaviour of the, economy as a whole, e.g. aggregate demand, aggregate supply,, levels of income, employment and price in the economy., Final Goods and Intermediate Goods, Goods are classified as final goods and intermediate goods on, the basis of the end use., Final goods are the goods which are used for final, consumption (i.e., for satisfaction of wants) or for, investment., Examples: (i) Machine purchased by a firm for installation in, factory, (ii) Milk or bread purchased by households, (iii), Printer purchased by a lawyer for office use, etc., Intermediate goods (or single use producer goods) are the, goods which are purchased during the year by a firm from

Page 42 :

another for the purpose of further production or resale., Examples: (i) Raw materials such as steel sheets used for, making automobiles and copper used for making utensils,, (ii) Mobile sets purchased by a mobile dealer, (iii) Chalks,, dusters, etc. purchased by a school, (iv) Paper purchased by, a publisher, (v) Purchase of rice by a grocery shop, (vi), Fertilisers used by the farmers, etc., , Consumption Goods and Capital Goods, Consumption goods (or consumer goods) are that part of, the final goods which are consumed (or used) for, satisfaction of wants by the consumers, e.g., food, clothing,, TV sets, refrigerators, etc., Capital goods (or investment goods or durable use, producer goods) are that part of the final goods which are, bought not for meeting immediate needs of the consumers, but are for producing other goods, e.g., machines and

Page 43 :

equipments. They are of durable character., Stocks and Flows, Stocks are economic variables which can be measured at a, given point of time, e.g. Capital, Wealth, Money supply,, Inventories, Buildings and machines in a factory, Balance in, a bank account, etc., Flows are economic variables which can be measured over a, period of time, e.g, National income or GDP or Production, or Output, Sales, Savings, Expenditure, Profits, Losses,, Exports, Imports, Gross/Net capital formation or Gross/Net, Investment, Depreciation, Interest, Change in inventories,, Change in money supply or money creation, Value addition,, etc., Gross Investment and Depreciation, Gross investment (or gross capital formation) refers to the

Page 44 :

addition to capital stock of an economy during an, accounting year., Depreciation is an annual allowance for normal wear and, tear and foreseen obsolescence of a fixed capital asset., Depreciation is also defined as value of consumption of fixed, capital or annual maintenance and replacement cost of fixed, capital assets., Depreciation on fixed capital asset =, , Note: Unexpected/unforeseen obsolescence or sudden, destruction of capital assets is not depreciation. It is called, capital loss., Net investment (or net capital formation) is the new, addition to capital stock in an economy. A part of the capital

Page 45 :

goods produced goes for maintenance or replacement of, existing capital goods. Thus, Net Investment = Gross, investment – Depreciation., Indirect Tax and Subsidy, Indirect tax is a tax imposed by government on production, and sale of goods and services. Examples: Goods and, services tax (GST), excise tax, etc. Indirect taxes increase, market prices of goods and services., Subsidy is a form of financial/economic assistance given by, the government to the firms and households, with a motive, of general welfare. Examples: Cash grants, interest-free loan, to the firms, subsidy on price of cooking gas to the, households, etc. Subsidies reduce the market prices of goods, and services., Net indirect tax = Indirect taxes – Subsidies

Page 46 :

Market Price and Factor Cost, Market price is what the buyers pay. It includes indirect, taxes but excludes subsidies., Factor cost is what is actually available to production units., Factor cost = Market price – Indirect taxes + Subsidies, Factor Income and Transfer Income, The payment for the services rendered to the production, units by the owners of factors of production is called factor, payment or factor income, e.g. wages and salary, rent,, interest profit, etc., Any payment for which no service is rendered is called a, transfer payment or transfer income. It does not involve, any production of goods and services. Examples: Gifts,, donations, charity, etc.

Page 47 :

Inventory and Change in Inventories, The stock of unsold finished goods, or semi-finished goods,, or raw materials which a firm carries from one year to the, next is called inventory., Net change (or increase) in inventories = Closing inventory – Opening inventory

Page 48 :

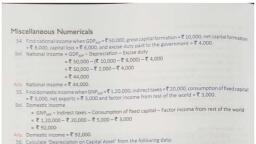

NUMERICAL 1, Calculate ‘Depreciation on Capital Asset’ from the, following data:, (CBSE Sample Question Paper 2020) (4 marks), S. No, , Particulars, , Amount (in `crore), , i., , Capital value of the asset, , 1,000, , ii., , Estimated life of the asset, , 20 years, , iii., , Scrap Value, , Solution: Depreciation on capital asset, , Nil

Page 49 :

Do it yourself 1, Arrange the following coefficients of price elasticity of, demand in ascending order:, (1 mark), (–) 3·1, (–) 0·2, (–) 1·1

Page 51 :

Question 1, The good or service purchased by an individual or an, enterprise is for :, (Choose the correct alternative), (a) Final use, (b) Use in further production, (c) Both (a) and (b), (d) Consumption, , Objective Type Questions 1.1

Page 52 :

Answer 1, (c) Both (a) and (b), , Objective Type Questions 1.1

Page 53 :

Question 2, A good that is meant for final use and will not pass, through any more stages of production or transformations, at the hands of any producer is called __________ ., (Fill in the blank), , Objective Type Questions 1.1

Page 54 :

Answer 2, a final good, , Objective Type Questions 1.1

Page 55 :

Question 3, A final good may also undergo transformations., True/False? Give reason., , Objective Type Questions 1.1

Page 56 :

Answer 3, True: Final goods may be transformed during their, consumption, e.g. the tea leaves purchased by the, consumers are used to make drinkable tea., , Objective Type Questions 1.1

Page 57 :

Question 4, It is not in the nature of the good but in the _______, that a good becomes a final good., (Fill in the blank), , Objective Type Questions 1.1

Page 58 :

Answer 4, economic nature of its use, , Objective Type Questions 1.1

Page 59 :

Question 5, If tea leaves are used in a restaurant for tea brewing ,, and the drinkable tea is sold to the customers, then the, tea leaves will be________________., (Choose the correct alternative), (a) Final goods, (b) Intermediate good, (c) Consumption goods, (d) Capital goods, , Objective Type Questions 1.1

Page 60 :

Answer 5, (b) Intermediate good, , Objective Type Questions 1.1

Page 61 :

Question 6, Final goods are:, (Choose the correct alternative), (a) Consumption goods, (b) Capital goods, (c) Both (a) and (b), (d) Intermediate goods, , Objective Type Questions 1.1

Page 62 :

Answer 6, (c) Both (a) and (b), , Objective Type Questions 1.1

Page 63 :

Question 7, Goods of durable character which make production of, other commodities feasible but they themselves don’t, get transformed in the production process, are called, __________., (Fill in the blanks), , Objective Type Questions 1.1

Page 64 :

Answer 7, Consumption goods or consumer goods, , Objective Type Questions 1.1

Page 65 :

Question 8, Goods like food and clothing and services like, recreation that are consumed when purchased by their, ultimate consumers are called ________________., (Fill in the blank), , Objective Type Questions 1.1

Page 66 :

Answer 8, Capital goods, , Objective Type Questions 1.1

Page 67 :

Question 9, The durable goods which undergo wear and tear with, gradual use, and thus are repaired or gradually replaced, over time are :, (Choose the correct alternative), (a) Intermediate goods, (b) Capital goods, (c) Consumer durables, (d) Both (b) and (c), , Objective Type Questions 1.1

Page 68 :

Answer 9, (d) Both (b) and (c), , Objective Type Questions 1.1

Page 69 :

Question 10, All the final goods and services produced in an economy, in a given period of time are either in the form of, ________________ or __________ ., (Fill in the blanks), , Objective Type Questions 1.1

Page 70 :

Answer 10, Consumption goods (both durable and non-durable);, Capital goods, , Objective Type Questions 1.1

Page 71 :

Question 11, Of the total production taking place in the economy, a, large number of products don’t end up in final, consumption and are not capital goods either. These are, ________________., (Fill in the blank), , Objective Type Questions 1.1

Page 72 :

Answer 11, Intermediate goods, , Objective Type Questions 1.1

Page 73 :

Question 12, Raw materials or non-factor inputs used for production, of other commodities are:, (Choose the correct alternative), (a) Capital goods, (b) Final goods, (c) Intermediate goods, (d) Consumer durables, , Objective Type Questions 1.1

Page 74 :

Answer 12, (c) Intermediate goods, , Objective Type Questions 1.1

Page 75 :

Question 13, Income, or output, or profits are concepts that make, sense only when a time period is specified. These are, called ___________., (Fill in the blank), , Objective Type Questions 1.1

Page 76 :

Answer 13, flows, , Objective Type Questions 1.1

Page 77 :

Question 14, (i) ______________ (Stock / Flows) are defined over a, period of time, whereas (ii) ______________ (Stock /, Flows) are defined at a particular point of time., (Choose the correct option), , Objective Type Questions 1.1

Page 78 :

Answer 14, (i) Flows (ii) Stocks, , Objective Type Questions 1.1

Page 79 :

Question 15, Capital goods (e.g. buildings or machines in a factory) or, consumer durables (e.g. television sets, home computers, etc), once produced do not wear out or get consumed in a, delineated time period. In fact, capital goods continue to, serve us through different cycles of production. There, can be addition to, or deduction from, these if a new, machine is added or a machine falls in disuse and is not, replaced. These are called ____________ . (Stock /, Flows), (Choose the correct option), , Objective Type Questions 1.1

Page 80 :

Answer 15, Stocks, , Objective Type Questions 1.1

Page 81 :

Question 16, Change in stocks are _____________. (Stocks /, Flows)., (Choose the correct option), , Objective Type Questions 1.1

Page 82 :

Answer 16, Flows, , Objective Type Questions 1.1

Page 83 :

Question 17, Suppose a tank is being filled with water coming from a, tap. The amount of water which is flowing into the tank, from the tap per minute is a (i) _________________, (Stock concept / Flow concept). But how much water is, in the tank is a (ii) _________________ (Stock, concept / Flow concept)., (Choose the correct option), , Objective Type Questions 1.1

Page 84 :

Answer 17, (i) Flow concept (ii) Stock concept, , Objective Type Questions 1.1

Page 85 :

Question 18, The part of final goods that comprises of capital goods, constitutes ______________ of an economy., (Fill in the blank), , Objective Type Questions 1.1

Page 86 :

Answer 18, Gross investment, , Objective Type Questions 1.1

Page 87 :

Question 19, All the capital goods produced in a year do not, constitute net addition to the capital stock already, existing., True/False Give reason, , Objective Type Questions 1.1

Page 88 :

Answer 19, True: Significant part of current output of capital, goods goes in maintaining or replacing part of the, existing stock of capital goods in an economy. This, is because the already existing capital stock suffers, wear and tear and needs maintenance and, replacement., , Objective Type Questions 1.1

Page 89 :

Question 20, A part of the capital goods produced this year goes for, replacement of existing capital goods and is not an, addition to the stock of capital goods already existing, and its value needs to be subtracted from gross, investment for arriving at the measure of net investment., This deletion, which is made from the value of gross, investment in order to accommodate regular wear and, tear of capital is called __________ . (Fill in the blank), , Objective Type Questions 1.1

Page 90 :

Answer 20, Depreciation/Consumption of fixed capital, , Objective Type Questions 1.1

Page 91 :

Question 21, New addition to capital stock in an economy is, ________________., , Objective Type Questions 1.1

Page 92 :

Answer 21, Net investment/Net capital formation, , Objective Type Questions 1.1

Page 93 :

Question 22, Which of the following does not explain the concept of, depreciation?, (Choose the correct alternative), (a) An annual allowance for wear and tear of a capital, good., (b) Cost of the capital good (minus scrap value) divided, by number of years of its useful life., (c) Unexpected or sudden destruction or disuse of, capital as can happen with accidents, natural, calamities etc., (d) Maintenance and replacement cost of existing, capital goods., , Objective Type Questions 1.1

Page 94 :

Answer 22, (c) Unexpected or sudden destruction or disuse of, capital as can happen with accidents, natural, calamities etc., , Objective Type Questions 1.1

Page 95 :

Question 23, Depreciation is an accounting concept., True/False? Give reason., , Objective Type Questions 1.1

Page 96 :

Answer 23, True: No real expenditure may have actually been, incurred each year yet depreciation is annually, provided for., , Objective Type Questions 1.1

Page 97 :

Question 24, Which of the following define ‘investment’ in Economics, ?, (Choose the correct alternative), (a) Purchase of share or property., (b) Having an insurance policy., (c) Using money to buy physical or financial assets., (d) Capital formation ,i.e. a gross or net addition to, capital stock., , Objective Type Questions 1.1

Page 98 :

Answer 24, (d) Capital formation ,i.e. a gross or net addition to, capital stock., , Objective Type Questions 1.1

Page 99 :

Question 25, In economics, investment implies using money to buy, physical or financial assets., True/False? Give reason., , Objective Type Questions 1.1

Page 100 :

Answer 25, False: In economics, ‘investment’ implies capital, formation, i.e. a gross or net addition to capital, stock/goods, e.g. machines, tools, and, implements, buildings, office spaces, store, houses, or infrastructure like roads, bridges,, airports or jetties., , Objective Type Questions 1.1

Page 101 :

Question 26, Total final output produced in an economy in a given, year are used :, (Choose the correct alternative), (a) To substain the consumption of the entire, population of the economy., (b) For maintenance and replacement of the existing, capital stock., (c) For new addition to the capital stock., (d) All of the above, , Objective Type Questions 1.1

Page 102 :

Answer 26, (d) All of the above, , Objective Type Questions 1.1

Page 103 :

Question 27, More capital goods would always mean more consumer, goods., True/False?, , Objective Type Questions 1.1

Page 104 :

Answer 27, False, , Objective Type Questions 1.1

Page 105 :

Question 28, _________ add to, or maintain, the capital stock of an, economy and thus make production of other, commodities possible., (Fill in the blank), , Objective Type Questions 1.1

Page 106 :

Answer 28, Capital goods, , Objective Type Questions 1.1

Page 107 :

Question 29, Match the following:, Column I, , Column II, , (i) Fertilisers or pesticides used (a) Intermediate goods, by, a farmer to produce wheat, (ii) Bread produced by a baker, for, , (b) Final goods, selling it to consumers or, restaurants, , Objective Type Questions 1.1

Page 108 :

Answer 29, (i) - (a), (ii) - (a), , Objective Type Questions 1.1

Page 109 :

Question 30, Depreciation is also known as:, (Choose the correct alternative), (a) Consumption of fixed capital, (b) Annual replacement cost, (c) Value of capital consumption, (d) All of the above, , Objective Type Questions 1.1

Page 110 :

Answer 30, (d) All of the above, , Objective Type Questions 1.1

Page 111 :

Question 31, Inventory is a stock variable., , True/False? Give reason., , Objective Type Questions 1.1

Page 112 :

Answer 31, True: Inventory is measured at a particular point of, time. It may have a value at the beginning of the, year or it may have a value at the end of the, year., , Objective Type Questions 1.1

Page 113 :

Question 32, Change in inventories is a stock variable ., True/False? Give reason., , Objective Type Questions 1.1

Page 114 :

Answer 32, False: Change in inventories is a flow variable. It takes, place over a period of time (say one year)., , Objective Type Questions 1.1

Page 115 :

Question 33, ‘Exports’ is a flow variable., , True/False? Give reason., , Objective Type Questions 1.1

Page 116 :

Answer 33, True: as exports are measured on an annual basis, i.e., over a period of time., , Objective Type Questions 1.1

Page 117 :

Question 34, Which of the following is a flow concept?, (Choose the correct alternative), (a) Foreign exchange reserves, (b) Inventory, (c) Capital, (d) Exports, , Objective Type Questions 1.1

Page 118 :

Answer 34, (d) Exports, , Objective Type Questions 1.1

Page 119 :

Question 35, Which of the following is a stock variable?, (Choose the correct alternative), (a) Money supply, (b) Depreciation, (c) Interest, (d) Output, , Objective Type Questions 1.1

Page 120 :

Answer 35, (a) Money supply, , Objective Type Questions 1.1

Page 121 :

Question 36, Losses are classified as:, (a) Stock variable, (b) Flow variable, (c) Either (a) or (b), (d) Neither (a) nor (b), , (Choose the correct alternative), , Objective Type Questions 1.1

Page 122 :

Answer 36, (b) Flow variable, , Objective Type Questions 1.1

Page 123 :

Question 37, Which of the following is not a flow?, (Choose the correct alternative), (a) Capital, (b) Income, (c) Investment, (d) Depreciation, , Objective Type Questions 1.1

Page 124 :

Answer 37, (a) Capital, , Objective Type Questions 1.1

Page 125 :

Question 38, Which of the following is a stock?, (Choose the correct alternative), (a) Wealth, (b) Saving, (c) Exports, (d) Profits, , Objective Type Questions 1.1

Page 126 :

Answer 38, (a) Wealth, , Objective Type Questions 1.1

Page 127 :

Question 39, Which of the following is a flow?, (Choose the correct alternative), (a) Deposits in a bank, (b) Capital, (c) Depreciation, (d) Wealth, , Objective Type Questions 1.1

Page 128 :

Answer 39, (c) Depreciation, , Objective Type Questions 1.1

Page 129 :

Question 40, Which one of the following is an intermediate product?, (Choose the correct alternative), (a) Purchase of pulses by consumers, (b) Machine purchased by a firm, (c) Wheat used by a flour mill, (d) Wheat used by households, , Objective Type Questions 1.1

Page 130 :

Answer 40, (c) Wheat used by a flour mill, , Objective Type Questions 1.1

Page 131 :

Question 41, Which of the following is an example of an intermediate, good?, (Choose the correct alternative), (a) Copper purchased for making utensils, (b) Steel and cement used to construct a flyover, (c) Fertilizers purchased by a farmer, (d) All of these, , Objective Type Questions 1.1

Page 132 :

Answer 41, (d) All of these, , Objective Type Questions 1.1

Page 133 :

Question 42, Depreciation of fixed capital assets refers to:, (Choose the correct alternative), (a) Normal wear and tear, (b) Foreseen obsolescence, (c) Normal wear and tear and foreseen obsolescence, (d) Unforeseen obsolescence, , Objective Type Questions 1.1

Page 134 :

Answer 42, (c) Normal wear and tear and foreseen obsolescence, , Objective Type Questions 1.1

Page 135 :

Question 43, Unforeseen obsolescence of fixed capital assets during, production is:, (Choose the correct alternative), (a) Consumption of fixed capital, (b) Capital loss, (c) Income loss, (d) None of the above, , Objective Type Questions 1.1

Page 136 :

Answer 43, (b) Capital loss, , Objective Type Questions 1.1

Page 137 :

Question 44, Refrigerator purchased by a confectionery shop is an, example of:, (Choose the correct alternative), (a) Final good, (b) Intermediate good, (c) Capital good, (d) Both (a) and (c), , Objective Type Questions 1.1

Page 138 :

Answer 44, (d) Both (a) and (c), , Objective Type Questions 1.1

Page 139 :

Question 45, Which of the following is an example of consumer nondurable good?, (Choose the correct alternative), (a) Milk, (b) Bread, (c) Both (a) and (b), (d) Clothes, , Objective Type Questions 1.1

Page 140 :

Answer 45, (c) Both (a) and (b), , Objective Type Questions 1.1

Page 141 :

Question 46, Addition to the capital stock of an economy is termed, as:, (Choose the correct alternative), (a) Investment, (b) Capital loss, (c) Consumption of fixed capital, (d) All of these, , Objective Type Questions 1.1

Page 142 :

Answer 46, (a) Investment, , Objective Type Questions 1.1

Page 143 :

Question 47, Goods purchased for the following purpose are final, goods :, (Choose the correct alternative), (a) For satisfaction of wants, (b) For investment in firm, (c) Both (a) and (b), (d) None of these, , Objective Type Questions 1.1

Page 144 :

Answer 47, (c) Both (a) and (b), , Objective Type Questions 1.1

Page 145 :

Question 48, Match the following:, (Choose the correct alternative), (i) Profits, (a) Stock variable, (ii) Savings, (b) Flow variable, (iii) Balance in a bank account, (iv) Gross Domestic Product (GDP), , Objective Type Questions 1.1

Page 146 :

Answer 48, (i) – (b), (ii) – (b), (ii) – (a), (iv) – (b), , Objective Type Questions 1.1

Page 147 :

Question 49, State giving reason whether the following statement is, True or False:, Capital formation is a flow concept., , Objective Type Questions 1.1

Page 148 :

Answer 49, True: Capital formation is measured over a period of, time., , Objective Type Questions 1.1

Page 149 :

Question 50, State giving reason whether the following statement is, True or False:, Bread is always a consumer good., , Objective Type Questions 1.1

Page 150 :

Answer 50, False: It depends on the economic use of bread. When, it is purchased by a household, it is a consumer, good. If it is purchased by restaurant, it is a, producer (intermediate) good., , Objective Type Questions 1.1

Page 151 :

Question 51, State giving reason whether the following statement is, True or False:, Savings are a stock., , Objective Type Questions 1.1

Page 152 :

Answer 51, False: It is a flow variable as it is measured over a, period of time., , Objective Type Questions 1.1

Page 153 :

Question 52, State giving reason whether the following statement is, True or False:, Butter is only a final product., , Objective Type Questions 1.1

Page 154 :

Answer 52, False: It will be an intermediate product if it is for, resale or used by a restaurant for preparing, meals., , Objective Type Questions 1.1

Page 155 :

Question 53, State giving reason whether the following statement is, True or False:, National income of a country is a stock variable., , Objective Type Questions 1.1

Page 156 :

Answer 53, False: National income is flow variable since it is, measured over a period of time., , Objective Type Questions 1.1

Page 157 :

Question 54, State giving reason whether the following statement is, True or False:, Capital goods are used up to produce other goods., , Objective Type Questions 1.1

Page 158 :

Answer 54, False: Capital goods like machines make production of, other goods feasible, but they themselves don’t, get transformed in the production process, i.e.,, they are not used up to produce other goods., , Objective Type Questions 1.1

Page 159 :

Question 1, 'Machine purchased is always a final good.' Do you agree, with the given statement? Give reasons., (3 marks), , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 160 :

Answer 1, The given statement is not correct. Whether ‘machine’, is a final good or not depends on how it is being used., • If the machine is bought by a household, then it is a, final good because it is used for final consumption., • If the machine is bought by a firm for its own use,, then also it is a final good because it is used for, investment., • If the machine is bought by a firm for re-sale, then it, is an intermediate good., , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 161 :

Question 2, Which of the following is a stock variable and which is a, flow variable? Give reasons., (3 marks), (a) Inventory, (b) Change in inventory, , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 162 :

Answer 2, (a) Inventory is a stock variable because it is measured, at a particular point of time, i.e., at the beginning or, end of the year., Inventories are treated as capital and hence it is a, stock variable., (b) Change in inventory (closing inventory – opening, inventory) is a flow variable because it takes place, over a period of time., Change in the inventory of a firm is treated as, investment, i.e., addition to the stock of capital of a, firm. So, it is a flow variable., HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 163 :

Question 3, Distinguish between stock and flow. Between net, investment and capital which is a stock and which is a, flow? Compare net investment and capital with flow of, water into a tank., (NCERT) (3 marks), , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 164 :

Answer 3, Stocks are defined at a particular point of time; whereas, flows are defined over a period of time., Capital is a stock variable as it is measured on a particular, day, i.e., at the beginning of the year or at the end of the, year. On the other hand, net investment, i.e., net addition, to the stock of capital is a flow variable as it takes place, over a period o For example, suppose a tank is being filled, with water coming from a tap. The amount of water, which is flowing into the tank from the tap per minute is a, flow. On the other hand, how much water there is in the, tank at a particular point of time is a stock., HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 165 :

Question 4, Which among the following are final goods and which, are intermediate goods ? Give reasons., (a) Milk purchased by a tea stall, (b) Bus purchased by a school, (CBSE 2018) (3 marks), , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 166 :

Answer 4, (a) Intermediate good, Reason: Since it is used up completely in the, production process (making tea) in the same year., (b) Final good, Reason: Since it is for final investment., , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 167 :

Question 5, Which of the following products are intermediate, products and final products? Give reasons. (3 marks), (i) Wheat and rice purchased by households, (ii) Purchase of ticket for train journey by an individual, (iii) Purchase of a car by an employer for office use by, his employees, , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 168 :

Answer 5, (i), , Final products; because these are used for, consumption., (ii) Final product; because it is a final consumption, expenditure., (iii) Final product; because it is a final investment, expenditure., , HOTs 1.1— Analysing, Evaluating & Creating Type Questions

Page 169 :

1.2, Domestic Territory and, Resident: Implications

Page 170 :

Domestic territory (or Economic territory), The first thing to note is that economic territory of a, country is not simply political frontiers of that country., The two may have common elements, but still they are, conceptually different. Let us first see how it is defined., According to the United Nations:, Economic territory (or Domestic territory) is the geographical, territory administered by a government within which persons, goods and capital circulate freely., The above definition is based on the criterion "freedom of, circulation of persons, goods and capital."The above, definition is based on the criterion "freedom of circulation, of persons, goods and capital." Clearly, those parts of the

Page 171 :

political frontiers of a country where the government of, that country does not enjoy the above 'freedom' are not to, be included in economic territory of that country. One, example is embassies. Government of India does not enjoy, the above freedom in the foreign embassies located within, India. So, these are not treated as a part of economic, territory of India. They are treated as part of the economic, territories of their respective countries. For example, the, U.S. embassy in India is a part of economic territory of the, U.S.A. Similarly, the Indian embassy in Washington is a part, of economic territory of India., Based on the criterion ‘freedom of circulation of persons,, goods and capital’, the scope of domestic territory is defined, to cover:

Page 172 :

1. Political frontiers or geographical boundaries, , including territorialwatersand airspace., , For example:, (i) Branch of an American Bank in India is included in, the domestic territory of India because it is located, within the geographical boundaries of India., (ii) Office of Tata Industries in America is not included in, the domestic territory of India because it is outside the, geographical boundaries of India.

Page 173 :

2. Embassies, consulates, military bases, etc., located abroad., For example:, (i) Indian embassy in Japan is a part of the domestic, territory of India., (ii) Russian embassy in India is not a part of the domestic, territory of India. It is a part of domestic territory, of, Russia.

Page 174 :

3. Ships, aircrafts etc. operated by the residents, between two or more countries., For example, aircrafts operated by Air India between, Russia and Japan are treated as a part of the domestic, territory of India.

Page 175 :

4. Fishing vessels, oil and natural gas rigs, etc., operated by the residents in the international, waters or other areas over which the country, enjoys the exclusive rights or jurisdiction., For example, fishing vessels operated by Indian fishermen, in international waters of Indian Ocean are treated as a, part of the domestic territory of India.

Page 176 :

Resident, A resident is defined as follows:, A resident, whether a person or an institution, is one, whose centre of economic interest lies in the domestic, territory of the country in which he lives., The ‘centre of economic interest’ implies two things:, (i), the resident lives or is located within the, domestic territory, and, (ii) the resident carries out the basic economic activities of earnings, spending and accumulation, from that location., Examples:, (i) Indians working in the office of the United Nations, Organisation (UNO) in India are normal residents

Page 177 :

of India since they live in India and their centre of, economic interest also lies in India., (ii) Indians going abroad for medical treatment are, residents of India. Normally, visit for medical, treatment is a short period visit., (iii) Foreign tourists who visit India for recreation,, holidays, medical treatment, study, sports,, conferences, etc. are not residents of India, e.g., foreign tourists visiting India to see the Taj Mahal., Normally, visit to see historical monuments like, Taj Mahal is a short period visit., (iv) Indian officials working in the Indian Embassy in, USA are not residents of India because although, they are living within the domestic territory of, India but they do not carry out the basic economic

Page 178 :

activities of earnings, spending and accumulation in, India. activities of earnings, spending and accumulation in India., (v) Americans working in Indian embassy in America, are not residents of India, but residents of America, because they live in America.

Page 179 :

, , Top Tip, , Resident versus Citizen, Note that citizen and resident are two different terms. This, does not mean that a citizen is not a resident, and a resident, not a citizen. A person can be a citizen as well as a resident,, but it is not necessary that a citizen of a country is necessarily, the resident of that country. A person can be a citizen of one, country and at the same time a resident of another country., For example a NRI, Non-resident Indian. A NRI is citizen of, India but a resident of the country in which he lives., Citizenship is basically a legal concept based on the place of, birth of the person or some legal provisions allowing a person, to become a citizen. On the other hand, residentship is, basically an economic concept based on the basic economic, activities performed by a person.

Page 180 :

Implications of the Concepts of Economic Territory and Resident, National income and related aggregates are basically, measures of production activity. There are two categories of national income aggregates: domestic income, and national income, or domestic product and national product., , Domestic product, Domestic product includes production activity of the, production units located in the economic territory, irrespective of whether carried out by the residents or, non-residents., Gross Domestic Product (GDP), Net Domestic Product, (NDP) are some examples.

Page 181 :

Illustrative example:, How will you treat the following while estimating domestic, product (or domestic factor income) of India?, (i) Rent received by an Indian resident from his, property in Singapore, (ii) Salaries received by Indian residents working in, Russian embassy in India, (iii) Profits earned by a foreign company or a foreign bank in, India, (iv) Salaries paid to Koreans working in Indian embassy in, Korea, (v) Compensation of employees to the resident of Japan, working in Indian embassy in Japan, (vi) Profits earned by a branch of State Bank of India in Japan

Page 182 :

Answer:, (i) No, it will not be included in domestic factor income, of India because this income is earned outside the, domestic territory (economic territory) of India. It is, factor income from abroad., (ii) No, it will not be included in domestic factor income, of India because Russian embassy in India is not a, part of domestic territory of India. So, this income is, not earned within the domestic territory of India. It is, factor income from abroad., (iii) Yes, it will be included in domestic factor income of, India because the foreign company or the foreign, bank is located within the domestic territory of India., So, it is an income earned within the domestic, territory of India.

Page 183 :

(iv) Yes, it will be included in domestic factor income, of India because this income is earned within the, domestic territory of India. Indian embassy in, Korea is a part of the domestic territory of India., (v) Yes, it will be included as it is part of Factor, Income earned in domestic territory of India,, though earned by non-resident., (vi) No, as profits are not earned within the domestic, territory of India. It is factor income from abroad.

Page 184 :

National product, National product includes production activities of residents irrespective of whether performed within the economic territory or outside it., Gross National Product (GNP), Net National Product, (NNP) are some examples., Illustrative example:, Will the following be included in Gross National, Product (GNP)? Give reasons., (i) Profits earned by a foreign company or a foreign, bank in India, (ii) Salary paid to Americans working in Indian, Embassy in America, (iii) Salaries received by Indian residents working in

Page 185 :

Russian Embassy in India, (iv) Dividend received by an Indian from his investment in, shares of a foreign company, Answers:, (i) No, because it is a factor income earned by a nonresident (a foreign company or a foreign bank) from its, contribution to production inside the domestic, territory of India, i.e., factor income paid to abroad., (ii) No, because this factor income is paid to nonresidents, i.e., factor income to abroad., (iii) Yes, because it is a factor income earned by Indian, residents outside the domestic territory of India i.e.,, factor income from abroad., (iv) Yes, because it is a factor income earned by a resident

Page 186 :

from outside the domestic territory of India, i.e., factor, income from abroad.

Page 187 :

, , Top Tip, , It can be realised that a factor income which is included in, domestic factor income of India may not be included in national, income. For example, profits earned by a branch of a foreign, bank in India will be included in the domestic factor income of, India because these profits are earned within the domestic, territory of India. However, it will not be included in national, income of India as it is a factor income paid to abroad. (Foreign, Bank is not a resident of India.), Similarly, an income which is included in national income may not be, included in the domestic factor income. For example, salaries received, by Indian residents working in Russian Embassy in India will be included, in the national income as it is residents’ contribution to production,, though outside the domestic territory of India. However, it will not be, included in domestic income since this income is earned outside the, domestic territory of the country i.e. factor income from abroad.

Page 188 :

Relation between national product and, domestic product, The concept of domestic product is based on the, production units located within economic territory,, operated both by residents and non-residents., The concept of national product is based on residents, and, includes their contribution to production both within and, outside the economic territory., Normally, in practical estimates, domestic product is, estimated first. National product is then derived from the, domestic product by making certain adjustments. Let us, see how?, National product is derived in the following way:, National product = Domestic product

Page 189 :

+Residents' contribution to production outside the, economic territory, –Non-residents' contribution to production inside the, economic territory, In practical estimates, the residents' contribution outside, the economic territory is called "factor income received, from abroad" and the non-residents' contribution inside, the economic territory is called "factor income paid, to abroad". Therefore:, National product =, Domestic product, +, Factor income received from, abroad, –, Factor income paid to abroad, 'Factor income received from abroad' is added to

Page 190 :

domestic product because this contribution of residents is in addition to their contribution to domestic, product., 'Factor income paid to abroad' is subtracted because, this part of domestic product, does not belong to, the residents., By subtracting "factor income paid to abroad" from, "factor income received from abroad", we get a net, figure, "Net factor income from abroad" popularly, abbreviated as NFIA.

Page 191 :

Net factor income from abroad, It is the excess of factor incomes (rent, wages, interest,, profit) earned from abroad over factor incomes (rent,, wages, interest, profit) paid to abroad., NFIA can be positive, negative or zero., 1. Positive NFIA: NFIA is positive when factor income, from abroad is more than factor income paid to, abroad., Note that if NFIA is positive, national product (or, national income) will be greater than domestic product, (or domestic income)., 2. Negative NFIA: NFIA is negative when factor income, from abroad is less than factor income paid to abroad., If NFIA is negative, national income will be less than

Page 192 :

domestic income., 3. Zero NFIA: NFIA is zero when factor income from, abroad is equal to factor income paid to abroad., If NFIA is zero, national product (or national income), will be equal to domestic product (or domestic, income)., It is important to note that ‘Net factor income paid, to abroad’ is opposite/negative of NFIA. If Net factor, income to abroad = `100 crore, then NFIA = (–) `` 100, crore.

Page 193 :

, , Top Tip, , Calculation of NFIA in different cases: Calculation of NFIA in, different cases:, 1. If factor income from abroad = `1000 crore and factor, income to abroad = `800 crore, then, NFIA = 1000 – 800 = `200 crore, 2. If factor income from abroad = `700 crore and factor, income to abroad = ` 1100 crore, then, NFIA = 700 – 1100 = (–) ` 400 crore, 3. If factor income to abroad = `200 crore and factor income, from abroad is not given, then we assume that factor, income from abroad is zero. Therefore, NFIA = 0 – 200 = (–, ) ` 200 crore, 4. If factor income to abroad = (–) `300 crore and, from abroad is not given, then we assume that factor, income from abroad is zero. Therefore, NFIA = 0 – (–)300, = `300 crore

Page 194 :

5. If factor income from abroad = (–) `50 crore and factor, income to abroad is not given, then we assume that factor, income to abroad is zero. Therefore, NFIA = –50 – 0 = (–) `, 50 crore5. If factor income from abroad = (–) `50 crore, and factor income to abroad is not given, then we assume, that factor income to abroad is zero. Therefore, NFIA = –, 50 – 0 = (–) ` 50 crore

Page 195 :

Key Terms, Domestic territory (or economic territory)—The geographical, territory administered by a government within which persons,, goods and capital circulate freely. Domestic territory (or economic, territory)—The geographical territory administered by a, government within which persons, goods and capital circulate, freely., Resident—A person or an institution whose centre of economic, interest lies in the domestic territory of the country in which he, lives., Domestic product—It includes production activity of the, production units located in the economic territory irrespective of, whether carried out by the residents or non-residents., National product—It includes production activities of residents, irrespective of whether performed within the economic territory, or outside it., Factor income received from abroad—Resident’s contribution, to production outside the economic territory of the country.

Page 196 :

Factor income paid to abroad—Non-resident’s contribution to, production inside the economic territory., Net factor income from abroad (NFIA)—Difference between, factor income from abroad and factor income to abroad.

Page 197 :

RECAP, , Domestic territory (or Economic territory), Domestic territory (or Economic territory) is the geographical, territory administered by a government within which, persons, goods and capital circulate freely. For example, (i), Branch of an American Bank in India, (ii) Embassies located, abroad, e.g. Indian embassy in America, etc. are included in, the domestic territory of India., , Resident, Resident is a person or an institution whose centre of, economic interest lies in the domestic territory of the country, in which he lives, for example, Indian officials working in the, Indian Embassy in USA, etc. are normal residents of India., , Implications of the Concepts of Domestic territory, and Resident., Domestic product includes production activity of the

Page 198 :

units located in the domestic territory of the country, irrespective of whether carried out by the residents or nonresidents, for example, (i) Profits earned by a foreign, company or a foreign bank in India (ii) Salaries paid to Koreans, working in Indian embassy in Korea (iii) Compensation of, employees to the residents of Japan working in Indian embassy in, Japan are included in domestic product as it is a factor income, earned in domestic territory of the country., National product includes production activity of residents, only irrespective of whether performed within the domestic, territory of the country or outside it, for example, (i) Salaries, received by Indian residents working in Russian Embassy in, India (ii) Dividend received by an Indian from his, investment in shares of a foreign company are included in, national product as it is a factor income earned by Indian, residents from abroad.

Page 199 :

Net factor Income from Abroad (NFIA), Net Factor Income from Abroad is the difference between, factor income earned from abroad and factor income paid to, abroad. (NFIA = Factor income from abroad – Factor income, to abroad), In other words, NFIA = Residents’ contribution to, production outside the domestic territory – Non-residents’, contribution to production inside the economic territory., NFIA is negative when factor income from abroad is less, than factor income paid to abroad (i.e., Net factor income, paid to abroad)., , Relation between Domestic Product and National, Product, National product = Domestic Product + Factor income, received from abroad – Factor income paid to abroad

Page 200 :

• Factor income received from abroad is added to domestic, product to calculate national product because this contribution of residents is in addition to their contribution to, domestic product., • Factor income paid to abroad is subtracted because this, part of domestic product does not belong to the residents.

Page 201 :

Question 1, Which of the following is within the domestic territory of, India?, (Choose the correct alternative), (a) State Bank of India in UK, (b) Google office in India, (c) Office of Tata Motors in USA, (d) Russian Embassy in India, , Objective Type Questions 1.2

Page 202 :

Answer 1, (b) Google office in India, , Objective Type Questions 1.2

Page 203 :

Question 2, Foreign embassies in India are a part of India’s :, (Choose the correct alternative), (a) Economic territory, (b) Geographical territory, (c) Both (a) and (b), (d) None of the above, , Objective Type Questions 1.2

Page 204 :

Answer 2, , , (b) Geographical territory, , Objective Type Questions 1.2

Page 205 :

Question 3, Out of the following, who are residents of India?, (Choose the correct alternative), (a) Indians working permanently in the office of the, United Nations Organisation in New York, (b) Indians working in Indian Embassy in America, (c) Indians working in a branch of an American Bank in, India, (d) Americans working in India embassy in America, , Objective Type Questions 1.2

Page 206 :

Answer 3, (c) Indians working in a branch of an American Bank in, India, , Objective Type Questions 1.2

Page 207 :

Question 4, Which of the following will be included in gross national, product of India?, (Choose the correct alternative), (a) Profits earned by a foreign company in India, (b) Salary paid to Americans working in Indian Embassy, in America, (c) Salaries received by Indians working in Russian, Embassy in India, (d) Salaries received by Indians working in Indian, Embassy in Korea, Objective Type Questions 1.2

Page 208 :

Answer 4, (c) Salaries received by Indians working in Russian, Embassy in India, , Objective Type Questions 1.2

Page 209 :

Question 5, National income is the sum of factor incomes accruing, to:, (Choose the correct alternative), (a) Nationals, (b) Economic territory, (c) Residents, (d) Both residents and non-residents, , Objective Type Questions 1.2

Page 210 :

Answer 5, (c) Residents, , Objective Type Questions 1.2

Page 211 :

Question 6, Which of the following will be included in Gross, Domestic Product (GDP) of India?, (Choose the correct alternative), (a) Rent received by an Indian resident from his, property in Singapore, (b) Salaries received by Indian residents working in, Russian embassy in India, (c) Profits earned by a branch of State Bank of India in, Japan, (d) Profits earned by standard Chartered Bank in India, Objective Type Questions 1.2

Page 212 :

Answer 6, (d) Profits earned by standard Chartered Bank in India, , Objective Type Questions 1.2

Page 213 :

Question 7, Factor income earned by the domestic factors of, production employed in the rest of the world – Factor, income earned by the factors of production of the rest, of the world employed in the domestic economy = ?, (Choose the correct alternative), (a) Net exports, (b) Net factor income from abroad, (c) Net compensation of employers, (d) Net retained earnings, Objective Type Questions 1.2

Page 214 :

Answer 7, (b) Net factor income from abroad, , Objective Type Questions 1.2

Page 215 :

Question 8, National income is always more than the domestic, income., True/False? Give reason., , Objective Type Questions 1.2

Page 216 :

Answer 8, False: National income can be less than domestic, income when net factor income from abroad, (NFIA) is negative. National income can also be, equal to domestic income if NFIA is zero., , Objective Type Questions 1.2

Page 217 :

Question 9, Wages earned by a citizen of India working in Saudi, Arabia will be included in GDP of India., True/False? Give reason., , Objective Type Questions 1.2

Page 218 :

Answer 9, False: It will be included in Saudi Arabian GDP , not in, GDP of India as it is not earned within the domestic, territory of India., , Objective Type Questions 1.2

Page 219 :

Question 10, Profits earned by the Korean-owned Hyundai car, factory in India will be included in National income of, India., True/False?, , Objective Type Questions 1.2

Page 220 :

Answer 10, False: It is a factor income paid to abroad. It will be, subtracted from the GDP of India to arrive at, the National income., , Objective Type Questions 1.2

Page 221 :

Question 11, GDP can be greater than GNP. True/False? Give reason., , Objective Type Questions 1.2

Page 222 :

Answer 11, True: GDP can be greater than GNP if factor income, paid to abroad is greater than factor income, received from abroad, i.e., when net factor, income from abroad (NFIA) is negative. True:, GDP can be greater than GNP if factor income, paid to abroad is greater than factor income, received from abroad, i.e., when net factor, income from abroad (NFIA) is negative., , Objective Type Questions 1.2

Page 223 :

Question 1, Will the following factor income be included in domestic, factor income of India? Give reasons., (i) Compensation of employees to the resident of Japan, working in Indian embassy in Japan., (ii) Rent received by an Indian resident from Russian, embassy in India., (CBSE Sample Question Paper 2018) (3 marks), , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 224 :

Answer 1, (i), , Yes, it will be included as it is part of factor income, earned in domestic territory of the country., (ii) No, as rent received by Indian resident from, Russian embassy will be part of Factor Income, received from abroad as Russian Embassy is not, part of domestic territory of the country., , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 225 :

Question 2, How will you treat the following in the calculation of, Gross Domestic Product of India? Give reasons., (i) Profits earned by a branch of foreign bank in India., (ii) Salaries of Indian employees working in embassy of, Japan in India., (iii) Salary of resident of Japan working in Indian, embassy in Japan., (3 marks), , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 226 :

Answer 2, (i), (ii), , (iii), , Yes, it will be included because profits are earned, within the domestic territory of India., No, it will not be included because the embassy of, Japan is not a part of the domestic territory of, India., Yes, it will be included because the Indian Embassy, is a part of the domestic territory of India., , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 227 :

Question 3, Will the following be included in domestic factor income, of India? Give reasons., (i) Profits earned by a resident of India from his, company in Singapore., (ii) Profits earned by a company in India which is owned, by a non-resident., (iii) Profits earned by a branch of State Bank of India in, England., (3 marks), , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 228 :

Answer 3, (i) No, it will not be included as the company is located, outside the domestic territory of India., (ii) Yes, it will be included as profits are earned within the, domestic territory of India., (iii) No, it will not be included as State Bank of India is, located outside the domestic territory of India., , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 229 :

Question 4, How will you treat the following in the calculation of, Domestic Income of India? Give reasons., (i) Compensation of employees to the residents of, Japan working in Indian embassy in Japan., (ii) Rent paid by the embassy of Japan in India to a, resident Indian., (iii) Salaries to Indian residents working in the Russian, embassy in India., (iv) Profits earned by Indian employees working in the, US embassy in India., (4 marks), HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 230 :

Answer 4, (i), , Yes, it will be included as the Indian embassy in Japan, is a part of the domestic territory of India., (ii) No, it will not be included as the Japanese embassy is, not a part of the domestic territory of India., (iii) No, it will not be included as the Russian embassy is, not a part of the domestic territory of India., (iv) No, it will not be included as the US embassy is not a, part of the domestic territory of India., , HOTs 1.2— Analysing, Evaluating & Creating Type Questions

Page 231 :

1.3, Circular Flow of Income, (Two- Sector Model)

Page 232 :

Circular flow of income refers to flow of income across, different sectors of an economy in a circular way., In a closed economy* without a government, external, trade or any savings, there are only two sectors, namely,, households and firms., Households are owners of factors of production. They, provide factor services (in the form of labour, capital,, land and entrepreneurship) to the firms (producing, units). Income is generated in production units in the, form of value of total final goods and services, produced in the economy., Firms distribute the entire income generated to make, factor payments (in the form of wages and salaries,, interest, rent and profit). Thus, factor payments flow, from firms to households.

Page 233 :

*Closed economy is one that does not trade with other nations in goods and, services, and in financial assets., •Leakages refer to withdrawal of money from the circular flow of income. It is that, part of income, which does not pass through the circular flow. For example,, savings, taxes and imports are leakages from the circular flow of income.

Page 234 :

In this simplified economy, there is only one way in, which the households may dispose off their earnings –, by spending their entire income to buy the goods and, services produced by the firms. Households do not save,, they do not pay taxes to the government – since there is, no government, and neither do they buy imported, goods since there is no external trade in this simple, economy. So, households buy goods and services from, firms for which they make payment to the firms. Thus,, consumption expenditure (i.e., spending on goods and, services) flows from households to the firms, making, the circular flow of income complete. Hence, circular, flow of income in a two sector economy is based on the, axiom that one’s expenditure is other’s income.

Page 235 :

The entire income of the economy, therefore, comes, back to the producers in the form of sales revenue., There is no leakage from the circular flow of income., Note that the same amount of money is moving in a, circular way. Thus, national income can be calculated, by three methods, which give us the same value., 1. Production method: Product method measures, aggregate value of final goods and services, produced by all the firms in the economy during a, year (Annual flow at A)., 2. Income method: Income distribution method, measures aggregate factor payments made in the, economy during a year (Annual flow at B).

Page 236 :

3. Expenditure method: Expenditure method, measures the aggregate final expenditure on goods, and services in the economy during a year (Annual, flow at C)., , , •, •, , Top Tip, Nominal Flow and Real Flow, Nominal Flow/Money Flow is the flow of factor payments, and payments for goods and services between households, and firms., Real Flow is the flow of factor services and the flow of, goods and services between households and firms.

Page 237 :

RECAP, , Circular flow of income in a two sector economy, In a two sector economy, households are owners of factors of, production. They provide factor services (in the form of, labour, capital, land and entrepreneurship) to the firms., Firms produce goods and services and make factor payments, (in the form of wages and salaries, interest, rent and profit) to, the households. So, factor payments flow from firms to, households., The factor income earned by the households will be used to, buy the goods and services produced by the firms, for which, they make payment to the firms. So, consumption, expenditure (i.e., spending on goods and services) flows from, households to the firms. Thus, aggregate final consumption, expenditure by the households in the economy is equal to the, aggregate factor income received by the households.

Page 238 :

Hence, circular flow of income in a two sector economy is, based on the axiom that one’s expenditure is other’s income.

Page 239 :

Question 1, Match the following:, Contribution made by factors of production Remuneration, (i) Human labour, , (a) Rent, , (ii) Capital, , (b) Wage, , (iii) Fixed natural resources (called ‘land’), , (c) Interest, , (iv) Entrepreneurship, , (d) Profit, , Objective Type Questions 1.3

Page 240 :

Answer 1, (i) – (b) , (ii) – (c) (iii) – (a) (iv) – (d), , Objective Type Questions 1.3

Page 241 :

Question 2, In a two sector economy, in which of the following way, the households may dispose off their entire earning or, income?, (Choose the correct alternative), (a) Spending on the goods and services produced by, the domestic firms., (b) Payment of taxes to the government., (c) To buy imported goods., (d) Savings, , Objective Type Questions 1.3

Page 242 :

Answer 2, (a)Spending on the goods and services produced by the, domestic firms., , Objective Type Questions 1.3

Page 243 :

Question 3, The sum of final expenditure in the economy must be, equal to ___________________., (Fill in the blank), , Objective Type Questions 1.3

Page 244 :

Answer 3, Aggregate factor payments (i.e. wages and salaries , rent ,, interest and profits)., , Objective Type Questions 1.3

Page 245 :

Question 4, In __________________ method we calculate the, aggregate value of all final goods and services produced, by all the firms within the domestic territory of the, country in a year., (Fill in the blank), , Objective Type Questions 1.3

Page 246 :

Answer 4, product or value added, , Objective Type Questions 1.3

Page 247 :

Question 5, Match the following:, (a) Sum total of all factor payments, , (i) Product method, , (b) Aggregate value of final goods and, services produced by all the firms., , (ii) Income method, , (c) Aggregate value of spending that the, firms receive for the final goods and, services which they produce., , (iii) Expenditure, method, , Objective Type Questions 1.3

Page 248 :

Answer 5, (a) – (ii), (b) – (i), (c) – (iii), , Objective Type Questions 1.3

Page 249 :

Question 6, Flow of factor payments and payments for goods and, services between households and firms is called, ______________ ., (Fill in the blank), , Objective Type Questions 1.3

Page 250 :

Answer 6, Nominal flow/Money flow, , Objective Type Questions 1.3

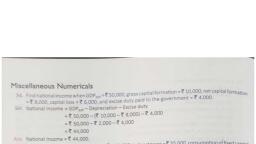

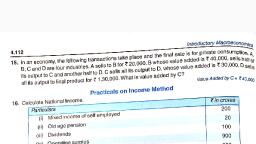

Page 251 :